The Current View

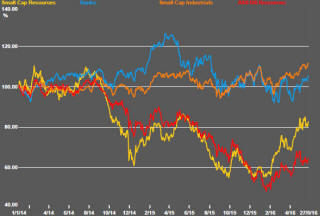

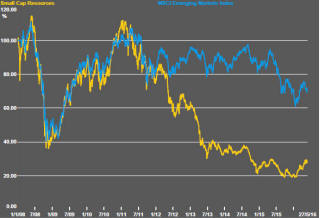

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

Market moves in the past week have continued the principal themes outlined in recent PortfolioDirect commentaries and described as:

-

ruptured links between oil and equity prices;

-

weak global growth momentum;

-

a strengthening US dollar;

-

insufficient gold price escape velocity; and,

-

the impact on equity prices of continued guessing at what the Federal Reserve is likely to do next.

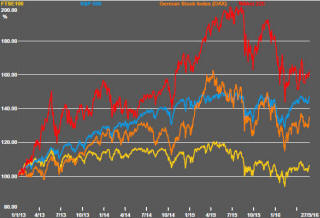

Janet Yellen made news by affirming her expectation that the Federal Reserve is on track to raise its overnight interest rate in the near term which has widely been interpreted as possibly June and not later than September. Her comments were reinforced by those of other Fed governors speaking recently.

The changing view about the timing of Fed policy

moves left investors to think about whether the negative valuation and

liquidity impacts of higher interest rates would be offset by improved

earnings. So far, at least, the judgment has favored equity returns

although, from the S&P 500 perspective, prices are now bumping against prior

high points in the market which are constraining prospective performance.

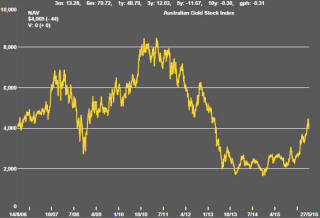

Linked to the mini-reappraisal of monetary conditions, the gold price fell for the eighth consecutive day after it seemed to lose the momentum which had propelled it 20% higher though the first five months of 2016.

The decline in the gold price has not been especially large but takes it back to the longer term downtrend to which PortfolioDirect has been drawing attention as a barrier to improved returns.

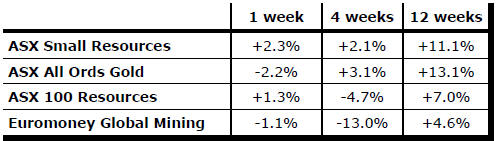

A weaker Australian dollar continues to offer a

cushion for Australian-based gold mining companies. Nonetheless, the All

Ordinaries gold index shed 2.2% during the week. Returns from smaller stocks

were slightly higher than from the largest stocks in the sector. The

Euromoney global mining index produced a negative return during the week.

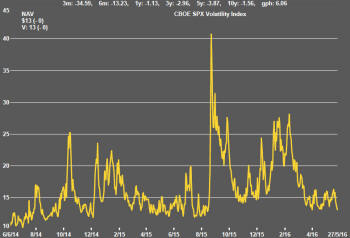

The market volatility index based on the S&P 500, trading toward the bottom of its feasible range, is reflecting an apparent judgment of relatively benign conditions. While the large macro themes such as a Chinese financial crisis and Greek debt default appear no longer to overhang the market as they once did, the balance of risks appears tilted toward a deterioration in market conditions.

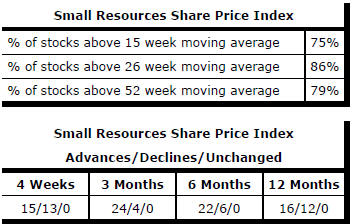

Market Breadth Statistics