The Current View

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments.

Has Anything Changed?

A 1990s scenario remains the closest historical parallel although the strength of the US dollar exchange rate since mid 2014 has added an unusual weight to US dollar prices.

The first signs of cyclical stabilisation in sector equity prices have started to show. This has meant some very strong ‘bottom of the cycle’ gains but only after prices have already fallen by 70% or more in many cases leaving prices still historically low.

Funding for project development may have passed its most difficult phase at the end of 2015 with signs of deals being done and evidence that capital is available for suitably structured transactions.

Key Outcomes in the Past Week

OPEC is getting close to the point at which it shows whether it is a weasel or a tiger. The Saudis and the US elections are setting the scene for the equity markets.

The leadership of the organization of oil exporters has worked hard to create the impression that it might be ready to reassert control over oil prices.

Agreement among countries with disparate political interests still appears elusive without one of the large producers being prepared to sacrifice market share for higher prices. Saudi Arabia is almost certainly the sole candidate for that role. A few others might commit to nominal adjustments but only the Saudis appear willing to contemplate such a step because of their more pressing fiscal needs for a change in market conditions.

Whether the Saudis will assume such a leadership position when it comes to the crunch later in November remains uncertain.

With expectations having been raised, the kingdom faces the possibility of sharply lower prices if it is unable to achieve a meaningful re-balancing in the market.

Since there has been considerable scepticism about

the likelihood of an agreement, price gains, possibly relatively modest

compared to the downside risk, are likely in the event credible production

cuts are announced.

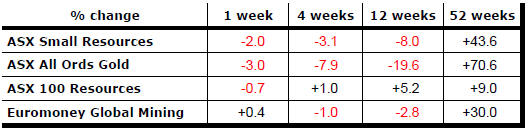

The small resources share price index has outshone the S&P/ASX 100 resources index over the past 12 months on the Australian market. The performance differential between the two has been among the largest observed over the past 20 years.

The swing in relative performance has reflected the leverage to changing conditions at the bottom of the cycle among smaller stocks in the sector particularly after the period of most intense cyclical weakness in late 2015.

A generally more tolerant attitude to risk since late 2015 favoured the smaller end of the resources market. To that extent, improved resource sector equity prices were not simply a response to an improvement in industry conditions.

One indicator of the improved risk appetite globally is the rise in high yield bond prices shown in the red line in the chart.

The small resources share price index had, until

recently, tracked the bond price indicator as one would expect given the

risk profile of the sector.

The recovery in the small resources sector, despite the magnitude of its gains in the first half of 2016, appears to have hit a ceiling.

One reason for the stalled performance is the likelihood that there have been insufficient numbers of new investors entering the market to sustain the rally while, in the face of unusually strong share price gains, existing investors have welcomed the chance to take profits.

More recently, the equity price index has been tending lower even as the bond price indicator has been moving higher.

It does not necessarily follow that resource sector equity prices are about to rise. Although there would be scope for some improvement in response to these perceptions of lowered risk, gains might require an external catalyst of some sort which could benefit bonds as well as resource equities.

What that catalyst might be is difficult to surmise. Perhaps a reaction to the end of the U.S. election cycle is one. An unexpectedly robust agreement among oil exporting countries to rebalance the market could be another. Consistent with the theme of the sector proceeding through a late 1990s-style adjustment, a lengthy period of modest returns or possibly small losses seems the most analytically plausible outlook currently.

.

‘Steak or sizzle?’ is a commentary on the top five performing ASX resources sector stocks in the past week. LINK

Market Breadth Statistics