The Current View

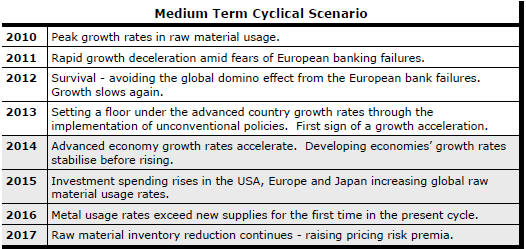

Growth in demand for raw materials peaked in late 2010. Since then, supply growth has continued to outstrip demand leading to inventory rebuilding or spare production capacity. With the risk of shortages greatly reduced, prices have lost their risk premia and are tending toward marginal production costs to rebalance markets.

To move to the next phase of the cycle, an acceleration in global output growth will be required to boost raw material demand by enough to stabilise metal inventories or utilise excess capacity.

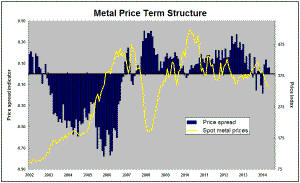

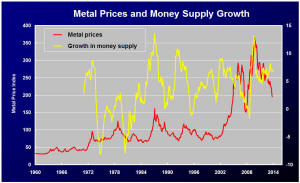

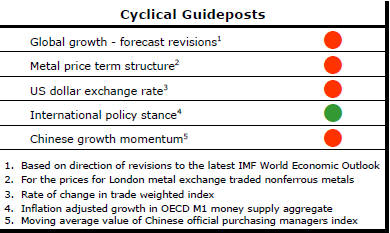

The PortfolioDirect cyclical

guideposts suggest that the best possible macroeconomic circumstances for

the resources sector will involve a sequence of upward revisions to

global growth forecasts, the term structure of metal prices once again

reflecting rising near term shortages, a weakening US dollar, strong money

supply growth rates and positive Chinese growth momentum. Only one of

the five guideposts is "set to green" suggesting the sector remains confined

to the bottom of the cycle .

Has Anything Changed?

Throughout 2014, PortfolioDirect had been characterising the cyclical position as ’Trough Entry’ with some expectation that by the end of 2015 an exit would be evident. Until very late in the year, the evidence supported that possibility before conditions took several backward steps.

The absence of a growth acceleration among the major economic regions other than the USA is contributing to the flagging momentum. A stronger US dollar is also imparting a downward bias to US dollar denominated prices presently. This is looking less like a temporary move than a multiyear change of direction.

The ECB has foreshadowed more monetary stimulus measures. However, monetary polices supporting asset prices alone are unable to directly affect growth sufficiently to encourage a better outlook for resource sector equities.

Fears about the impact of low oil prices have affected sentiment adversely. The beneficial effect of lower oil prices on demand within the advanced economies has not yet been felt and is still being underestimated as a source of additional output growth.

Low US Investment More Cyclical than Structural

Relative to business profitability, US private sector investment

spending (shown in the red line) has been lower than at any time since the

late 1940s and has shown no sign of rising. This is of particular

significance for raw material commodity markets whose fortunes are normally

tied to a rise in relatively metal intensive investment spending. A

speeding up of the commodity price cycle will most likely need a rising

investment contribution to growth.

The low propensity to invest from profits has led to

worries that structural impediments to investment might prolong a cyclical

trough in raw material markets.

Relative to sales (shown in blue), on the other hand, the discrepancy between current conditions and historical performance is less evident.

Investment spending typically rises after a period of sales growth as optimism about market conditions grows and, from a practical standpoint, there is a need for additional production capacity. Investment spending has been rising, as one would expect.

The apparent reticence to invest implied by the comparison with profits is due to cyclical factors rather than structural impediments such as lending constraints imposed by financial institutions.

The numbers imply that sales margins have been expanding through the cycle without a corresponding need for additional investment spending and that sales have not been rising strongly enough to warrant business committing a larger share of profits to investment.

Chinese Steel Producers Sustain Record Output

Chinese steel production in the first two months of 2015 is estimated by the

World Steel Association to have fallen by 0.2% compared with the

corresponding period in 2014. This could be viewed as no growth or,

alternatively, as steel production being kept at a record level after having

grown by 66% since 2007.

Whatever

interpretation one adopts, the results are consistent with China's

transition to a less metal intensive economy. This was always to be

expected despite some in the iron ore industry unrealistically expressing

surprise or doubt about growth coming to an end.

Whatever

interpretation one adopts, the results are consistent with China's

transition to a less metal intensive economy. This was always to be

expected despite some in the iron ore industry unrealistically expressing

surprise or doubt about growth coming to an end.

In 2014, for example, China opened approximately 8,000 kilometres of new rail line. In 2015, the national government is aiming to do something similar. It would be analytically unreasonable to expect the quantity of rail lines being laid to go on increasing indefinitely. Simply sustaining the current rate of elevated use is a challenge.

Many of the uses of steel do not lend themselves to neverending growth. This is particularly so in infrastructure construction. The same constraint does not necessarily apply to other metals such as aluminium, nickel and copper which, like all metals, have a connection with infrastructure but are also driven by population and income growth affecting private decision making.

Quite possibly, the steel intensity of Chinese economic activity will decline even as the intensity of use of other metals more capable of sustaining growth in the long term is on the rise.

A Dent in the Prospects for Lithium

An ultrafast rechargeable aluminium-ion battery is the subject of a report

in the science journal Nature on 6 April. The research by a group of

chemists at Stanford University contends that a newly developed form of

aluminium-ion battery will recharge faster and last up to seven times longer

than the equivalent lithium-ion battery and also offer a safer alternative

to batteries using flammable electrolyte.

A development such as this puts a dent in the expectations of those touting lithium as the prime beneficiary of the search for energy storage alternatives.

Whether true or not, the clearer investment message is that simply extrapolating current knowledge bases into the future is fraught with danger. There are smart people around the world looking for better ways to store energy and, implicitly, attempting to make current knowledge (and assertions of impregnable margins from current products) redundant. What we know today about the subject will almost certainly end up looking like the equivalent of purple flared trousers as a fashion statement.