The Current View

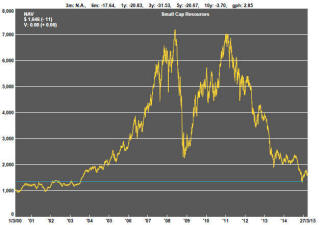

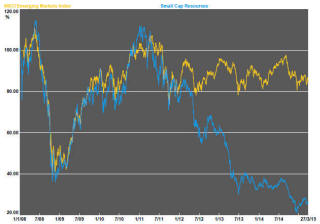

A lengthy downtrend in sector prices had given way to a relatively stable trajectory after mid 2013 similar to that experienced in the latter part of the 1990s and first few years of the 2000s.

The late 1990s and early 2000s was a period of macroeconomic upheaval during which time sector pricing nonetheless proved relatively stable. That remains a possible scenario for sector prices.

Relative stability suggests a chance for companies genuinely adding value through development success to see their share prices move higher. This was the experience in the late 1990s and early 2000s.

The lower equity prices fall - and the higher the cost of capital faced by development companies - the harder it becomes to justify project investments. The market is now entering a period prone to even greater disappointment about project delivery .

Has Anything Changed?

The assumption that June 2013 had been the cyclical trough for the market now appears premature.

Sector prices have adjusted to the next level of support. The parallel with the 1990s is being tested. Prices will have to stabilise around current levels for several months for the thesis to hold.

Key Outcomes in the Past Week

US equity markets fell for the first four days of the week leaving the S&P 500 within three points of a loss for the March quarter. That would be the first quarterly loss for 6 years.

Oil prices ended the week higher after geopolitical tensions reappeared when Saudi Arabian forces intervened in Yemen to fight off Shiite Moslem insurgents.

The US dollar fell for a second consecutive week although the currency remains close to its peak values against its main trading partners and continues to act as a dampener on US dollar denominated commodity prices as well as US output growth.

Speaking at the end the week, Fed chair Janet Yellen seemed to modify her comments about the timing of an interest rate increase. She said that the FOMC would not need to see an increase in inflation to make a change to interest rates, clarifying comments at her March FOMC press conference that Fed members wanted to be confident about inflation rising to 2% before interest rates would begin to rise. Fed personnel appear keen to reduce the reliance of markets on what they say about their intentions. A preference for more ambiguous statements to leave investors to decide for themselves about what is going to happen seems to be emerging.

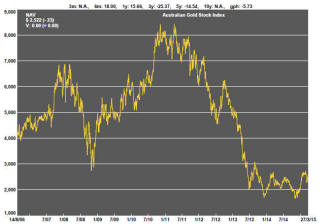

Australian resource sector equity prices seemed to stabilise further during the week albeit near cyclically low levels. The small resources share price index rose 2.5% while the S&P/ASX 100 resources index was unchanged.

The smallest stocks in the sector - those primarily engaged in mineral exploration - continued to face more extreme downward price pressures as cash balances diminished further without signs of an improvement in risk appetites that might signal easier availability of funding for the sector.

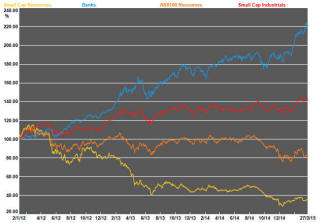

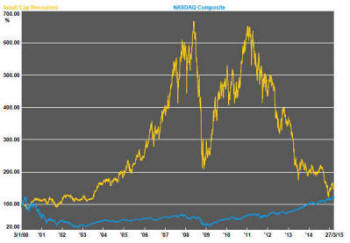

NASDAQ and Australian Resource Sector Returns

Since 2000, there has been little difference between the investment

performance of the Australian resources sector and the technology oriented

NASDAQ market. The chart shows the NASDAQ composite share price indicator

(in blue) and the Australian small resources share price index (in yellow).

There are strong similarities in the risk profiles of

many companies making up the NASDAQ index and the bulk of the stocks making

up the Australian resources sector. The similarities include binary

exploration/drug discovery outcomes and, then, lengthy lead-times before

commercialisation.

Despite the similarities, there’s been no significant leakage of risk appetite in favour of resources even as biotech stocks reach new record prices and fears about them being overvalued emerge.

Theory would say that the less volatile of the two sectors (i.e. the NASDAQ composite) should be preferred by investors but the most recent disparity in performance is once again pushing the two sectors toward cyclical extremes (i.e. a peak in NASDAQ and a resources sector trough) which have been reversed in the past.

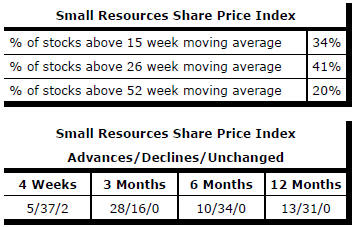

Market Breadth Statistics