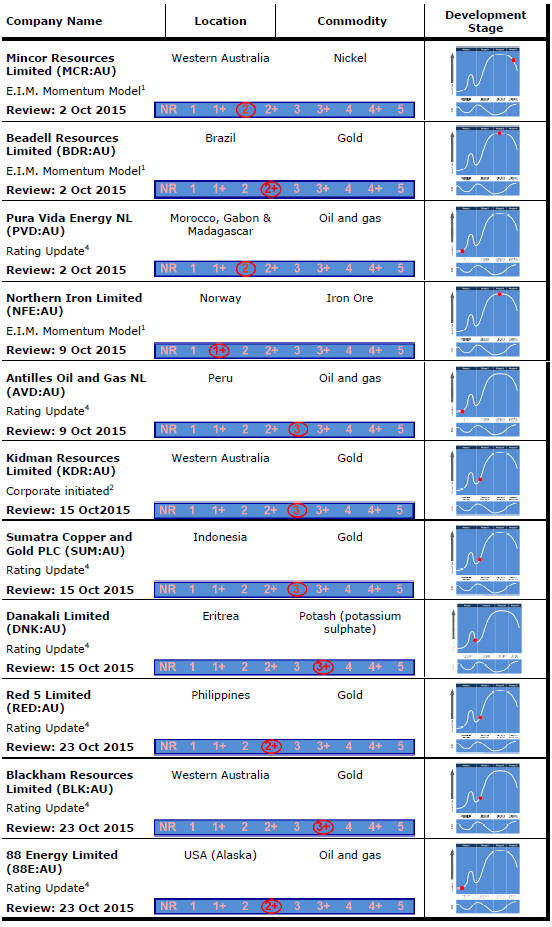

Ratings and Investment Outcomes

The tables below summarise the investment returns within the universe of PortfolioDirect rated stocks over the most recent four week period (in the first table) and over the period since a stock was first given its current rating (in the second table).

Ratings are not intended as short term share price predictors. The primary purpose of a rating is to identify for investors (and assess the extent to which) companies are going to meet and possibly exceed market expectations about their business outcomes.

The ratings are intended to point to those companies which, over time, are most capable of building underlying value through their projects or primary development assets.

In the short term, market returns may vary due to factors other than those taken into account in formulating the PortfolioDirect ratings.

Stocks with relatively low ratings are regarded as more risky (i.e. less likely to achieve their exploration or development goals over a reasonable investment time horizon) than those with relatively high ratings.

A company in the middle of the rating scale will have been been judged likely to meet its development goals with a limited chance of doing better. A higher rating may be given for a company whose investment return has not adequately reflected the achievement of its development goals implying lesser market risk.

Individual stock ratings do not anticipate changes in the macroeconomic or policy environment unless such a change is specific to an individual company. Changes in the macroeconomic conditions in which the companies operate and their implications for stock selection and portfolio construction are addressed separately within the PortfolioDirect analytical framework.

Companies already in production are rated against their ability to sustain value building activities without having to rely on favourable changes in the macro environment in which they operate.

A company with a low rating may achieve better investment returns than a company with a higher rating. Among the reasons a company may receive a low rating are inadequate funding, operational shortcomings or generally inferior exploration interests. Companies in such positions can display very strong share price leverage to a change in their circumstances. Rating reviews will often highlight where this might be the case but a low rating is intended to signal that such changes, although possible, are uncertain or so ill-defined as to warrant significant investor caution.