The �Steak or Sizzle?� blog comments on each of the top five performing resources stocks in the prior week.

�Sell the sizzle, not the steak� is a famous sales adage. The sizzle is the showily attractive distraction from the quality of the meat. Sizzle plays on the emotions of buyers.

�All sizzle and no steak� is a reference to excitement which fails to measure up to expectations of quality.

Resource sector investors are constantly confronted by choices requiring them to distinguish between �steak� and �sizzle�.

Each commentary offers an opinion about whether recent unusually strong price performance is 'sizzle' or �steak� .

Being steak or sizzle does not necessarily say anything about near term investment returns. But sizzle can only take a company so far. Ultimately, steak is needed to sate the appetite of investors for something financially nourishing.

End of December Summary

FULL YEAR 2017

See

below for links to previous comments on the companies which showed the best investment returns

during 2017.

See

below for links to previous comments on the companies which showed the best investment returns

during 2017.

Avonlea Minerals Verdict: Sizzle.

Australian Mines Verdict: Sizzle.

Jervois Mining Verdict: Sizzle.

Draig Resources Verdict: Steak.

Ardea Resources did not register as a top performing stock in any of the weekly, monthly or quarterly ratings during 2017 but built performance through the year with a notable tripling in share price during February and a subsequent doubling in October after listing in February under the banner of having "the developed world's largest cobalt resource". The company also had precious and base metal exploration interests in New South Wales. It raised additional capital during the year and reported a cash balance of $12.1 million at the end of October to enable ongoing drilling and work toward a pre-feasibility study. Verdict: Steak.

QUARTER ENDED 31 DECEMBER

See

below for links to previous comments on the companies which showed the best investment returns

during the December quarter.

See

below for links to previous comments on the companies which showed the best investment returns

during the December quarter.

Australian Mines Verdict: Sizzle.

Sayona Mining Verdict: Sizzle.

Nova Minerals (formerly Quantum Resources) Verdict: Sizzle.

Kogi Iron Verdict: Sizzle.

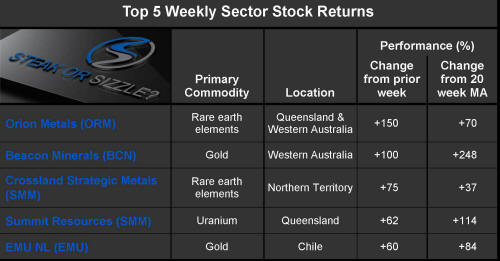

Orion Metals Verdict: Sizzle.

MONTH ENDED 31 DECEMBER

See

below for links to previous comments on two of the companies which showed the best investment returns

during the December quarter.

See

below for links to previous comments on two of the companies which showed the best investment returns

during the December quarter.

Cape Lambert Resources Verdict: Sizzle.

PepinNini Lithium Verdict: Sizzle.

Aruma Resources was quizzed at the end of December by ASX about the reason for recent unusual share trading activity. Directors said they were not aware of anything that should have been announced but pointed to having disclosed in late November that a drilling program was to commence at its gold exploration properties near Kalgoorlie in Western Australia (and for which no results have as yet been released). Verdict: Sizzle.

Fe announced that it had commenced drilling at a property in the Democratic Republic of the Congo prospective for copper-cobalt mineralisation. The company had purchased the property in November from Cape Lambert Resources (also among the best five performing stocks during the month), its largest shareholder with a 45% interest. The company had reported cash assets of $232,000 at the end of September 2017 with only $3,000 allocated to exploration expenses in the December quarter. At the end of December, the company announced that it was about to undertake a placement to raise up to $1 million at a price which would be 59% below the price at which its shares had last traded. Verdict: Sizzle.

Cobalt Blue Holdings, a spin-off of Broken Hill Prospecting which continues to hold a 49% joint venture interest in its Thackaringa project, has been on a rising share price trend since mid-November while the company has been reporting geophysical survey results from its cobalt exploration interests near Broken Hill. Subsequent drilling has been geared toward estimating an upgraded resource in early 2018 and a pre-feasibility study in the middle of the year. The company raised an additional $2.5 million after having reported cash assets of $5.1 million at the end of September 2017.

Week ended 22 December 2017

THEME OF THE WEEK: More Batteries

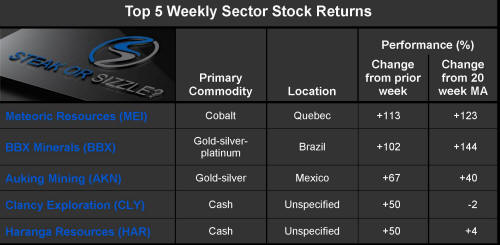

Haranga

Resources announced an agreement to purchase a 100% interest in a

tenement 25 kilometres west of Laverton in Western Australia where drilling

has shown nickel-cobalt mineralisation. The scrip based acquisition is

conditional on a rights issue and share consolidation. The $1.5 million

company had previously reported being left with cash of $269,000 at the end

of September 2017 after having spent nothing on exploration but $1.1 million

to cover administration and corporate costs in the prior nine months. The

company had announced in June that it would sell its iron ore exploration

interests in Mongolia which had previously been the focus of its attention. Verdict: Sizzle.

Haranga

Resources announced an agreement to purchase a 100% interest in a

tenement 25 kilometres west of Laverton in Western Australia where drilling

has shown nickel-cobalt mineralisation. The scrip based acquisition is

conditional on a rights issue and share consolidation. The $1.5 million

company had previously reported being left with cash of $269,000 at the end

of September 2017 after having spent nothing on exploration but $1.1 million

to cover administration and corporate costs in the prior nine months. The

company had announced in June that it would sell its iron ore exploration

interests in Mongolia which had previously been the focus of its attention. Verdict: Sizzle.

China Magnesium Corporation did not make any announcement which might account for the additional investor interest in the company in the past week. At its annual general meeting at the end of November 2017, the managing director spoke about the company�s plans for lithium exploration in the Greenbushes area in Western Australia as well as plans to recommence magnesium production in 2018. Metal production in China has been disrupted by regulatory measures to curtail environmental damage. The most recent price appreciation is consistent with the trading range of shares since early November. Verdict: Sizzle.

Duketon Mining labeled the results of a drilling program at its Golden Star property in Western Australia �a major new discovery�. Gold grades in the range of 1.6-9.4 g/t were encountered over a distance of 500 metres starting 20 metres below the surface. The company has other gold and nickel exploration interests in Western Australia. It is relatively well positioned financially with a $3.6 million cash position at the end of September 2017 and anticipated spending of $0.6 million in the December quarter. Verdict: Steak.

Week ended 15 December 2017

THEME OF THE WEEK: Batteries

Laramide

Resources, a Canadian-listed company with uranium exploration

interests in Queensland and north America, barely trades once a month in

Australia through its Chess Depositary Interests leaving it with an

Australian market value of less than $1 million. On its home exchange, the

company has produced a return of 126% since late October and 44% since the

end of November. The illiquidity in the Australian market often means local

price action bears little relationship to what is happening on its home

exchange although the recent move has brought the two prices more into line

than had been the case for several months.

Verdict: Steak.

Laramide

Resources, a Canadian-listed company with uranium exploration

interests in Queensland and north America, barely trades once a month in

Australia through its Chess Depositary Interests leaving it with an

Australian market value of less than $1 million. On its home exchange, the

company has produced a return of 126% since late October and 44% since the

end of November. The illiquidity in the Australian market often means local

price action bears little relationship to what is happening on its home

exchange although the recent move has brought the two prices more into line

than had been the case for several months.

Verdict: Steak.

Legend Resources announced anomalous nickel-copper-cobalt assays at its Fraser Range property. The company compared its results favorably with those from the Nova-Bollinger discovery at an equivalent time in its exploration program. After spending $1.2 million in the September quarter, the company retained cash assets of $5.4 million positioning it well to further its exploration interests. Verdict: Steak.

Global Geoscience announced that it had successfully demonstrated a heap leaching process for its Rhyolite Ridge lithium-boron mineralisation in Nevada. The approach potentially reduces capital and operating costs associated with the project. The results will be an input into a feasibility study being prepared for the company which already has a market value of $426 million in anticipation of development. Cash assets amounted to $5.6 million at the end of September 2017. Verdict: Sizzle.

Anson Resources confirmed that it was on track to produce its first lithium carbonate in April 2018 at its proposed project site in Utah. Although supposedly nearing production, the company also highlighted that it was only just about to commence its first stage drilling program. The drilling will access a historical oil wellhead to reach brines for sampling. The company held cash assets of $1.2 million at the end of September 2017 after having raised $1.2 million in new funds during the quarter. Verdict: Sizzle.

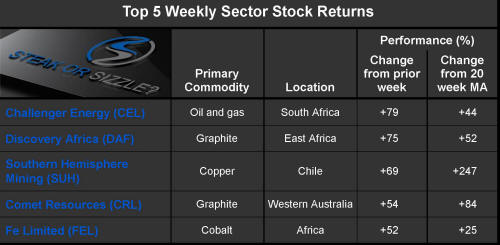

Comet Resources announced that it had commenced drilling for graphite at its Springdale property in Western Australia. The company also said that it would target potential cobalt-nickel mineralisation. The move has pushed the company�s market value to $23 million. The company had $1.6 million in cash on hand at the end of September 2017 after having raised $0.6 million during the preceding quarter. Verdict: Sizzle.

Week ended 8 December 2017

THEME OF THE WEEK: Ontario Resurgence

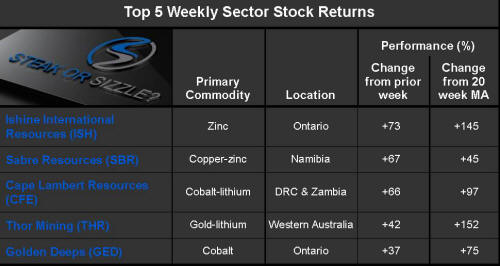

Ishine

International Resources announced that it had acquired an option to

purchase a 70% interest in an Ontario zinc project which had ceased

production in 1998 shortly after opening. The value of the scrip based

transaction, if completed, would be $2.9 million. The acquisition is

conditional on the company also completing a $2.5 million capital raising.

At the end of September 2017, the company had cash assets of $541,000. In

its activities report for the September quarter, the company disclosed that

it had been undertaking desktop studies on tenements held in Western

Australia and that it was searching for new project opportunities. The

company does not have an exploration or development track record. Verdict: Sizzle.

Ishine

International Resources announced that it had acquired an option to

purchase a 70% interest in an Ontario zinc project which had ceased

production in 1998 shortly after opening. The value of the scrip based

transaction, if completed, would be $2.9 million. The acquisition is

conditional on the company also completing a $2.5 million capital raising.

At the end of September 2017, the company had cash assets of $541,000. In

its activities report for the September quarter, the company disclosed that

it had been undertaking desktop studies on tenements held in Western

Australia and that it was searching for new project opportunities. The

company does not have an exploration or development track record. Verdict: Sizzle.

Sabre Resources is usually a lightly and infrequently traded stock which attracted buying through the week with a value of approximately$ 20,000. The company had cash assets of $84,000 at the end of September 2017 after having borrowed $130,000. The company expected to spend only $56,000 in the December quarter. The company holds exploration tenements in Namibia prospective for copper and zinc. The company�s fortunes had been affected adversely by a lengthy delay in receiving tenement renewals from the Namibian government. Those matters had been resolved in August but the company had not made any public disclosures about its prospects since and before its annual meeting in mid-November. Verdict: Sizzle.

Thor Mining has benefited from a rising price trend since late October for a 286% net gain. The company has mineral projects in the USA and Australia prospective for tungsten. It also has copper exploration interests in South Australia, gold related activities in the Northern Territory and lithium prospects in the USA. In its activities report for the three months to September 2017, the company also referred to possibly having gold and lithium related opportunities in the Pilbara. The disclosure, issued at the beginning of November, came at an opportune time with significant interest being shown by investors in recent discoveries in the region resulting in large price fluctuations among companies with the targeted exposure. Verdict: Sizzle.

Golden Deeps announced that it had agreed to buy two cobalt projects in Ontario. The company suggested that it can add value to historical exploration efforts through the application of new geophysical techniques. The company has been attempting to reposition itself as a participant in the energy storage space. The company reported having cash assets at the end of September 2017 of $68,000. The company raised $824,000 in association with the acquisition. Verdict: Sizzle.

November 2017

THEME OF THE MONTH: More batteries

Of

the highest returning companies during November, the following are commented

upon below:

Of

the highest returning companies during November, the following are commented

upon below:

Orion Metals Verdict: Sizzle.

Quantum Resources Verdict: Sizzle.

St George Mining Verdict: Steak.

European Lithium was unable to throw any light on the cause of its share price performance when queried by ASX. The company did release a new presentation to be used in Europe in the last week of November and which outlined plans for a lithium project located in Austria. The project, dating from exploration activity in the 1980s, was acquired through a reverse takeover in September 2016. The company anticipates completing a pre-feasibility study in the first quarter of 2018. According to the company�s activities and financial report for the three months ended September 2017, it had cash assets of $300,000 with plans to spend $1.3 million in the upcoming December quarter. The company raised $2.1 million during October. Verdict: Sizzle.

Cohiba Minerals attracted unusually strong investor interest during the week despite there being no fresh disclosures to explain the new buying. During the September quarter, the company had completed acquisition of Cobalt X. However, Cohiba announced at the start of November that a mining licence application covering tenements in which the acquired company had an interest had been withdrawn after being unable to obtain required third party consent. The most recent share price performance has been a recovery from the fall in price which occurred in early November following the release of the license application news. The most recent price fluctuation could suggest some further impending news. The company held cash assets of $1.7 million at the end of September 2017. Verdict: Sizzle.

Week ended 1 December 2017

THEME OF THE WEEK: Only One Real Discovery

Queensland Bauxite combines mineral development with a 55% interest in a cannabis producing and marketing company. The company announced that hemp food products had become legally available for human consumption in Australia from 12 November. The company also announced that its cannabis investment had acquired an interest in a hemp seed processing group in a move to vertically integrate the business. Verdict: Sizzle.

St George Mining announced drill results from its Mount Alexander property in Western Australia (see below). Verdict: Steak.

Lepidico had shown strong returns through the first half of October and again through the first half of November with a relatively modest gain later in the month. Lepidico has portrayed itself as a technological leader in using its own innovative hydrometallurgical technique for the treatment of mica ores to extract lithium carbonate. Interest in Lepidico was spurred in October by Galaxy Resources, another lithium development company, taking a stake in the company. Galaxy also participated in a subsequent entitlement offer. The Galaxy backing will facilitate funding of Lepidico�s own development efforts. Verdict: Steak.

Week ended 24 November 2017

THEME OF THE WEEK: A Real Discovery

Ventnor Resources received a query from ASX about the reasons for its share price performance but said, in response, that it did not have any information which was not publicly available already. Directors pointed to an earlier statement that the company had been investigating a silica sand mining opportunity in Western Australia to supply glass and concrete manufacturers in the Asia Pacific region. Previously, the company had been engaged in a range of base metal and gold exploration ventures in Western Australia. The company had limited financial resources with cash assets of $830,000 at the end of September 2017 with budgeted expenditure of $245,000 in the December quarter. Verdict: Sizzle.

Spectrum Rare Earths announced that it had raised $0.9 million to kick start a program of exploration on a Pilbara gold prospect. The company has characterised the current state of its work there as �preliminary investigations�. An exploration permit is yet to be granted. The company had cash assets of $520,000 prior to the capital raising. The company�s prior involvement in rare earths and uranium has been abandoned. Verdict: Sizzle.

Crater Gold Mining announced that it had negotiated a $4 million unsecured loan facility with its major shareholder. Although the first $1 million can be drawn down at the option of the company, the balance of the funding is subject to the agreement of the lender. Prior to the funding arrangement, the company had reported cash assets at the end of September of $0.4 million with December quarter budgeted expenditures of $1.78 million. The funding will facilitate activity at the company�s Crater Mountain gold project in Papua New Guinea. Earlier in the month, the company had reported drilling results from a polymetallic deposit in north west Queensland. Verdict: Sizzle.

Week ended 17 November 2017

THEME OF THE WEEK: Cobalt!

Venture

Minerals has base metal exploration interests in Western

Australia. The company announced that it had commenced a maiden drilling

program targeting nickel and copper sulphide mineralisation. Subsequently,

the company announced that it had secured an exploration licence for a

property along strike from a recent nickel-cobalt discovery. The company

ended the September quarter with cash assets of $1.5 million after having

raised $0.9 million from new share issues during the quarter. Verdict: Sizzle.

Venture

Minerals has base metal exploration interests in Western

Australia. The company announced that it had commenced a maiden drilling

program targeting nickel and copper sulphide mineralisation. Subsequently,

the company announced that it had secured an exploration licence for a

property along strike from a recent nickel-cobalt discovery. The company

ended the September quarter with cash assets of $1.5 million after having

raised $0.9 million from new share issues during the quarter. Verdict: Sizzle.

Nex Metals Exploration did not make any specific disclosure during the week which might have precipitated the company�s share price performance. The company had previously announced that it had commenced a trial to process gold-rich tailings at a site in Western Australia. The company had cash assets of $0.6 million at the end of September 2017. Verdict: Sizzle.

Great Boulder Resources announced that it had intersected copper-nickel-cobalt mineralisation east of Laverton in Western Australia. The company had received results from nine holes out of a 20 hole maiden drilling program. The company is in a relatively strong financial position to follow up this activity and other gold-related targets with cash assets at the end of September 2017 of $3.9 million. Verdict: Steak.

Winmar Resources announced that it had withdrawn from its Lomero polymetallic project in Spain after its joint venture partner entered administration and the company was unable to exercise control. Winmar announced that it would seek to acquire alternative mineral assets. To assist in its new endeavours, the company completed a $492,000 capital raising. The company also announced measures to cut its operating costs. It had finished of the September quarter with cash assets of $205,000. Verdict: Sizzle.

Quest Minerals was reinstated to trading after having been suspended during the prior week and announcing that it had agreed to acquire a business with a portfolio of cobalt and gold exploration tenements in Austria. The transaction will involve issuing 426 million shares and 65 million options in addition to the company�s existing 106.7 million outstanding shares. The company intends to raise $4.5 million to supplement its $712,000 cash holdings at the end of September 2017. Previously, the company had been engaged in gold exploration near Sandstone in Western Australia. It had also reported vanadium and titanium in assay samples. Verdict: Sizzle.

Week ended 10 November 2017

THEME OF THE WEEK: More Battery Frenzy

Redbank

Copper was reinstated for trading after having been suspended

during the prior four weeks for having failed to lodge its annual accounts.

The company holds tenements prospective for base metals in the Macarthur

River region of the Northern Territory. After having spent $140,000 on

exploration in the three months to September 2017, it had cash assets of

only $2,000 remaining at the end of the quarter. The company�s chairman has

agreed to lend the company up to $1 million until such time as it is able to

raise additional equity funds. Verdict: Sizzle.

Redbank

Copper was reinstated for trading after having been suspended

during the prior four weeks for having failed to lodge its annual accounts.

The company holds tenements prospective for base metals in the Macarthur

River region of the Northern Territory. After having spent $140,000 on

exploration in the three months to September 2017, it had cash assets of

only $2,000 remaining at the end of the quarter. The company�s chairman has

agreed to lend the company up to $1 million until such time as it is able to

raise additional equity funds. Verdict: Sizzle.

Astro Resources, which has exploration interests in Western Australia focused on mineral sands and diamonds and has recently acquired exploration properties in Nevada, did not make any specific disclosures likely to have a share price impact. It had reported previously that had cash assets at the end of September 2017 of $5,000 after having spent $61,000 in the prior quarter on exploration. The company trades infrequently with turnover in the past week valued at $14,002. Verdict: Sizzle.

Hampton Hill Mining did not make any specific disclosure during the week to explain the rise in share price. Its principal activity is an earned 25% interest in the Millennium zinc project in Western Australia managed by Encounter Resources. After having completed its $2 million spending obligation in the September quarter, the company had remaining cash assets of $30,000. The company also had investments with a market value of approximately $4 million which could be realised to fund its ongoing activities. Verdict: Sizzle.

Archer Exploration is a South Australian focussed mineral explorer where it plans to establish an integrated graphite mining and graphene production operation. Its South Australian interests have also included copper, manganese and magnesium exploration. The company reported cobalt grades of 0.94% from one of its South Australian properties based on rock chip sampling. It has also recently reported cobalt and copper anomalies at North Broken Hill following rock chip sampling. The company had cash assets of $1.03 million at the end of September 2017 after having spent $353,000 on exploration during the prior quarter and with the budgeted total spending of $940,000 during the December quarter. A share purchase plan to raise up to $2.25 million has been announced. Verdict: Sizzle.

Elysium Resources announced that it had completed due diligence on an acquisition of gold and base metal properties in the Pilbara region of Western Australia, first foreshadowed in late October having already flagged that it would favour gold over base metals in its 2018 exploration efforts. Previously, the company�s primary interest had been in properties prospective for copper-gold mineralisation in central New South Wales. The company�s decision-making appears indicative of a weak commitment or an insufficiently strong intellectual underpinning to its exploration efforts. With the new spread of interests, the company would have been at risk of losing focus with the consequence of having to make choices about the allocation of capital and spreading its management over a broader geography. The company has flagged a change in name to reflect its new priority in the Pilbara region and the downgrading of its New South Wales efforts. At the end of September 2017, the company held cash assets of $1.9 million to further its exploration activities after having raised $2.2 million from an issue of new shares during the quarter. Verdict: Sizzle.

Week ended 3 November 2017

THEME OF THE WEEK: More Battery Frenzy

Gulf

Manganese Corporation reported progress toward completion of its

ferro-manganese smelting hub in west Timor, in its quarterly activities

report. The company announced that it had entered agreements to purchase ore

for the startup smelting operation in 2018. Meanwhile, it expects to ship

its own ore in late 2017. The company�s strategy involves a staged increase

in smelting capacity as market development permits. The company also

advised that it had completed the final $1.5 million tranche of a funding

round dating from June 2017. At the end of September, the company held cash

assets of $3.6 million with expected December quarter expenditure of $3.15

million.

Verdict: Steak.

Gulf

Manganese Corporation reported progress toward completion of its

ferro-manganese smelting hub in west Timor, in its quarterly activities

report. The company announced that it had entered agreements to purchase ore

for the startup smelting operation in 2018. Meanwhile, it expects to ship

its own ore in late 2017. The company�s strategy involves a staged increase

in smelting capacity as market development permits. The company also

advised that it had completed the final $1.5 million tranche of a funding

round dating from June 2017. At the end of September, the company held cash

assets of $3.6 million with expected December quarter expenditure of $3.15

million.

Verdict: Steak.

Anson Resources announced that it had executed a memorandum of understanding with a Chinese group to assist in the development of the company�s lithium brine project in Utah. The Chinese party also took an $800,000 equity stake in the company currently capitalised at $29.5 million. The company had also announced that the Utah state government had given the company permission to commence drilling activity in the fourth quarter of 2017. Verdict: Sizzle.

Sundance Resources retains a large but stalled iron ore development in Cameroon which also requires extensive rail and port construction for its commercial viability. In its September quarter activities report, the company said that it had seen increased interest in the project from companies able to participate in the infrastructure components and capable of helping with funding. At the end of September 2017, the company had cash assets of $2.3 million after spending $0.6 million in the prior quarter. Verdict: Sizzle.

Blina Minerals announced that it had acquired exploration interests in an area of Chile with a history of high-grade cobalt mineral discoveries. The company, currently capitalised at $3 million, agreed to issue 1.05 billion shares, an increase of 36%, in stages to secure its interest in the properties. The company had $340,000 in cash assets at the end of September 2017 with estimated expenditures of $167,000 in the December quarter. The company has pre-existing gold exploration interests in Burkina Faso which it has characterised recently as �highly prospective�. Additionally, the company reported that it had been reviewing new projects in Australia and overseas. Verdict: Sizzle.

October 2017

THEME OF THE MONTH: Batteries

Of

the highest returning companies during October, the following are commented

upon elsewhere:

Of

the highest returning companies during October, the following are commented

upon elsewhere:

Castle Minerals Verdict: Steak.

Resource Mining Corporation Verdict: Sizzle.

Liontown Resources Verdict: Steak.

Week ended 27 October 2017

THEME OF THE WEEK: WA Gold Frenzy

Stone

Resources Australia is an infrequently traded stock with gold

exploration interests in the Laverton region of Western Australia. The

company�s June quarter activities report comprised two sentences in four

lines of text. The company has received unusually strong investor interest

in the past six trading days during which time share turnover has been

several times higher than normal monthly volumes. The company has not

disclosed any information which might have caused the added activity. The

company had previously reported having only $64,000 in cash assets at the

end of September 2017. Shortly after, the company had said that a party

related to its largest shareholder had agreed to provide a $500,000

convertible loan. Verdict: Sizzle.

Stone

Resources Australia is an infrequently traded stock with gold

exploration interests in the Laverton region of Western Australia. The

company�s June quarter activities report comprised two sentences in four

lines of text. The company has received unusually strong investor interest

in the past six trading days during which time share turnover has been

several times higher than normal monthly volumes. The company has not

disclosed any information which might have caused the added activity. The

company had previously reported having only $64,000 in cash assets at the

end of September 2017. Shortly after, the company had said that a party

related to its largest shareholder had agreed to provide a $500,000

convertible loan. Verdict: Sizzle.

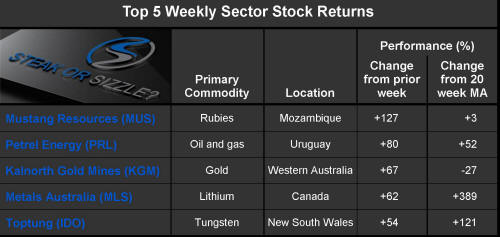

Petrel Energy announced that drilling in Uruguay had confirmed oil shows in sand at a depth of 793 metres. The results are too insignificant to excite views about production potential but are worthy of comment for being the first onshore exploration well in the country for 30 years. The company announced that it would be seeking to raise up to $5.4 million after having finished the September quarter with cash assets of $592,000 and budgeted expenditure in the December quarter of $5.3 million. Verdict: Sizzle.

Lake Resources has made several recent references to preparations to commence drilling at a lithium brine project in Argentina. The latest disclosure at the end of the week referred to the final step in the drilling approval process involving local community consultations having been completed. The company had $1.4 million in cash available at the end of June 2017 with expected expenditure of $509,000 in the already completed September quarter. Verdict: Sizzle.

Elysium Resources announced that it had entered into a binding agreement to purchase exploration interests in Western Australia prospective for gold and base metals and covering Witwatersrand formations which have created excitement as the source of recent nugget discoveries in the Pilbara region. The transaction will more than double the number of shares on issue and include the need for a capital raising. At the end of June 2017, the company had available cash assets of $922,000 prior to spending $524,000 during the September quarter. Verdict: Sizzle.

Andromeda Metals announced an agreement under which it would acquire up to 11 exploration licence applications in the Pilbara region of Western Australia. The company also announced commitments from investors to subscribe $1.98 million to permit recommencement of exploration activities. The company joins the rush into the region after the Novo Resources discovery referred to in earlier posts over the past six to eight weeks. The company had previously been primarily interested in South Australian exploration interests. It had cash assets of $268,000 at the end of June 2017. Verdict: Sizzle.

Week ended 20 October 2017

THEME OF THE WEEK: Inexplicable

Target

Energy did not make any formal disclosure which might have

accounted for the recorded share price rise. As reported previously in the

�Steak or Sizzle?� blog, Target Energy has been seeking to restructure its

North American business. With a sub-$5 million market value, the company

will be especially highly leveraged to any improvement in U.S. oil market

conditions or changed expectations about the speed of its asset

restructuring. Verdict: Sizzle.

Target

Energy did not make any formal disclosure which might have

accounted for the recorded share price rise. As reported previously in the

�Steak or Sizzle?� blog, Target Energy has been seeking to restructure its

North American business. With a sub-$5 million market value, the company

will be especially highly leveraged to any improvement in U.S. oil market

conditions or changed expectations about the speed of its asset

restructuring. Verdict: Sizzle.

Lepidico did not disclose any new information to account for the share price rise. The company had dispatched a prospectus for a rights issue immediately prior to the increased investor interest but additional share purchases would not have improved the entitlement to participate in the issue. New funds are expected to go to completion of technical studies to demonstrate the effectiveness of the company�s technology used to process lithium-bearing ores and to continue related exploration activities. The effectiveness of the Lepidico technology has not been demonstrated in full scale operations although tests have shown that it can process previously untreatable ores containing lithium. Earlier in the month, Galaxy Resources took a 12% stake in the company via a $2.9 million share placement at one-third of the company�s closing price on Friday. Verdict: Sizzle.

Hampton Hill Mining is an infrequently traded stock with zinc exploration interests in the Pilbara region of Western Australia. The company did not making any specific disclosures which might account for the change in market value. The company had cash assets of $75,000 at the end of June 2017 with foreshadowed expenditure of $185,000 in the recently concluded September quarter. The company had a partially used finance facility from interests associated with its directors on which to draw. The share price rise occurred with turnover worth only $1,000 in the only trade of the month so far. Verdict: Sizzle.

Week ended 13 October 2017

THEME OF THE WEEK: One Weekly Gem

Nex Metals Exploration announced that it had received approval for a trial processing of ore from its Kookynie gold tailings project north of Kalgoorlie. The company held cash assets of $718,000 at the end of June 2017 after having received $1.04 million to finalise the sale of the Kookynie gold project. The company has said that it continues to evaluate projects but that they �need to show exceptional value� in the current commodities market. Apparently, that had not been a criterion for past investments. Verdict: Sizzle.

Lakes Oil announced that it had put a proposal to the Victorian state government under which it would begin exploration for gas using conventional drilling techniques to help alleviate the increasingly acute shortage of gas for power generation. Lakes Oil, which had extensive properties prospective for oil and gas in the state, has been blocked from exploration by a government ban on all forms of gas exploration. While the proposal by the company is a seemingly reasonable way for both parties to work together, the overtly political nature of the ban may prevent the government giving way. The possibility of a breakthrough raises hope that something may eventuate but there has been no reported response from the relevant minister to the communication from the company making a judgement about the likelihood of a change premature. A sensible government would permit a �Steak� rating for Lakes Oil. Verdict: Sizzle.

Uranium Equities announced that a review of historical auger sampling results from its Dundas project near Norseman in Western Australia had shown a lithium and beryllium anomaly. The company had been reviewing all of its tenement data for gold prospectivity, including for the Dundas area which was acquired in June 2017. The company had previously flagged a change in name to reflect its pursuit of a wider commodity exposure than the uranium orientation which had been its principal focus. The company had $146,000 at the end of June 2017 with the intention of spending $215,000 in the September quarter. In the past week, the company announced that it had raised $570,000 to pursue copper-gold and lithium exploration interests in Western Australia and the Northern Territory. Verdict: Sizzle.

Mustang Resources, which is scheduled to conduct its first ruby gemstone tender at the end of October 2017, announced that it had accumulated an inventory for sale in excess of 350,000 carats. The tender will be a critical step in guiding expectations about the longer term revenue potential of the company although it has yet to make any formal disclosures about its sustainable ruby production. Proceeds of the sale will contribute to the formal definition of a resource at its Mozambique mining tenements. Having spent $10.9 million in 2016/17, the company�s cash assets had declined to under $400,000 by the end of June 2017 with upcoming expenditure of $3.4 million. The company has raised relatively small amounts to fund ongoing activities. With the large share price rise in the past week and a strong marketing campaign based around its unique investment offering having been undertaken, a significant capital raising should be expected despite the proximity to receipt of its first revenue. Verdict: Steak.

Week ended 6 October 2017

THEME OF THE WEEK: New Directions

Kalamazoo

Resources announced that it had acquired options to purchase three

gold projects in the Pilbara region of Western Australia. In making its

announcement, the company highlighted the proximity of the properties to

those of Novo Resources and an array of other explorers caught up in the

excitement over the possibility of a Witwatersrand type mineralisation in

the region. The company has 90 days in which to exercise the options for

which it has paid $150,000 and issued shares valued at $200,000 enabling it

to acquire interests of between 80% and 100%. On exercise, payments of

$150,000 and $250,000 in cash and shares, respectively, will be required.

One million dollars will be payable upon estimating a 50,000 oz resource.

The company had $3.6 million in cash assets at the end of June 2017 after

having raised $6.1 million in new equity in the past year. The company

spent 43% of its 2016/17 outlays on exploration. Verdict: Sizzle.

Kalamazoo

Resources announced that it had acquired options to purchase three

gold projects in the Pilbara region of Western Australia. In making its

announcement, the company highlighted the proximity of the properties to

those of Novo Resources and an array of other explorers caught up in the

excitement over the possibility of a Witwatersrand type mineralisation in

the region. The company has 90 days in which to exercise the options for

which it has paid $150,000 and issued shares valued at $200,000 enabling it

to acquire interests of between 80% and 100%. On exercise, payments of

$150,000 and $250,000 in cash and shares, respectively, will be required.

One million dollars will be payable upon estimating a 50,000 oz resource.

The company had $3.6 million in cash assets at the end of June 2017 after

having raised $6.1 million in new equity in the past year. The company

spent 43% of its 2016/17 outlays on exploration. Verdict: Sizzle.

Traka Resources has exploration interests in Western Australia. In September, the company said that exploration drilling was about to commence at its Latitude Hill and Ravensthorpe properties. The former is subject to a 70% earn-in by Chalice Gold which is seeking to identify what it has described as Nova/Bollinger style mineralisation. The latter includes a joint venture north of Mt Caittlin prospective for lithium and tantalum. The company did not disclose any further details to which the large increase in market volumes in the past week could be attributed although interest had risen considerably through the latter part of September. Traka Resources held cash assets of $855,000 at the end of June 2017 with expected expenditure in the September quarter of $268,000 of which 44% was to cover exploration activity. Traka relies on free carried interests in its properties for its investment appeal. Verdict: Sizzle. .

Mount Burgess Mining announced that the first phase of diamond drilling at its Nxuu lead-zinc-silver prospect in Botswana �will commence soon�. The anticipated program will build on exploration drilling in 2011 as a precursor to a feasibility study in 2018. At the end of June 2017, the company had cash assets of $126,000 after having raised $183,000 in the quarter and before anticipated expenditure of $112,000 in the following three months. Verdict: Sizzle.

Inca Minerals had reported grades in excess of 6% zinc and 4% lead from underground channel samples at a mineral concession in Peru. It subsequently reported grades of between 15% and 41% zinc from a second source. The site of the mineralisation had been worked on a small scale historically. The company which had raised $6.2 million during 2016/17 raised a further $250,000 in July although it had ended June with cash assets of $3.1 million. It had expected to spend $1.1 million over the last three months. Verdict: Steak.

Emu, with gold exploration interests in Utah and Chile, did not make any significant disclosure of new information but lodged a document entitled �Introducing EMU� with the ASX in which it outlined its business strategy. The company�s primary focus is now on a gold target in Chile after its pursuit of a Carlin-style gold system in Utah fell short of its objectives. The company is scheduled to commence soil sampling in November 2017 and drilling in December. This is a very early stage venture even for a sector steeped in very early stage exploration objectives. The document lodged with the ASX appeared designed to attract attention and could be best described as being what you say when you do not really have anything significant to say. The company has $2.7 million to spend on its next steps including $470,000 in the September quarter, three quarters of which was expected to be on exploration activities. Verdict: Sizzle.

Month ended 30 September 2017

Quarter ended 30 September 2017

Year to date 30 September 2017

Year ended 30 June 2017

Week ended 29 September 2017

THEME OF THE WEEK: Pilbara Gold Rush

DGO Gold

has been caught up in the ensuing gold rush after Novo Resources and Artemis

Resources reported finding nuggets on their Pilbara region exploration

tenements (see below). The finds appear to have

attracted considerable interest with reports of individuals heading to the

area with metal detectors. The discoveries themselves are insufficient

to enable an assumption that sustainable mining operations are possible.

The inconsistency and unpredictability of the finds will make funding mining

activity for a publicly listed company difficult. That is not to say

that periodic new finds will not keep interest alive and produce multiple

trading opportunities for equity investors. Verdict: Sizzle.

DGO Gold

has been caught up in the ensuing gold rush after Novo Resources and Artemis

Resources reported finding nuggets on their Pilbara region exploration

tenements (see below). The finds appear to have

attracted considerable interest with reports of individuals heading to the

area with metal detectors. The discoveries themselves are insufficient

to enable an assumption that sustainable mining operations are possible.

The inconsistency and unpredictability of the finds will make funding mining

activity for a publicly listed company difficult. That is not to say

that periodic new finds will not keep interest alive and produce multiple

trading opportunities for equity investors. Verdict: Sizzle.

De Grey Mining announced that he had increased its estimated Pilbara region gold resource by 207,000 ounces to 1.2 million ounces. Earlier in the week, the company had also announced the discovery of gold nuggets at its Pilbara properties playing into the excitement generated by Novo Resources and Artemis Resources following their identification of �Witwatersrand� style gold mineralisation. At the end of the week, the company had requested a trading halt pending the release of an announcement on Monday. Verdict: Sizzle.

Kairos Minerals is another one of the companies caught up in the frenzy over Pilbara gold nuggets (see below). At the end of the week, the company said it would start an exploration program within a week. Being able to report multiple gold nugget finds may create considerable interest but still leave an insufficient basis upon which to draw a conclusion about the prospects for a commercially sustainable mining project. Verdict: Sizzle.

Hamoa Mining did not make any disclosure to precipitate the recorded share price gains although the company has gold-related tenements in the Pilbara. It had reported having only $10,000 in cash assets at the end of June 2017 leaving it to rely on debt funding from its chairman. The company has said it expects to spend $750,000 in the September quarter. Verdict: Sizzle.

Venturex Resources is another company caught up in the Pilbara gold rush. It has tenements which cover interpreted extensions of mineralisation within the properties of De Grey Mining. The company had reported $960,000 in cash assets at the end of June 2017 with anticipated spending in the September quarter of $1.41 million. These companies with gold exploration interests in the region are now highly likely to refresh their funding to take advantage of the intense interest arising from frequent reports of nuggets being discovered. Verdict: Sizzle.

Week ended 22 September 2017

THEME OF THE WEEK: Repriced Oil Exploration

Norwest

Energy, prospecting for all oil in the Perth Basin in offshore

Western Australia, reported intersecting hydrocarbon bearing reservoirs at

its Xanadu-1 well. The company has a 25% interest in the well on which

further work must now be carried out to clarify the nature of the discovery.

The company�s financial resources remain limited with only $542,000

available at the end of June 2017 and anticipated spending of $350,000 in

the current quarter. During the quarter, the company raised additional funds

of $1 million to meet near-term expenses.

Verdict: Steak.

Norwest

Energy, prospecting for all oil in the Perth Basin in offshore

Western Australia, reported intersecting hydrocarbon bearing reservoirs at

its Xanadu-1 well. The company has a 25% interest in the well on which

further work must now be carried out to clarify the nature of the discovery.

The company�s financial resources remain limited with only $542,000

available at the end of June 2017 and anticipated spending of $350,000 in

the current quarter. During the quarter, the company raised additional funds

of $1 million to meet near-term expenses.

Verdict: Steak.

Gladiator Resources disclosed in July 2017 that the company had conducted no exploration activity in the preceding quarter and had no interest in any mining or exploration tenements. The company had, however, entered into an agreement to acquire gold exploration properties in Western Australia in exchange for 5 million shares in the company with a market value of $15,000 at the time. There have been no subsequent disclosures about the transaction but the company did advise the market that it had raised $150,000 through a share placement. At the end of June 2017, the company reported having cash assets of only $92,000. Verdict: Sizzle.

Jacka Resources is an oil and gas exploration company with minor interests in a range of African properties and cash assets at the end of June 2017 of $398,000. Exploration expenditure in the quarter had ceased with upcoming corporate spending of $200,000. Trading volume increased strongly in the past week but, when queried by ASX about reasons for the heightened activity, the company was not able to identify any reasons. More broadly, prices of oil exploration stocks have increased recently with signs of having broken above a previous downtrend associated with weak crude oil markets. Verdict: Sizzle.

Kairos Minerals reported that a field assessment of its exploration tenements had identified rocks consistent with the nearby gold discoveries by Novo Resources and Artemis Resources (see below). Interest in the region has led the company to fast track further field work to take advantage of other companies wishing to access the area. A week earlier, the company had raised $1.71 million after having been left with $1.4 million at the end of June 2017 and needing $750,000 to meet upcoming spending commitments. Verdict: Sizzle.

Triangle Energy (Global) has had a rising price trend since late July 2017 during which time it has been among the best performing stocks in the sector. Triangle has a 30% interest in the Xanadu-1 well in which Norwest Energy (see above) is the operator and holder of a 25% interest. Verdict: Steak.

Week ended 15 September 2017

THEME OF THE WEEK: Ideas Without Funding

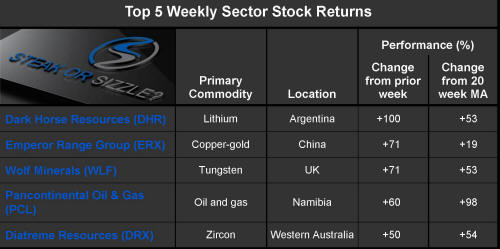

Dark

Horse Resources has disclosed ambitious plans to identify and

develop pegmatite mineralisation in Argentina with a view to meeting growing

demand for lithium. To that end, the company made an announcement at the end

of the week that its managing director had actually visited its Argentine

properties during late August-early September. It may take up to two years

for the company�s plans, all going well, to lead to a resource estimate. The

company�s move on lithium involves divesting coal and related power

interests which had been its earlier focus. At the end of June 2017, the

company had cash assets of a $294,000 and near-term anticipated cash

outflows of $200,000 leaving a question about its ability to do justice to

any portfolio of exploration properties. Verdict: Sizzle.

Dark

Horse Resources has disclosed ambitious plans to identify and

develop pegmatite mineralisation in Argentina with a view to meeting growing

demand for lithium. To that end, the company made an announcement at the end

of the week that its managing director had actually visited its Argentine

properties during late August-early September. It may take up to two years

for the company�s plans, all going well, to lead to a resource estimate. The

company�s move on lithium involves divesting coal and related power

interests which had been its earlier focus. At the end of June 2017, the

company had cash assets of a $294,000 and near-term anticipated cash

outflows of $200,000 leaving a question about its ability to do justice to

any portfolio of exploration properties. Verdict: Sizzle.

Emperor Range Group is a very infrequently traded stock with a $1.35 million market value and a focus on exploration interests in China. Over 90% of the outstanding shares in the company are owned by three Chinese-connected investors. The company only spent $43,000 over the first six months of 2017. Verdict: Sizzle.

Wolf Minerals has a tungsten development underway in southwest England with an end 2017 target to establish a sustainable production base after previously falling well short of nameplate capacity. At the end of August, the company had announced the receipt of additional funds from an existing financial backer but has not made any significant disclosures to validate a higher market value. The tungsten price has, however, been improving benefitting a range of other tungsten-related investments. Verdict: Sizzle.

Pancontinental Oil and Gas announced that it had negotiated a capital injection into a subsidiary engaged in offshore Namibian oil and gas exploration giving Pancontinental an effective 20% residual holding. The company has been caught up in the share price weakness facing the oil and gas exploration sector. The recent share price action for Pancontinental coincides with some improvement in sector prices. Verdict: Sizzle.

Diatreme Resources has a mix of exploration properties extending across Western Australia, South Australia and Queensland. The company announced that it had entered into a non-binding memorandum of understanding with a Chinese engineering group for completion of a bankable feasibility study for its Cyclone zircon project in Western Australia near the South Australian border. The agreement covers assistance with sourcing of equity and debt funds through Chinese institutions. The company has reported having only $51,000 available to fund its activities at the end of June 2017. At the end of July, the company said that it was in the midst of raising additional capital but has since made no announcement about the adequacy of its cash resources. Verdict: Sizzle.

Week ended 8 September 2017

THEME OF THE WEEK: Mostly Hope

Valor

Resources has been building share price momentum since of the end

of August when it had reported exploration results from its Berenguela

copper-silver project in Peru. The company had highlighted intercepts of 8

metres at 2.95% copper and 3 metres at 5.42% in a manganese oxide orebody.

Silver content exceeded 4,000 g/t in the latter intersection. During the

latest week, the company disclosed further detail about the drill results

confirming the high-grade intercepts. The company appears to have

encountered a high grade zone within one of a possible network of mineral

lenses with further modeling necessary to clarify its understanding of the

regional geology. The company had $2.0 million in cash assets at the end of

June 2017 with which to carry out its exploration efforts after having

raised $2.2 million during the preceding quarter.

Verdict: Steak.

Valor

Resources has been building share price momentum since of the end

of August when it had reported exploration results from its Berenguela

copper-silver project in Peru. The company had highlighted intercepts of 8

metres at 2.95% copper and 3 metres at 5.42% in a manganese oxide orebody.

Silver content exceeded 4,000 g/t in the latter intersection. During the

latest week, the company disclosed further detail about the drill results

confirming the high-grade intercepts. The company appears to have

encountered a high grade zone within one of a possible network of mineral

lenses with further modeling necessary to clarify its understanding of the

regional geology. The company had $2.0 million in cash assets at the end of

June 2017 with which to carry out its exploration efforts after having

raised $2.2 million during the preceding quarter.

Verdict: Steak.

Tungsten Mining had been on a rising share price trend (commented on below) since mid-July before an acceleration in the speed of the rise in the past week. Questioned by ASX about the reason for the latest rise, the company said that it had no information to disclose although directors drew attention to the large rise in tungsten prices which had occurred recently as a possible reason for the fresh investor interest. Verdict: Steak.

Astro Resources announced that it had agreed to purchase 100% of a gold-silver project in Nevada to complement its mineral sands, diamond and base metal exploration interests in Western Australia. The company has been financially stretched and will struggle to do justice to its exploration interests. At the end of June 2017, the company�s meagre cash assets of only $7,000 required it to rely on borrowings to keep the corporate doors open. Whether the company will be able to convince investors that the quality of its assets warrant funding is yet to be seen. Verdict: Sizzle.

Ventnor Resources has base metal exploration interests in Western Australia but made no fresh disclosure in the past week to warrant the unusually strong share price performance. The infrequently traded stock also attracted unusually high turnover. The gain came after the company had struck historically low price levels leaving the higher share price at the end of the week little different from the price which had prevailed over the previous six months. Verdict: Sizzle.

MRG Metals has had gold and base metal exploration interests in Western Australia and Queensland. The company also has a farm-in agreement with Mandalay Resources covering a base metal exploration property in Sweden under which MRG can acquire a 50% interest over three years. In the event of a discovery, in an unusual agreement, Mandalay has an option to buy back the MRG interest leaving some uncertainty about the nature of the company�s exposure to exploration success. In August, the company outlined plans to commence drilling in the near term. Despite not having made any announcements more recently about its activities, the company attracted unusually heavy investor interest through the week with volumes over the first few days of September approximating those in August as a whole. The company had limited cash assets of $588,000 at the end of June 2017. Verdict: Sizzle.

Week ended 1 September 2017

THEME OF THE WEEK: Struggling

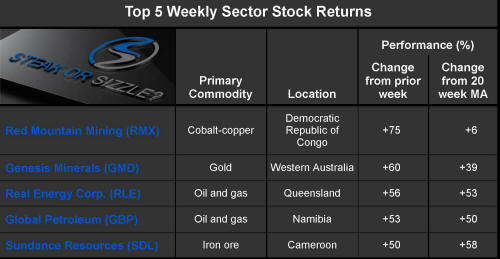

Red

Mountain Mining benefited from a surge in trading activity. Having

been queried about the market action, the company was unable to identify a

reason for the heightened interest. The company which had a long history in

the Philippines has given up on its gold exploration initiatives in favour

of a cobalt-copper project in the Democratic Republic of Congo. Finalisation

of the Congo earn-in agreement has been postponed on several occasions. The

company had also had lithium exploration interests in the USA but drilling

results at the brine prospects have not justified further work. Verdict: Sizzle.

Red

Mountain Mining benefited from a surge in trading activity. Having

been queried about the market action, the company was unable to identify a

reason for the heightened interest. The company which had a long history in

the Philippines has given up on its gold exploration initiatives in favour

of a cobalt-copper project in the Democratic Republic of Congo. Finalisation

of the Congo earn-in agreement has been postponed on several occasions. The

company had also had lithium exploration interests in the USA but drilling

results at the brine prospects have not justified further work. Verdict: Sizzle.

Genesis Minerals announced drilling results from properties currently held by Metallo Resources over which Genesis holds options to purchase. The results from the company�s Murchison district tenements are regarded as good enough to warrant proceeding with the purchase. Reported intersections have included 17 metres at 3.36 g/t of gold and 9 metres at 18.8 g/t. The May 2017 purchase agreement was subject to an initial proof of concept exploration program. The company is well positioned financially with cash assets of $4.2 million available at the end of June 2017. Verdict: Steak.

Real Energy Corporation has been pursuing development of a Cooper Basin gas project aimed at the emerging gas shortage in eastern Australia. The company has been testing its Tamarama-1 well and has negotiated a memorandum of understanding with Santos for the processing of gas. There was no new disclosure to precipitate last week�s price action but the company did release a presentation suggesting that it will have been speaking with investors about its prospects. Verdict: Steak.

Global Petroleum benefited from a surge of investor interest without having made any specific announcement about its business activities. The company�s primary exploration efforts are in offshore Namibia. Verdict: Sizzle.

Sundance Resources was dramatically affected by the cyclical slump in iron ore prices which prevented it financing a major iron ore development in Cameroon. Efforts to negotiate financing and construction agreements with Chinese parties have continued while prices have been cyclically low with the company retaining hope that the major infrastructure project involving rail and port facilities as well as a mining hub can proceed. The company is under some pressure from the government to show progress or possibly lose access to the tenements. It has made no specific announcement about development progress but has foreshadowed a capital raising through a share purchase plan issue to assist in near term needs. Verdict: Sizzle.

August 2017

THEME OF THE MONTH: Breakthrough Prices

Of

the highest returning companies during August, the following were commented

upon previously:

Of

the highest returning companies during August, the following were commented

upon previously:

Pacific Bauxite Verdict: Sizzle.

OM Holdings Verdict: Steak.

Apollo Consolidated made several announcements during the month about gold exploration progress at prospects near Kalgoorlie in Western Australia. The company reported intersections of wide zones of strongly sulphidic alteration. The company also reported that down-hole electromagnetic surveying had identified off-hole conductors. Assays of up to 17.8 metres at 15.95 g/t were reported from one hole with 28 metres at 2.41 g/t recorded from a second. The company is in a relatively strong financial position having reported cash holdings of $9.2 million at the end of June 2017. Verdict: Steak.

Draig Resources reported that it had reviewed data sets from historical workings at the Bellevue gold mine near Leinster in Western Australia. The data examination is intended as a precursor to a program of field work with geophysical analysis assisting in the identification of drill targets around historical tailings and instances of more shallow mineralisation. Later in the month, the company announced that it had received commitments from investors for $3.3 million in fresh equity financing part of which is subject to shareholder approval. The company had cash assets of $1.7 million at the end of June 2017. Verdict: Sizzle.

Week ended 25 August 2017

THEME OF THE WEEK: More Undercapitalised Efforts

Cougar

Metals had been earning a 50% interest in a Madagascan graphite

project as well as having interests in Brazilian lithium. The company

announced at the start of the week that it had received an extension of time

within which to meet its obligations under the graphite project farm-in

agreement. Subsequently, the company received increasingly strong investor

interest before being placed in a trading halt on the last day of the week,

presumably pending a clarifying announcement about the source of the renewed

interest in the company. Verdict: Sizzle.

Cougar

Metals had been earning a 50% interest in a Madagascan graphite

project as well as having interests in Brazilian lithium. The company

announced at the start of the week that it had received an extension of time

within which to meet its obligations under the graphite project farm-in

agreement. Subsequently, the company received increasingly strong investor

interest before being placed in a trading halt on the last day of the week,

presumably pending a clarifying announcement about the source of the renewed

interest in the company. Verdict: Sizzle.

Cannindah Resources reported that its exploration efforts at the Piccadilly gold exploration site in Queensland had resulted in evidence of mineralisation over a wider area than had previously been discerned. The company is operating on a tight budget with only $318,000 available to spend at the end of June 2017 after having raised $300,000 through a convertible note issue. Expected expenditure on exploration in the September quarter was just $75,000 with $120,000 to go on administration and corporate costs suggesting it is under-resourced financially to do justice to its exploration potential. Verdict: Sizzle.

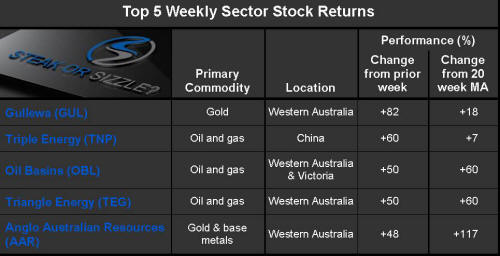

Triple Energy rose from the lowest share price in the 12 year history of the company leaving it very close to the lower end of its historical trading range. The Chinese coal bed methane project developer had received a query in the past fortnight from the ASX asking about the adequacy of the company�s cash resources. In response, the company indicated that it would continue to rely on the support of its largest shareholder to provide finance and assist in capital raising as it has done before. Verdict: Sizzle.

Week ended 18 August 2017

THEME OF THE WEEK: Premature Excitement

Metals Australia has a portfolio of exploration interests including uranium in Namibia, base metals in Western Australia and lithium in Quebec. There was no company-specific news during the week to attract the fresh investor interest which helped the company�s share price to recover from levels previously reached in late 2016. Verdict: Sizzle.

NMG Corporation has tenements prospective for gold in Ghana which have been subject to renewal and, as a result, have attracted a minimal spending commitment from the company which has also announced that directors would forgo their fees until the financial position of the company has improved. The company had $0.48 million in cash at the end of June 2017 but announced on 11 August that it had raised $200,000 in a placement. The subsequent share price rise in the infrequently traded company came from a handful of low value trades. Verdict: Sizzle.

Atrum Coal, whose market value had declined by over 80% in12 months, announced that it had appointed an experienced Canadian executive as managing director of the company. Subsequently, the company announced changes to the non-executive directors on its board. The company has been seeking to develop anthracite interests in British Columbia. Progress in terms of timing and size of development has fallen short of what the company had originally portrayed as its potential when attracting investors. The company�s comments have not indicated a significant improvement in the outlook for international markets with sales having been limited to North America without any penetration of the long-promised Asian buyers. The most recent share price action indicates some momentum improvement but only a minor recoupment of losses over the prior year. Verdict: Sizzle.

Week ended 11 August 2017

THEME OF THE WEEK: Undercapitalised Efforts

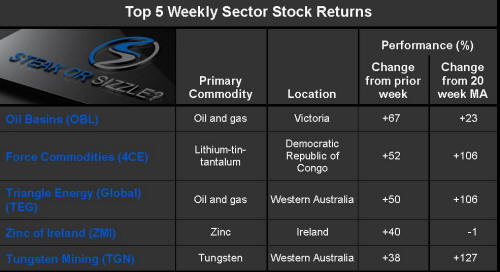

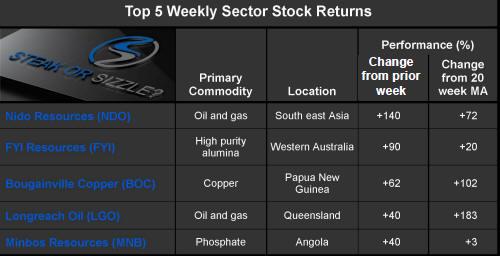

Oil

Basins reported a reassessment of historical data relating to oil

and gas resources in the vicinity of its Bass Strait exploration interests

in relatively shallow water off of the Victorian coast. Significantly larger

conventional gas potential has been identified from reprocessed data by a

newly appointed consultant. The company�s financial position, with cash

assets of only $58,000 at the end of June 2017, will limit the extent to

which it is able to initiate an appropriate exploration effort without some

combination of capital raising and farm-out agreement. The infrequently

traded company attracted a large increase in trading interest in the last

day of the week. Verdict: Sizzle.

Oil

Basins reported a reassessment of historical data relating to oil

and gas resources in the vicinity of its Bass Strait exploration interests

in relatively shallow water off of the Victorian coast. Significantly larger

conventional gas potential has been identified from reprocessed data by a

newly appointed consultant. The company�s financial position, with cash

assets of only $58,000 at the end of June 2017, will limit the extent to

which it is able to initiate an appropriate exploration effort without some

combination of capital raising and farm-out agreement. The infrequently

traded company attracted a large increase in trading interest in the last

day of the week. Verdict: Sizzle.

Force Commodities announced that it had executed heads of agreement with a state-owned company and a privately held group to acquire 70% interests in licences over areas within the Democratic Republic of Congo prospective for lithium, tin and tantalum mineralisation. The agreement remains subject to conditions including completion of a technical due diligence and shareholder approval. The transaction involves a combination of cash, shares and assumption of vendor liabilities. The number of new shares to be issued will approximate 50% of the number currently outstanding in the $11 million company. The company had previously reported that it held cash assets of $478,000 at the end of June 2017 suggesting that it will need to raise additional capital in the near term and possibly before it is able to conduct any meaningful exploration activities over the newly acquired properties. The company had expected to spend $415,000 in the September quarter of which $318,000 was to cover administration and corporate costs. Verdict: Sizzle.

Triangle Energy attracted consistently higher trading volumes throughout the week without having made any specific announcement to spur new investor interest. The company did release an investor presentation in which it outlined exploration and development plans for its oil and gas interests in the Perth Basin of Western Australia. The company reported positive operational cash flows in the June quarter leaving it with cash assets at the end of the period of $2.2 million following a capital raising of $1.5 million. With a market capitalisation of $15 million, the company�s present cash flows remain expensive. The company�s ultimate attractiveness will rest on a more aggressive exploration effort or on its ability to source product from other companies drilling in the region and wishing to utilise an expanded regional processing centre operated by Triangle Energy approximately 350 kilometres north of Perth. Verdict: Sizzle.

Zinc of Ireland announced at the end of the week that drilling had commenced at its Kildare zinc prospect in Ireland. There were no details to disclose. Earlier in the week, the company had announced receiving �significant interest� from sophisticated investors prepared to take up a shortfall in a poorly subscribed rights issue. Other than expectations about the possibility of favourable drill results being reported in the near future, there was no obvious connection between what the company had disclosed and the market reaction. At the end of June 2017, the company held cash assets of $1.4 million prior to its targeted rights issue raising of $1.6 million and expected spending of $0.68 million in the September quarter. Verdict: Sizzle.

Week ended 4 August 2017

THEME OF THE WEEK: Fresh Starts

Pelican

Resources has no currently operating mines or exploration

interests. It has been in a prolonged negotiation over the sale of mineral

interests in the Philippines which has most recently been delayed by

government regulations limiting the shipment of the lateritic nickel ores

present on the tenements in question. The share price performance, based on

a small number of trades in an infrequently traded stock, has coincided with

the recent rise in the price of nickel metal. Verdict: Sizzle.

Pelican

Resources has no currently operating mines or exploration

interests. It has been in a prolonged negotiation over the sale of mineral

interests in the Philippines which has most recently been delayed by

government regulations limiting the shipment of the lateritic nickel ores

present on the tenements in question. The share price performance, based on

a small number of trades in an infrequently traded stock, has coincided with

the recent rise in the price of nickel metal. Verdict: Sizzle.

King River Copper received a query from the ASX about the share price rise experienced by the company. It was unable to point to any specific reason but, in replying, highlighted interest by investors in the Speewah mineral resource in Western Australia where the company had originally begun exploring for copper-gold mineralisation. Subsequently, assays showed a vanadium resource which has been estimated at 4.7 billion tonnes grading 0.3% vanadium pentoxide and 2.0% titanium. The vanadium find has prompted studies into whether the mineral can be commercially processed. The company had cash holdings of $716,000 at the end of June 2017. Verdict: Sizzle.

Impact Minerals reported visible mineralisation from diamond drill holes at its Silica Hill prospect in New South Wales where the company is seeking to identify high-grade feeder zones to an existing gold-silver discovery. The company has said that the metal composition of the mineralisation is consistent with the edges of a high grade feeder zone which, if demonstrated, would confirm the company�s interpretation of the nature of mineralisation in the region. Assays have not yet been completed. The company had cash assets of $1.9 million at the end of June 2017 after having completed a capital raising during of the month. It expected to spend $810,000 in the September quarter. Verdict: Steak.

Sabre Resources has been exploring properties in northern Namibia for copper although it is currently awaiting approvals from the government to renew existing exploration licences. Its minimal levels of expenditure have been associated with compilation of the relevant documentation required for the mining licence applications which would allow continuation of exploration and evaluation activities. The cash holdings of the company at the end of June 2017 were only $66,000. Verdict: Sizzle.

Red 5 announced a new growth strategy involving consolidation of mineral properties prospective for gold in Western Australia after having spent many years attempting to bring a Philippines gold mine into production. A succession of operational shortcomings, unfavorable natural conditions and uncertainty about the regulatory environment have either hampered or forced closure of the Siana mine development from time to time. The company has agreed to purchase an operating gold mine and mill about 900 kilometres northeast of Perth in the Leonora-Leinster gold district where it could establish a regional processing hub. The company has also agreed to buy non-core assets from Saracen Mineral Holdings within the region. Completion of the transactions is expected at the end of September 2017. The $33 million market cap company intends to raise $12.5 million to meet its purchase obligations which also involve the vending companies taking large stakes in Red 5. The company had cash assets of $13.2 million at the end of June 2017. Verdict: Steak.

July 2017

THEME OF THE MONTH: Still Searching

Changes

in strategic direction as companies have looked for new lines of business

have been among the principal sources of investment returns among the best

performing stocks during July. In the majority of cases among the five best

performing stocks, the resulting share price has remained close to the

average in the prior several months suggesting that gains have been a

reaction from unusually low prices.

Changes

in strategic direction as companies have looked for new lines of business

have been among the principal sources of investment returns among the best

performing stocks during July. In the majority of cases among the five best

performing stocks, the resulting share price has remained close to the

average in the prior several months suggesting that gains have been a

reaction from unusually low prices.

New Talisman Gold Mines, reviewed on 14 July 2017, was the only one of the five companies being rewarded for pursuing a development commitment.

South Pacific Resources, reviewed on 14 July 2017, appeared to have little financial capacity to add value to its PNG oil and gas assets suggesting investors were anticipating a change in its financial position.