The �Steak or Sizzle?� blog comments on each of the top five performing resources stocks in the prior week.

�Sell the sizzle, not the steak� is a famous sales adage. The sizzle is the showily attractive distraction from the quality of the meat. Sizzle plays on the emotions of buyers.

�All sizzle and no steak� is a reference to excitement which fails to measure up to expectations of quality.

Resource sector investors are constantly confronted by choices requiring them to distinguish between �steak� and �sizzle�.

Each commentary offers an opinion about whether recent unusually strong price performance is 'sizzle' or �steak� .

Being steak or sizzle does not necessarily say anything about near term investment returns. But sizzle can only take a company so far. Ultimately, steak is needed to sate the appetite of investors for something financially nourishing.

Year ended December 2019

Of

the highest returning companies during 2019, the following have been commented

upon previously:

Of

the highest returning companies during 2019, the following have been commented

upon previously:

Spectrum Metals Verdict: Steak.

Andromeda Metals Verdict: Steak.

Magmatic Resources Verdict: Sizzle.

MRG Metals Verdict: Steak.

Celamin Holdings Verdict: Sizzle.

The strongest performing stocks in 2019 typically produced their qualifying returns in the latter part of the year, including three in the fourth quarter. The correlation in the timing of returns did not reflect market conditions as much as the tendency for strongly performing stocks in the sector to give up a large proportion of gains following an initial surge in investor interest. Strongly performing stocks in the first part of the year will have had more time in which to lose momentum. Stocks with similarly strong investment returns later in 2019 may also experience similar retracements in performance given sufficient time.

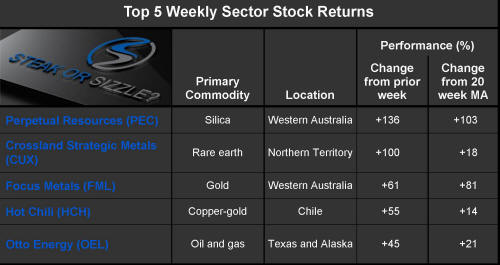

During 2019, eight additional companies produced returns from the start of the year greater than the 419% recorded by the company with the fifth highest return over the entire year. The eight companies were Warrego Energy (+950%), Liontown Resources (+650%), Meteoric Resources (+618%), Stavely Minerals (+610%), Tietto Minerals (+485%), Fenix Resources (+465%), Laneway Resources (+433%) and Hot Chili (+420%).

Quarter ended December 2019

Of

the highest returning companies during the December quarter, the following have been commented

upon previously:

Of

the highest returning companies during the December quarter, the following have been commented

upon previously:

Magmatic Resources Verdict: Sizzle.

Australia United Mining Verdict: Sizzle.

Mount Ridley Mines Verdict: Sizzle.

MRG Metals Verdict: Steak.

Bougainville Copper Verdict: Sizzle.

Month ended December 2019

Of

the highest returning companies during December, the following have been commented

upon previously:

Of

the highest returning companies during December, the following have been commented

upon previously:

Legend Mining Verdict: Steak.

MRG Metals Verdict: Steak.

EHR Resources Verdict: Sizzle.

African Energy Resources announced that it had agreements with buyers in Zambia and Zimbabwe for power generated at its proposed coal fired power station in Botswana. The improved market investment returns commenced earlier in the month before the company was placed in a trading halt (see 20 December 2019). The agreement will enable permitting to proceed. Verdict: Steak.

Gibb River Diamonds commenced a strong price recovery after the company announced that interests associated with Sir Ron Brierley had sold the last of the shares owned in the company. The final sale coincided with the arrest of Sir Ron over unrelated matters recently but after a prolonged period during which the Brierley interests had been liquidated and by which time the share price had reached historically low levels in early December. The company has been moving to develop the Blina diamond property in Western Australia. The company had cash assets of $1.1 million at the end of September 2019. It had stated an intention to sell assets to enable its development objectives. The Brierley exit should make financing the project�s very modest capital needs easier. Late in the month, the company announced that it had been invited by the state government to apply for additional ground in the Ellendale region enabling of the company to extend its area of activity. Verdict: Steak.

Week ended 20 December 2019

Variscan

Mines posted a gain which left the share price within the range

occupied throughout 2019 and near historically low levels. The higher level

within the range was reached on numerous previous occasions but not

sustainably. A week earlier, the company had completed an acquisition of two

zinc properties in Spain. It had previously held copper exploration

interests in Chile. Late in the last week, the company reported assays from

rock samples taken from the newly acquired Spanish properties where drilling

is expected to commence in early 2020. At the end of September 2019, the

company held cash assets of $1.2 million. These funds were supplemented by a

later $2.4 million raising. The company confirmed that it will undertake a

share consolidation after the recent issue of shares in connection with the

Spanish acquisition boosted the number of units on issue to 4.1 billion. Verdict: Sizzle.

Variscan

Mines posted a gain which left the share price within the range

occupied throughout 2019 and near historically low levels. The higher level

within the range was reached on numerous previous occasions but not

sustainably. A week earlier, the company had completed an acquisition of two

zinc properties in Spain. It had previously held copper exploration

interests in Chile. Late in the last week, the company reported assays from

rock samples taken from the newly acquired Spanish properties where drilling

is expected to commence in early 2020. At the end of September 2019, the

company held cash assets of $1.2 million. These funds were supplemented by a

later $2.4 million raising. The company confirmed that it will undertake a

share consolidation after the recent issue of shares in connection with the

Spanish acquisition boosted the number of units on issue to 4.1 billion. Verdict: Sizzle.

PepinNini Minerals did not make any formal disclosure which part explain the improved investment return. In any event, the increase leaves the $2 million market capitalisation company very near the lowest historical levels. The apparent returns reflect the extraordinary share price leverage accompanying even minor changes in sentiment when share prices are so depressed. Some part of the preceding share price weakness could be attributed to a share purchase plan which, on completion in early December, had raised $300,000. The company held cash assets of $334,000 at the end of September 2019. Verdict: Sizzle.

Aeon Metals announced that it had received indicative funding offers which, it claimed, would be non-dilutive and capable of progressing a pre-feasibility study for a copper-cobalt project in north west Queensland. The company, with a market capitalisation of $105 million, also announced a resource estimate upgrade for the project. The company held cash assets of $3.1 million at the end of September 2019 with expectations of spending $1.15 million in the current December quarter. Verdict: Steak.

MRG Metals was queried by ASX about the reasons for the recent share price action. The rise in price accelerated in the past week but dates from the beginning of November. The initial rise was precipitated by announcements about drilling results from the company�s mineral sands interests in Mozambique. The initial results were followed up with assays in the past week. Other assays are still pending. Earlier in December, the company raised $1.25 million via a share placement to help accelerate its exploration efforts. The company had reported having cash assets of $754,000 at the end of September 2019. Verdict: Steak.

African Energy Resources was placed in a trading halt on the first day of the week and subsequently suspended �pending the release of an announcement regarding a commercial agreement�. The company has coal projects in South Africa which it is positioning as an energy source for a much needed expansion in South African electricity generation capacity. Verdict: Sizzle.

Week ended 13 December 2019

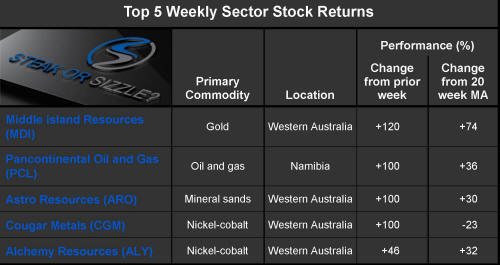

Pancontinental

Oil and Gas did not make any formal disclosure which might explain

the share price gain. The company�s share price, having plumbed historically

low levels, is now highly leveraged to even the slightest improvement in

sentiment. The company, which reported having cash assets of $1.4 million at

the end of September 2019, holds oil and gas exploration permits for areas

off the coast of Namibia. The costs of exploration make it likely that the

company will seek farm-in the participants to realise the exploration

potential of the licences. Otherwise, it might have to rely on the success

of others within the region to precipitate a re-evaluation of its assets and

discovery potential. Verdict: Sizzle.

Pancontinental

Oil and Gas did not make any formal disclosure which might explain

the share price gain. The company�s share price, having plumbed historically

low levels, is now highly leveraged to even the slightest improvement in

sentiment. The company, which reported having cash assets of $1.4 million at

the end of September 2019, holds oil and gas exploration permits for areas

off the coast of Namibia. The costs of exploration make it likely that the

company will seek farm-in the participants to realise the exploration

potential of the licences. Otherwise, it might have to rely on the success

of others within the region to precipitate a re-evaluation of its assets and

discovery potential. Verdict: Sizzle.

Legend Mining reported having discovered nickel-copper-cobalt mineralisation in the Fraser Range in Western Australia. Further assay are pending. With cash assets of $10.6 million at the end of September 2019, the company is well positioned to undertake the further exploration activities necessary to demonstrate an economically attractive find. Verdict: Steak.

EHR Resources has announced that it intends to acquire a Canadian company with interests in diamond exploration from a company associated with one of its directors. EHR had been earning an interest in a Peruvian gold-silver project on which it had spent C$2 million for a 10% stake. The company held cash assets of $2.3 million at the end of September 2019. It has flagged an intention to look for other diamond assets. A new director has been appointed to the board to lead the diamond exploration strategy. Verdict: Sizzle.

Greenvale Energy did not make any formal disclosure which might explain the improved investment return. Earlier in 2019, the company had taken a 50% stake in a company with rights over a 50% share in a gold exploration property in Arizona. The company announced a maiden resource in October. Previously, the company�s primary interest was in properties prospective for oil shale in Queensland. It held cash assets at the end of September 2019 of $117,000 and has flagged an intention to raise additional capital. The company has yet to report on its need to replenish its capital base. Verdict: Sizzle.

Lithium Australia announced that it has set up a joint venture with a Chinese company to market lithium-ion batteries and other renewable energy solutions in Australia. The company did not disclose any sales or financial objectives or funding arrangements. The company had earlier announced that it would take a 90% stake in Australia�s leading lithium-ion battery recycler. The company reported having cash assets of $2.4 million with the intention of spending $1.5 million in the current December quarter, primarily on staff and administrative expenses. During the week, the company also announced that it had raised $300,000 via a share issue. It is in need of a more significant working capital boost if it is to make a meaningful impact through its new ventures. Verdict: Sizzle.

Week ended 6 December 2019

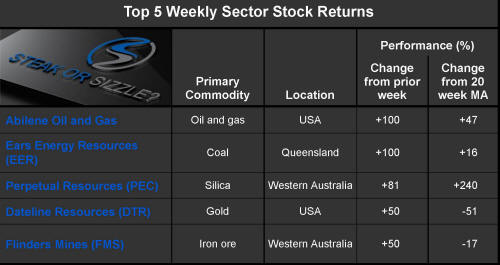

Audalia

Resources did not make any formal disclosure which might explain

the improved investment results. The company holds exploration areas in

Western Australia prospective for vanadium-titanium-iron mineralisation. The

company had cash assets of $751,000 at the end of September 2019 after

completing a $600,000 equity raising in the prior three months. The company

also had borrowings of $3 million. Directors have said that they have been

assessing funding alternatives through which to continue their exploration

and evaluation activities. In any event, the resulting gain from

historically low levels left the share price lower than at any time prior to

September 2019. Verdict: Sizzle.

Audalia

Resources did not make any formal disclosure which might explain

the improved investment results. The company holds exploration areas in

Western Australia prospective for vanadium-titanium-iron mineralisation. The

company had cash assets of $751,000 at the end of September 2019 after

completing a $600,000 equity raising in the prior three months. The company

also had borrowings of $3 million. Directors have said that they have been

assessing funding alternatives through which to continue their exploration

and evaluation activities. In any event, the resulting gain from

historically low levels left the share price lower than at any time prior to

September 2019. Verdict: Sizzle.

Adavale Resources did not make any formal disclosure which might explain the share price rise at the end of the week. Late in November, the company announced changes in its board membership and a $235,000 capital raising. The company had previously reported having cash assets of just $1,000 at the end of September 2019. The company had been relying on a standby subscription facility for its working capital. The company holds uranium exploration licences in South Australia. Verdict: Sizzle.

Astro Resources announced that the company had received the raw results from a drilling program in Nevada over areas prospective for gold but did not disclose any details pending their evaluation. The company reported having just $14,000 in cash assets at the end of September 2019. Additional borrowings of $325,000 during the quarter pushed the amount owed to supportive shareholders to $1.9 million. The share price rise was from a historically low level leaving the end of week price still near the lowest levels in the history of the company. Verdict: Sizzle.

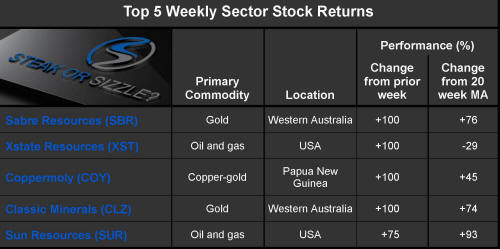

Sun Resources did not make any formal disclosure which might explain the improved investment performance. In any event, the share price uplift came from historically low levels leaving the price near life of company low levels. The company had conducted a shareholder meeting a week earlier at which no resolutions of strategic significance were considered although shareholders did approve a change of name for the company. The company was also queried by ASX about its financial position. It said, in response, that it was negotiating a farm-out agreement and had alternative funding arrangements under review. The company has offshore oil exploration interests in Louisiana where it is looking to drill its first well during the first quarter of 2020. The company reported having cash assets of $250,000 at the end of September 2019. Verdict: Sizzle.

Santana Minerals announced that it had received subscription commitments of $3 million from investors. The new funding will allow the company to complete an acquisition of nickel exploration interests in Laos and to commence fresh exploration efforts. Prior to the purchase, the company had gold exploration interests in Chile and Mexico. It reported having cash assets at the end of September 2019 of $209,000. Verdict: Sizzle.

Month ended November 2019

Of

the highest returning companies during November, the following have been commented

upon previously:

Of

the highest returning companies during November, the following have been commented

upon previously:

Ikwezi Mining Verdict: Sizzle.

MetalsTech Verdict: Sizzle.

Bougainville Copper Verdict: Sizzle.

Australia United Mining did not make any formal disclosure which might explain the improved investment returns. In any event, the stock is extremely lightly traded with turnover valued at little more than $3,000 during the entire month of November. The company holds properties in Queensland and New South Wales prospective for gold. The company has very limited financial capacity with cash assets of just $35,000 at the end of September 2019. ASX did query the company during the month about its ongoing financial capacity. Directors said in response that the company was assessing and evaluating opportunities for the farm-out or joint development of its projects. Meanwhile, directors are funding the company�s expenses through loans. Verdict: Sizzle.

Celamin Holdings did not make any formal disclosure which might explain the improved investment performance. The company held a general meeting of shareholders mid-month at which no strategically significant resolutions were considered. The share price appreciation was underway prior to the annual meeting but did subsequently accelerate suggesting that favourable inferences about the company�s prospects had been drawn from the discussions at the meeting. The company has been in the midst of a dispute in Tunisia where, it claimed, its interest in a phosphate deposit had been transferred illegally. The company has since had court decisions in its favour with damages pending. Directors confirmed that the company was taking steps to regain control of the previously disputed assets and to progress studies leading to development. Verdict: Sizzle.

Week ended 29 November 2019

Galileo

Mining was asked by ASX if it could explain the sharp rise in the

share price. Directors said they did not have any information but speculated

that investors were anticipating results from the company�s Fraser Range

exploration efforts. They drew attention to Legend Mining being in a trading

halt. Galileo�s main exploration interests are along strike from those of

Legend. Earlier in the week, the company had announced the commencement of

drilling at a copper-gold prospect near Norseman in Western Australia. Verdict: Sizzle.

Galileo

Mining was asked by ASX if it could explain the sharp rise in the

share price. Directors said they did not have any information but speculated

that investors were anticipating results from the company�s Fraser Range

exploration efforts. They drew attention to Legend Mining being in a trading

halt. Galileo�s main exploration interests are along strike from those of

Legend. Earlier in the week, the company had announced the commencement of

drilling at a copper-gold prospect near Norseman in Western Australia. Verdict: Sizzle.

Conico did not make any formal disclosure which might explain the stronger investor returns. At the end of the prior week, the company held is annual general meeting of shareholders. The meeting did not consider any resolutions of strategic significance. The company�s primary exploration interest is a 50% stake in a cobalt prospect near Norseman in Western Australia. The company held cash assets of $275,000 at the end of September 2019 after raising $312,000 in the prior three months. Verdict: Sizzle.

Renegade Exploration did not make any formal disclosure which might explain the higher share price which, in any event, was from a historically low level resulting in a price still in the middle of the range in which trading has occurred during 2019. At the end of the previous week, the company had held a meeting of shareholders. There were no strategically significant resolutions considered at the meeting. The company has gold exploration interests in Western Australia and in the Yukon. It has been seeking partners to help fund activity at the North American site. The company held cash assets of $764,000 at the end of September 2019. Verdict: Sizzle.

Austpac Resources did not make any formal disclosure which might explain the higher share price. The share price gains were accompanied by a significantly higher than usual trading volume on the final day of the week. Directors did postpone the company�s annual meeting of shareholders until mid-December. The meeting is not being asked to consider any strategically significant resolutions although directors are at risk from a spill motion following opposition to the remuneration report of the company a year earlier. The company continues to undertake testing of its process to treat zinc contaminated furnace dust generated in steelmaking. The company held cash assets of $1.5 million at the end of September 2019. Verdict: Sizzle.

Global Petroleum released an estimate for a prospective oil resource in which the company has an 85% interest off the coast of Namibia. The company�s higher share price is a modest recovery from a historically low level. The price at the end of the week was little different from the level a year earlier. The company had previously reported cash assets of $2.2 million at the end of September 2019. Verdict: Steak.

Week ended 22 November 2019

MetalsTech

announced that it had acquired an option to purchase a gold project in

Slovakia. The project had been the subject of a pre-feasibility study by a

prior owner in 2013. The site has a long history with underground and open

pit production occurring over many centuries. A proven and probable reserve

of 873,000 ounces of gold was estimated under the 2004 JORC Code.

Consideration for the transaction is a combination of cash, royalties and

performance shares. Prior to the latest initiative, the company had been

primarily interested in lithium mineralisation in Quebec. The company,

obviously in search of a strategy, joins a long line to access historical

mines often in the mistaken belief that they are easier targets than a

greenfield opportunity. Verdict: Sizzle.

MetalsTech

announced that it had acquired an option to purchase a gold project in

Slovakia. The project had been the subject of a pre-feasibility study by a

prior owner in 2013. The site has a long history with underground and open

pit production occurring over many centuries. A proven and probable reserve

of 873,000 ounces of gold was estimated under the 2004 JORC Code.

Consideration for the transaction is a combination of cash, royalties and

performance shares. Prior to the latest initiative, the company had been

primarily interested in lithium mineralisation in Quebec. The company,

obviously in search of a strategy, joins a long line to access historical

mines often in the mistaken belief that they are easier targets than a

greenfield opportunity. Verdict: Sizzle.

Ikwezi Mining had not traded since the end of October. It did not take make any formal disclosure which might explain the sharp increase in investor interest. Ikwezi is developing thermal coal production facilities in South Africa and had foreshadowed increased capacity through the development of new infrastructure. The company reported revenue of A$2.85 million in the three months ended September 2019. Verdict: Sizzle.

Bougainville Copper did not make any formal disclosure which might explain the share price appreciation during the week. The share price reached its highest level since early 2014. At the end of October, it had released a simple 15 word quarterly activities report saying there had been no production since May 1989. Periodically, speculation mounts that a production restart is being contemplated. Verdict: Sizzle.

Gas2Grid did not make any formal disclosure which might explain the stronger investment performance. The stock had not traded since late October before fresh investor interest emerged in the past week. It has oil and gas production assets in the Philippines. It has also been in dispute with the French government over a denied licence approval for which it is seeking compensation (see September 2019). A general meeting of shareholders is scheduled for later in November but no resolutions of strategic importance have been placed on the agenda. Verdict: Sizzle.

Minrex Resources did not make any formal disclosure which might explain the improved investment performance. In early November, the company had released details of a rock sampling exercise conducted during September and October over exploration areas in the east Pilbara. The focus had been on areas prospective for gold mineralisation. The company had foreshadowed work recommencing in the near future. Verdict: Sizzle.

Week ended 15 November 2019

Australian

United Mining was queried by ASX about its financial capacity. The

company continues to rely on borrowings from its principal shareholders to

cover its ongoing expenses. Directors have said they are evaluating

opportunities to fund activities through farm-out or joint development of

projects. The company holds exploration interests in New South Wales and

Queensland prospective for gold. Verdict: Sizzle.

Australian

United Mining was queried by ASX about its financial capacity. The

company continues to rely on borrowings from its principal shareholders to

cover its ongoing expenses. Directors have said they are evaluating

opportunities to fund activities through farm-out or joint development of

projects. The company holds exploration interests in New South Wales and

Queensland prospective for gold. Verdict: Sizzle.

Caeneus Minerals did not make any formal disclosure which might explain the uptick in investor interest. The company has gold exploration interests in Nevada but lacks the financial capacity for effective exploration. It had cash assets of just $5,000 at the end of September 2019. The share price rise is consistent with the leverage available to investors at historically low price levels. The company�s share price remains within the same trading range occupied through 2019. Verdict: Sizzle.

Bass Oil reported on its production rate in Indonesia in October. Output was 7% higher than in September. The company's share of production in October was 11,884 barrels. The company has said it is looking for additional opportunities in Indonesia. Earlier in the month, the company reported the results from a production test at a new well in which it has a 55% interest. The share price activity is consistent with highly leveraged responses to relatively unimportant matters at the bottom of the cycle. Similar price shifts through 2019 have not been sustained. Verdict: Sizzle.

Andromeda Metals had experienced a fourteen fold share price rise through 2019 before losing some ground (see September quarter 2019). The most recent gain is a partial recoupment of losses through the second half of October. The company did not make any formal disclosure in the past week which might explain the share price performance. Andromeda has assembled a variety of exploration properties in South Australia, Western Australia, the Northern Territory and Queensland. It has attracted interest for its halloysite-kaolin deposit on the Eyre Peninsula for which it has prepared a scoping study and for which off-take expressions of interest have been obtained in recent months. Evolution Mining has also committed to a further round of funding for a gold deposit in Queensland. Verdict: Steak.

European Metals Holdings did not make any formal disclosure which might explain the strong share price appreciation, the start of which dates from late October. The company had previously said that a European power utility had entered into a conditional agreement to provide a finance facility. It has lithium-tin exploration licences in the Czech Republic. The company has said that the European power utility is undertaking due diligence prior to confirming the funding arrangement. A decision on that funding could be imminent. The company held cash assets of $1.03 million at the end of September 2019. Verdict: Sizzle.

Week ended 8 November 2019

Mount

Ridley Mines did not make any specific disclosures which might

explain the improved investment return. The price action followed a stronger

investment performance dating from late October (see

1 November 2019). In both periods, unusually strong high turnover

accompanied the share price gains. Verdict: Sizzle.

Mount

Ridley Mines did not make any specific disclosures which might

explain the improved investment return. The price action followed a stronger

investment performance dating from late October (see

1 November 2019). In both periods, unusually strong high turnover

accompanied the share price gains. Verdict: Sizzle.

Egan Street Resources was the subject of an all-scrip takeover bid from fellow Western Australian gold producer Silver Lake Resources. During the week, the bidder increased the offer and declared it unconditional. Verdict: Steak.

Victory Mines did not make any formal disclosure which might explain the improved investment return which, in any event, resulted in the company�s share price remaining within a historically low range prevailing since June 2019. The company holds exploration interests in New South Wales and Western Australia. It has commenced a drilling program over tenements with potential for scandium and cobalt mineralisation in New South Wales. The company�s cash assets of $62,000 at the end of September 2019 have since been supplemented by a rights issue which raised $1.48 million. Verdict: Sizzle.

Gladiator Resources did not make any formal disclosure which might explain the improved investment return from this lightly traded stock. The rise was within the trading range occupied by the share price since April 2019. The trading activity was consistent with earlier unsustained results leading to the investment performance being near the top of the sector rankings (see 18 October 2019). Verdict: Sizzle.

Pacific Bauxite it did not make any formal disclosure which might explain the improved investment return in this normally lightly traded stock. Following the improved return, the share price remained near historically low levels. The share price move was similar to an earlier unsustainable move in similar circumstances (see 4 October 2019). Verdict: Sizzle.

Week ended 1 November 2019

Global

Vanadium did not make any formal disclosure which could account for

the unusually strong investor interest. The company released a two page

quarterly activities report late in the week in which it recounted details

of a capital raising during the quarter and details of its proposed exit

from a magnetite-vanadium project in the Philippines. The company also

confirmed that its focus was now �firmly� on advanced oil and gas

opportunities. It would consequently seek approval for a name change to

reflect the strategic redesign. It referred in general terms to a potential

African investment. At the end of the September quarter, the company held

cash assets of $701,000. Having opted for a name change in late 2018, to

reflect its move from oil and gas to vanadium exploration, the present group

of directors are proving to be seriously unaccomplished in their endeavours

to create value from their strategic redirections. Verdict: Sizzle.

Global

Vanadium did not make any formal disclosure which could account for

the unusually strong investor interest. The company released a two page

quarterly activities report late in the week in which it recounted details

of a capital raising during the quarter and details of its proposed exit

from a magnetite-vanadium project in the Philippines. The company also

confirmed that its focus was now �firmly� on advanced oil and gas

opportunities. It would consequently seek approval for a name change to

reflect the strategic redesign. It referred in general terms to a potential

African investment. At the end of the September quarter, the company held

cash assets of $701,000. Having opted for a name change in late 2018, to

reflect its move from oil and gas to vanadium exploration, the present group

of directors are proving to be seriously unaccomplished in their endeavours

to create value from their strategic redirections. Verdict: Sizzle.

Avenira announced that it had completed sale of a West African phosphate project leaving it debt free and with $2.7 million in cash after a share repurchase. The company will retain its interest in the Wonarah phosphate deposit in the Northern Territory. The company has flagged a review to set a new strategic direction. The company had reported having cash assets of $301,000 at the end of June 2019 with outstanding loans exceeding $7 million. Verdict: Sizzle.

Mount Ridley Mines did not make any formal disclosure which could account for the surge in investor interest. It had recently completed a capital raising and, during the week, sent out a notice for an annual general meeting of shareholders. The proposed resolutions did not include any strategic initiatives which might underpin an improved valuation. At the top of the list of activities undertaken in the quarter, according to its updated activities statement, was a change of postal address. In any event, the price rise came from historically low levels leaving the company well within the range of prices which have prevailed throughout the past 12 months. The company holds exploration tenements in the south of Western Australia prospective for nickel on which it spent $55,000 during the September quarter. Verdict: Sizzle.

Peninsula Mines is a very lightly traded stock which had been priced at historically low levels before trades with a market value of $1,500 forced the share price higher. The company did not make any formal disclosure which might account for any greater investor interest other than release its activities report for the three months ended September and send out a notice for an annual meeting of shareholders. The company referred to a proposed merger, announced in July, of its Korean activities with another graphite project developer. The company reported that discussions were continuing despite a delay caused by management changes at the partnering company. The resolutions to be put to shareholders do not include any strategic initiatives which might impact corporate value. The Korean graphite mine developer reported having cash assets at the end of September of $171,000. Verdict: Sizzle.

Talon Petroleum did not make any formal disclosure which might explain the investment return although the higher price remains within the lower end of a range which has prevailed through the past 12 months. The company had produced similarly top five results recently (see 18 October 2019) before giving up those gains and reverting to the lower end of the prevailing price range. The company released its activities report for the three months ended September recounting its North sea oil and gas exploration interests. It reported having cash assets at the end of September of $2.2 million. Verdict: Sizzle.

Month ended October 2019

Of

the highest returning companies during October, the following have been commented

upon previously:

Of

the highest returning companies during October, the following have been commented

upon previously:

East Energy Resources Verdict: Steak.

Accent Resources Verdict: Sizzle.

Eclipse Metals Verdict: Sizzle.

Magmatic Resources has been on a rising share price trend since mid September following an announcement by Alkane Resources of a copper-gold discovery near the company's own exploration activities in the East Lachlan region in New South Wales (see 13 September 2019). Subsequently, Magmatic announced that it had cancelled plans to demerge its interests in the region and to acquire new assets in Western Australia to focus efforts on the newly attractive New South Wales tenements. The company has partially completed a $2.2 million capital raising and directors have given former Atlas Iron chief executive David Flanagan a position on the board. Verdict: Sizzle.

Avenira announced that it had completed sale of a West African phosphate project leaving it debt free and with $2.7 million in cash after a share repurchase. The company will retain its interest in the Wonarah phosphate deposit in the Northern Territory. The company has flagged a review to set a new strategic direction. The company had reported having cash assets of $301,000 at the end of June 2019 with outstanding loans exceeding $7 million. Verdict: Sizzle.

Week ended 25 October 2019

Latin

Resources came back from an eight day trading halt with an

acquisition announcement. The company being acquired holds exploration

interests in Western Australia covering halloysite and silver-lead deposits

in the Paterson range. The first deposit is still in the application stage.

Consideration will be in the form of shares in the buyer, options over

shares and milestone shares. The company also announced a $1.5 million

capital raising package. The company had previously been engaged in several

South American exploration interests including hard rock lithium mining in

Argentina. It had faced long delays in gaining approval for its intended

activities. At the end of June 2019, it had cash assets of just $32,000 and

undrawn loan facilities of $3.15 million, potentially payable with the issue

of new shares. Verdict: Sizzle.

Latin

Resources came back from an eight day trading halt with an

acquisition announcement. The company being acquired holds exploration

interests in Western Australia covering halloysite and silver-lead deposits

in the Paterson range. The first deposit is still in the application stage.

Consideration will be in the form of shares in the buyer, options over

shares and milestone shares. The company also announced a $1.5 million

capital raising package. The company had previously been engaged in several

South American exploration interests including hard rock lithium mining in

Argentina. It had faced long delays in gaining approval for its intended

activities. At the end of June 2019, it had cash assets of just $32,000 and

undrawn loan facilities of $3.15 million, potentially payable with the issue

of new shares. Verdict: Sizzle.

Encounter Resources was queried by ASX about the reasons for the increased price and higher turnover. Directors said that they did not have any information to disclose although they referred to results of previously announced drilling in the Tanami region of Western Australia which are expected in November. The exploration effort is being conducted through a joint venture with Newcrest Mining. The company holds several copper-gold-cobalt mineral exploration properties in Western Australia. It held cash assets of $2.48 million at the end of June 2019. Verdict: Sizzle.

Quantum Graphite did not make any formal disclosure which might explain the share price move although the responsible turnover amounted to only $1,242. The company, which is developing a graphite property in South Australia, had cash assets of $299,000 at the end of June 2019. It dispatched a notice of meeting to shareholders at the end of the week. Resolutions, which included moves to consolidate the number of shares on issue and approve share-based compensation for directors, did not include any strategic initiatives. Verdict: Sizzle.

Devex Resources announced that a diamond drill rig had been mobilised to begin work on a shallow copper-gold deposit at Bogong in New South Wales. Later in the week, the company announced that it had appointed the former chief executive of Silver City Minerals as chief geologist for New South Wales. The company also has uranium and lithium exploration interests in the Northern Territory and Western Australia. It had cash assets of $1.2 million at the end of June 2019 after a $1.4 million capital raising. The company had foreshadowed quarterly spending of $1.28 million ahead of the recently completed September quarter. Verdict: Sizzle.

Challenger Exploration had announced a week earlier that it had commenced a drilling program at its Hualilan gold project in Argentina. In the past week, it said that it would receive the first assay results in two or three weeks. The company was conducting investor briefings in Hong Kong which coincided with the improved investment performance. Verdict: Sizzle.

Week ended 18 October 2019

Gladiator

Resources did not make any formal disclosure which might explain

the share price rise or stronger than usual market turnover. The rise left

the company's share price within the range it had occupied throughout 2019

near historically low levels. Prior to the rise and earlier in the week, the

company released its activities statement for the three months ended

September 2019. The company reported that a work programme would be

submitted for approval covering gold mining areas in Western Australia over

which an exploration licence had been granted during the quarter. The

company also reported that it had given up other exploration areas after

drilling had failed to demonstrate economic mineralisation. The company

reported cash assets at the end of the quarter of $174,000 following a

$100,000 capital raising. It flagged an intention to spend just $20,000 on

exploration in the current December quarter. Verdict: Sizzle.

Gladiator

Resources did not make any formal disclosure which might explain

the share price rise or stronger than usual market turnover. The rise left

the company's share price within the range it had occupied throughout 2019

near historically low levels. Prior to the rise and earlier in the week, the

company released its activities statement for the three months ended

September 2019. The company reported that a work programme would be

submitted for approval covering gold mining areas in Western Australia over

which an exploration licence had been granted during the quarter. The

company also reported that it had given up other exploration areas after

drilling had failed to demonstrate economic mineralisation. The company

reported cash assets at the end of the quarter of $174,000 following a

$100,000 capital raising. It flagged an intention to spend just $20,000 on

exploration in the current December quarter. Verdict: Sizzle.

Xstate Resources is an example of the extraordinary leverage which comes from a normally illiquid stock trading at a historically low share price. The unusually large turnover in this usually very lightly traded stock left the share price close to historically low levels despite doubling. The company, which has had oil and gas exploration interests in Texas, did not make any formal disclosure which could account for the share price rise. In August, the company had announced that it had terminated the Texas farm-in agreement. It held cash assets of $517,000 at the end of June 2019. Verdict: Sizzle.

Northern Cobalt announced that it had entered into an agreement to earn an 80% interest in a gold exploration project in Alaska, near the Pogo mine of Northern Star, subject to completion of due diligence . The company, which held cash assets of $742,000 at the end of June 2019 with plans to spend $290,000 in the completed September quarter, also announced a $1.5 million capital raising. The company had previously been engaged in vanadium exploration in Alaska over land which includes magnetite mineral deposits. Verdict: Sizzle.

Talon Petroleum did not make any formal disclosure which might explain interest in the usually very lightly traded company. In any event, the share price gain occurred with a single trade valued at just $750. The company has oil and gas exploration interests in the North Sea through an acquisition completed in May 2019 and other licences in the area. The company held cash assets of $2.6 million at the end of June 2019. Following the rise, the share price remained within the range it had occupied since late 2018. Verdict: Sizzle.

Trek Metals did not make any disclosure which could account for a pick-up in investor interest. In any event, the share price, which had been trading near historically low levels, remained within a range which had prevailed through most of 2019. Earlier in the month, the company had completed a consolidation in the number of shares on issue which followed a $2.4 million capital raising a month earlier. In September 2019, the company had announced an agreement under which Apollo Minerals would earn an interest of up to 80% in a zinc-lead exploration property it acquired in April 2018. It also announced management and board changes so as to identify future opportunities. Verdict: Sizzle.

Week ended 11 October 2019

Krakatoa

Resources announced in late September that the company had agreed

to acquire 100% of an exploration area prospective for copper-gold

mineralisation in New South Wales. Consideration for the transaction was a

combination of shares (10 million in addition to the 150 million on issue),

cash ($300,000) and net smelter royalty (1%). The area in question is near

the Newcrest Cadia mine and a recent discovery by Alkane Resources. In the

past week, the company confirmed completion of due diligence. Prior to this

transaction, the company had exploration interests in Western Australia

covering a range of commodity exposures including rare earth elements,

mineral sands and gold. The Western Australian rare earth assets were

acquired as recently as June. The company held cash assets of $407,000 at

the end of June 2019 after raising $379,000 in June. Verdict: Sizzle.

Krakatoa

Resources announced in late September that the company had agreed

to acquire 100% of an exploration area prospective for copper-gold

mineralisation in New South Wales. Consideration for the transaction was a

combination of shares (10 million in addition to the 150 million on issue),

cash ($300,000) and net smelter royalty (1%). The area in question is near

the Newcrest Cadia mine and a recent discovery by Alkane Resources. In the

past week, the company confirmed completion of due diligence. Prior to this

transaction, the company had exploration interests in Western Australia

covering a range of commodity exposures including rare earth elements,

mineral sands and gold. The Western Australian rare earth assets were

acquired as recently as June. The company held cash assets of $407,000 at

the end of June 2019 after raising $379,000 in June. Verdict: Sizzle.

Accent Resources did not make any formal disclosure which might explain the improved investor interest in this very rarely traded $905,000 company. In any event, the gain was made with a single transaction with a value of just $38. The company holds magnetite and gold exploration interests in Western Australia. Directors have said they are looking for new investment opportunities. The company had cash assets of $362,000 at the end of June 2019 with the intention of spending $290,000 during the just completed September quarter. Verdict: Sizzle.

GBM Resources announced that it had completed a $300,000 capital raising and had appointed a new non-executive director with an extensive background in the mining industry in large and small companies. The company has gold and copper exploration interests in north west Queensland as well as gold in Victoria. It held cash assets of $333,000 at the end of June 2019 with the intention of spending $300,000 in the just completed September quarter. It had a partially drawn convertible note facility which permitted it to draw down $350,000 in July. The share price rise left the company trading within the same range it had occupied since mid-2018 and near historically low levels. Verdict: Sizzle.

Australian Pacific Coal did not make any formal disclosure which might explain the improved investment outcome which raised the company�s share price from a historically oversold position. The company holds a currently closed coal mine in New South Wales. In August, the government had declined to extend a development approval by the five years requested by the company. The company is able to appeal the determination but has additional time in which to do so. The company held cash assets of $671,523 at the end of June 2019 with outstanding loans of $53.2 million. It sold assets to raise $1.6 million in July but must find alternative funding for its ongoing activities, including the possibility of partners to enable it to reopen its mining operations. Verdict: Sizzle.

Eclipse Metals did not make any formal disclosure which might explain the improved investment return. The company has uranium exploration interests in the Northern Territory and manganese exploration interests in Queensland. The company which has a historical track record of very light trading attracted significantly greater interest during the past week. After trading at historically weak prices at the end of September, the recent rise took the company�s share price to the upper end of the trading range prevailing over the past 12 months. The company held cash assets of $358,000 at the end of June 2019 with expected spending of $130,000 in the just completed September quarter. Verdict: Sizzle.

Week ended 4 October 2019

East

Energy Resources did not make any formal disclosures which might

explain the stronger interest in the normally rarely traded stock. In any

event, the share price improvement came with turnover valued at less than

$3,000. The company's principal resource interests are in coal deposits near

Blackall in Queensland. Development of the coal interests depend heavily on

the Adani coal mine in the Galilee Basin proceeding and construction of the

associated transport infrastructure on which a new Blackall mine would

depend. The company relies on financial support from Noble which holds 93%

of the company�s shares. Directors have said they are looking for

alternative opportunities. Verdict: Sizzle.

East

Energy Resources did not make any formal disclosures which might

explain the stronger interest in the normally rarely traded stock. In any

event, the share price improvement came with turnover valued at less than

$3,000. The company's principal resource interests are in coal deposits near

Blackall in Queensland. Development of the coal interests depend heavily on

the Adani coal mine in the Galilee Basin proceeding and construction of the

associated transport infrastructure on which a new Blackall mine would

depend. The company relies on financial support from Noble which holds 93%

of the company�s shares. Directors have said they are looking for

alternative opportunities. Verdict: Sizzle.

Legacy Iron Ore received a query from ASX about why the company had attracted unusually strong investor interest. Directors referred to general market conditions, including a higher gold price. They added that a drilling program at a gold exploration site in the goldfields of western Australian had concluded, after having commenced in June. They referred to results being released within the next two weeks. Verdict: Sizzle.

New Standard Energy did not make any formal disclosure which might explain the stronger investor interest. It did release its annual report. The company holds oil and gas exploration interests in the onshore Carnarvon Basin in Western Australia. In July, the company said that it was seeking to renew an exploration permit but approval had not yet been granted. In any event, the share price movement has left the company trading within the same range it has occupied throughout 2018 and 2019 and near historically low levels. Verdict: Sizzle.

Pacific Bauxite did not make any formal disclosure which might explain the stronger investor interest although, in any event, the change represents only a very small increment to a historically low share price. Earlier in September, the company announced a rights issue to raise approximately $992,000 to help fund activity at its Solomon Islands bauxite deposits. The company had been in dispute with the government which had refused an application for renewal of an exploration licence. In September, the High Court ruled in favour of the company which is now free to seek renewal of the licence. Verdict: Sizzle.

Audalia Resources did not make any formal disclosure which might explain heightened investor interest in the company which holds licences over land in Western Australia prospective for vanadium and titanium mineralisation. The company reported having cash assets at the end of June 2019 of $551,000 and $3.0 million in outstanding loans. It completed a $0.6 million placement during July. Directors said they are evaluating future funding sources. The rise leaves the price of the company�s rarely traded shares still lower than in October 2017 and little different from the lowest levels in the company�s history. Verdict: Sizzle.

Quarter ended September 2019

Of

the highest returning companies during the September quarter, the following have been commented

upon previously:

Of

the highest returning companies during the September quarter, the following have been commented

upon previously:

Stavely Minerals Verdict: Steak.

Strike Energy Verdict: Sizzle.

Surefire Resources attracted abnormally strong investor interest from mid-July and a rising share price trend throughout the remainder of the quarter. The company began planning a Western Australian gold exploration program in July/August with drilling commencing in September. The area covered by the exploration in the midwest region south of sandstone had been acquired as a vanadium exploration opportunity (see 3 May 2019). The company has not released any results but is following up historical drilling which had identified several areas of high-grade gold mineralisation. The company received commitments from investors to subscribe for new shares with a value of $1.15 million after finishing June 2019 with cash assets of $136,000. Verdict: Sizzle.

Andromeda Metals has been on a rising share price trend for the second consecutive quarter. The company's shares were among the best performed equities in the June quarter (see here) on the back of its kaolin exploration interests in South Australia which have been identified as a potential source of material for the ceramics industry. During the quarter, the company had announced off-take negotiations. The originally foreshadowed involvement of the project in producing high purity alumina has not been considered in the completed scoping study. Verdict: Steak.

Classic Minerals reported high grade gold intersections from drilling in September at its Forrestania gold project. Commencement of activity in August had encouraged a brief boost to interest in the company (see 16 August 2019) followed by a more sustained reaction later in September. Verdict: Sizzle.

Month ended September 2019

Of

the highest returning companies during September, the following have been commented

upon previously:

Of

the highest returning companies during September, the following have been commented

upon previously:

Stavely Minerals Verdict: Steak.

Magmatic Resources Verdict: Sizzle.

Gas2Grid announced in early September that drilling was about to commence on oil and gas exploration properties it holds under licence in the Philippines. Until that point, the company�s shares had been trading at historically low prices. Weighing on the investment returns would have been a dispute with the French government which had refused to renew an exploration permit in that country. A tribunal subsequently concluded that the refusal was unlawful, opening the way for the company to launch a damages claim. Verdict: Sizzle.

Alice Queen shares commenced their upward price move in early August after hovering near historically low levels over the prior 12 months. The company was asked if it could explain the unusual share price movement. Other than the possible impact of higher gold prices, the company was unable to cite any company specific reasons for the move although it referred to having been testing the market appetite for a share placement. The rise in the share price accelerated sharply in mid-September after the company drew attention to a discovery by Alkane near its own gold exploration interests in New South Wales. The company drew attention to similar geological features within its exploration areas as those encountered by Alkane. Verdict: Sizzle.

AustChina Holdings has coal mining interests in Queensland which have been stalled by inadequate transport infrastructure and political hostility to mine development. The company has referred to recent support for development of the Adani mine in the Galilee Basin as possibly resulting in an improvement in the available infrastructure and benefitting the company�s development chances. The company also holds a 5% interest in a Queensland copper explorer. It did not make any formal disclosure which might explain the change in investor returns. The company ended 2018/19 with cash assets of $66,000 prior to completing a $831,317 placement in July. Verdict: Sizzle.

Week ended 27 September 2019

Stavely

Minerals reported a very high grade copper gold intersection from

drilling at its exploration project in western Victoria. A copper grade of

5.88% over 32 metres included 2 metres grading 40%. The discovery occurred

from a depth of 62 metres. Further drilling is in progress with results

upcoming. The drilling activity will assist the company to improve its

understanding of the regional geology where mineralisation had been

identified historically without suspicions of a potential major deposit

being proven.

Verdict: Steak.

Stavely

Minerals reported a very high grade copper gold intersection from

drilling at its exploration project in western Victoria. A copper grade of

5.88% over 32 metres included 2 metres grading 40%. The discovery occurred

from a depth of 62 metres. Further drilling is in progress with results

upcoming. The drilling activity will assist the company to improve its

understanding of the regional geology where mineralisation had been

identified historically without suspicions of a potential major deposit

being proven.

Verdict: Steak.

Stone Resources Australia did not make any formal disclosure which might explain the stronger investor interest. In any event, the share price gain in the usually lightly traded stock came from a handful of trades with a value of $1,530. The company�s share price remains near historically low levels after the rise in the past week. The company had previously reported having cash holdings of $140,000 at the end of August 2019. The Western Australian gold explorer depends on loans from its majority shareholder to continue in business. In its June quarter activities report, the company disclosed that it had contracted a consultant to compile and review the available geoscientific data relating to its properties. Verdict: Sizzle.

Lincoln Minerals received a query from ASX about why it had attracted unusually strong investor interest but directors said they did not have any information which might be relevant. The fresh buying occurred in the lead up to the release of the company�s annual report. The company�s principal interest is a graphite exploration property on the Eyre Peninsula in South Australia. The company held cash assets of $1.7 million at the end of June 2019. Verdict: Sizzle.

Discovery Africa did not make any formal disclosure which might explain the unusually strong investor interest in what is usually a lightly traded stock. The company, which holds an option to purchase a 100% interest in gold projects in Western Australia, released its annual report during the week. In August, it had reported settlement of a legal dispute which had netted it $1.85 million. The company has said that it is looking to identify new acquisition opportunities. Verdict: Sizzle.

Mount Ridley Mines did not make any formal disclosures which might explain the stepped up investor interest in the company which holds exploration tenements in the Fraser Range region in Western Australia. The company has not completed significant exploration work in recent months and has said that it is evaluating other opportunities. It held cash assets of $1.0 million at the end of June 2019. Verdict: Sizzle.

Week ended 20 September 2019

Mount Burgess Mining did not make any formal announcement which might

explain the improved investment performance. The company, which was queried

by ASX, could not provide any insight into the reason. In the second half of

August, the company had announced the results of metallurgical test work on

samples of ore from its Nxuu base metal and vanadium deposit in Botswana.

The results highlighted the use of improved sorting technology to lower

costs. There was no market reaction at the time of that announcement. At the

end of June, the company held cash assets of $35,000. It subsequently raised

$70,000 through an issue of new shares.

Verdict: Sizzle.

Mount Burgess Mining did not make any formal announcement which might

explain the improved investment performance. The company, which was queried

by ASX, could not provide any insight into the reason. In the second half of

August, the company had announced the results of metallurgical test work on

samples of ore from its Nxuu base metal and vanadium deposit in Botswana.

The results highlighted the use of improved sorting technology to lower

costs. There was no market reaction at the time of that announcement. At the

end of June, the company held cash assets of $35,000. It subsequently raised

$70,000 through an issue of new shares.

Verdict: Sizzle.

Red Sky Energy did not make any formal disclosure which might explain the share price action. When queried by the ASX about the price moves, directors said they could not provide a reason other than a recent announcement of a farm-out agreement with Santos which involved an injection of $9 million into the company�s oil exploration interests in the Cooper Basin. The company also acknowledged having had discussions with potential investors about a capital raising and, as a result, directors decided to enter the company into a trading halt until they had finalised their views about how to proceed. The company held cash assets of $36,000 at the end of June 2019. Verdict: Sizzle.

Azumah Resources received an unsolicited bid for all of the shares in the company from an investment fund which had been appointed project manager of the Wa gold project in Ghana in 2017. The fund had sought to buy out Azumah�s 53.5% interest in the project which is in the latter stages of a feasibility study. The bid was launched after an approach to take over the company did not receive a response within the specified tight deadline. The fund holds 17.7% of its target. Verdict: Steak.

Alta Zinc had announced the appointment of a new chief executive a week earlier and, in the last week, announced the appointment of a corporate advisory firm with which the new executive has worked in the past. The advisory firm claims to be able to unlock value from mining projects, a talent it intends to deploy in favour of the company�s Gorno zinc project in Italy. Verdict: Sizzle.

Scorpion Minerals announced that it had been granted an exploration licence over an area in Western Australia�s Murchison region prospective for base metals, gold and cobalt. Previously, the company had entered into an agreement to take up a 70% joint venture interest in a Burkina Faso exploration venture. The company reported having cash assets at the end of June 2019 of only $5,000 with undrawn loan facilities of approximately $500,000. Verdict: Sizzle.

Week ended 13 September 2019

Magmatic

Resources announced that it had signed an agreement with unlisted

Blue Cap Mining under which the latter would fund pre-production work and

early stage working capital needs for the company�s North Iron Cap gold

project in Western Australia. At the end of June 2019, Magmatic held cash

assets of $234,000 while flagging expenditure of $857,000 in the current

September quarter. During the week, Magmatic also released a statement

referring to recent discoveries by Alkane Resources on property near the

Magmatic assets. Magmatic remains financially stretched in meeting the

demands of the number of sites on which work would be required to do justice

to its portfolio.

Verdict: Sizzle.

Magmatic

Resources announced that it had signed an agreement with unlisted

Blue Cap Mining under which the latter would fund pre-production work and

early stage working capital needs for the company�s North Iron Cap gold

project in Western Australia. At the end of June 2019, Magmatic held cash

assets of $234,000 while flagging expenditure of $857,000 in the current

September quarter. During the week, Magmatic also released a statement

referring to recent discoveries by Alkane Resources on property near the

Magmatic assets. Magmatic remains financially stretched in meeting the

demands of the number of sites on which work would be required to do justice

to its portfolio.

Verdict: Sizzle.

Austpac Resources made a very simple three line announcement that it had sold a synthetic rutile technology package for $1.5 million. Otherwise, the company did not make any disclosure which might explain the improved investment return. The volume of shares on the last day of the week, although valued at just $39,500, was well above average volumes in this lightly and infrequently traded stock. The higher share price remained within a longer term trading range referred to in an earlier comment (see 23 August 2019) when the company previously moved up within the same range. Verdict: Sizzle.

Australia United Mining did not make any formal disclosure which might explain the improved investment return. The usually very lightly traded company made the share price gain on the last day of the week with turnover valued at $3,350. The company holds properties in Queensland and New South Wales prospective for gold. It reported having cash assets at the end of June 2019 of $37,000. Company directors have said they would be prepared to lend money to fund the business while longer term arrangements were put in place. Verdict: Sizzle.

Oilex announced that it had entered into an agreement under which it could acquire an interest of up to 50% in gas discoveries in the East Irish Sea. The company cautioned that no binding agreement had been finalised. The company said it was looking for funding to cover its involvement in the transaction. It also announced that it had extended the settlement date for a Cooper Basin- Eromanga Basin property transaction by two weeks until mid-October 2019 (see 9 August 2019). Verdict: Sizzle.

Winchester Energy reported that it had recovered significant oil following fracture stimulation of oil prospects in the Permian Basin. The company subsequently said it was continuing to monitor flow rates to optimise production. Winchester has a 17,000 acre leasehold position where production has commenced and over which it is conducting drilling. Verdict: Sizzle.

Week ended 6 September 2019

Tamaska

Oil and Gas announced recently that it had acquired the right to

earn a 50% interest in a Romanian oil and gas exploration licence. The

company has held an interest in a Louisiana production platform which is

producing intermittently as its performance declines. The company which had

a market capitalisation of $8 million at the end of the week generally

trades infrequently. Its improved market value was achieved on turnover

with a value of just $1,000. Following its rise, the share price remained

within a historically low range which has prevailed since 2016. During the

week, the company lodged a presentation with the ASX in which it referred

briefly to a rights issue without having made any formal announcement about

the potential terms and conditions of a capital raising.

Verdict: Sizzle.

Tamaska

Oil and Gas announced recently that it had acquired the right to

earn a 50% interest in a Romanian oil and gas exploration licence. The

company has held an interest in a Louisiana production platform which is

producing intermittently as its performance declines. The company which had

a market capitalisation of $8 million at the end of the week generally

trades infrequently. Its improved market value was achieved on turnover

with a value of just $1,000. Following its rise, the share price remained

within a historically low range which has prevailed since 2016. During the

week, the company lodged a presentation with the ASX in which it referred

briefly to a rights issue without having made any formal announcement about

the potential terms and conditions of a capital raising.

Verdict: Sizzle.

Big Star Energy disclosed that it had completed a helium soil gas survey, reporting that the prospect is larger than originally mapped. Subsequently, the company requested a trading halt, still in place at the end of the week, pending an announcement. Verdict: Sizzle.

Pilot Energy did not make any further disclosure following its statement in the prior week in response to a query from ASX (see 30 August 2019) about what might be driving the heightened investor interest. Verdict: Sizzle.

Carnavale Resources announced the appointment of a technical advisor with extensive exploration and project development experience. His role was described as marketing the company and its projects. Carnavale is farming into a tin exploration venture in Uganda where it has a right to earn a 70% interest over five years. The company held cash assets of $191,000 at the end of June 2019 and subsequently completed a rights issue which raised $2.25 million, including the placement of a shortfall. Verdict: Sizzle.

White Cliff Minerals announced that it had agreed to sell its 90% interest in a Kyrgyzstan copper-gold property for $2.65 million, comprising cash and shares. White Cliff holds an interest in the purchasing company. The transaction would leave the company to focus on nickel-cobalt interests in Western Australia, although it had previously indicated that it was looking for buyers or joint venture partners with whom to progress the Australian licences. It held cash assets of $369,000 at the end of June 2019. Despite the share price rise, the $3.1 million company has a market value near historically low levels. Verdict: Sizzle.

Month ended August 2019

Of

the highest returning companies during August, the following have been commented

upon previously:

Of

the highest returning companies during August, the following have been commented

upon previously:

Pilot Energy Verdict: Sizzle.

Key Petroleum Verdict: Sizzle.

Metalsearch Verdict: Sizzle.

Horizon Gold has benefited from a rising share price throughout August without having made any formal disclosure which might have precipitated the price action. The company has gold exploration interests in Western Australia with an estimated resource containing 1.38 million ounces of gold within a region with a long history of successful production. The company will have benefited from a stronger gold price as bond yields declined through August. Verdict: Steak.

Norwest Energy announced that its Springy Creek conventional oil prospect in the Perth Basin, in which it has a 20% interest, had been upgraded to a drill candidate. Re-interpretation of the geological conditions affecting the decision to drill has been influenced by the results of Strike Energy (see 20 June 2019), also operating in the northern Perth Basin. Verdict: Steak.

Week ended 30 August 2019

Key Petroleum had provided a short update for investors about its

exploration activities in the Cooper Basin early in the week. Subsequently,

the company released an update about its activities in the Perth Basin where

Strike Energy and Warrego Energy had reported a significant gas discovery.

The Strike/Warrego discovery is leading Key Petroleum to reappraise plans

for its own permits in the region, according to the company's commentary.

Verdict: Sizzle.

Key Petroleum had provided a short update for investors about its

exploration activities in the Cooper Basin early in the week. Subsequently,

the company released an update about its activities in the Perth Basin where

Strike Energy and Warrego Energy had reported a significant gas discovery.

The Strike/Warrego discovery is leading Key Petroleum to reappraise plans

for its own permits in the region, according to the company's commentary.

Verdict: Sizzle.

Pilot Energy did not make any formal disclosure which might explain the improved investor interest. The company did receive a query from the ASX about the reasons for the market move. In replying, Pilot Energy directors referred the exchange to an announcement by Key Petroleum in which that company drew attention to a gas discovery at West Erregulla-2 by a joint venture between Strike Energy and Warrego Energy. Pilot is in two joint ventures with Key Petroleum in the northern Perth Basin which is the location of the Strike/Warrego discovery. Verdict: Sizzle.

3D Resources did not make any formal disclosure which might explain the company�s improved investment performance. The improved investor interest left the company�s share price within the trading range the infrequently traded stock had occupied since May. 3D holds exploration interests in Western Australia prospective for gold. Its activities in Western Australia have been constrained by land access difficulties which have led the company to look for opportunities offshore. In its activities report for the June quarter released at the end of July, the company disclosed that it was considering the purchase of interests in copper and gold exploration properties in Africa. Verdict: Sizzle.

Warrego Energy had experienced a rising share price since late July (see 26 July 2019) after drilling commenced and the company reported a gas discovery at West Erregulla-2 in the Perth Basin. A second of discovery was reported in the past week. The company had reported having cash assets of $7.3 million at the end of June 2019. Verdict: Steak.

Strike Energy is the joint venture partner of Warrego Energy in the West Erregulla-2 prospect and regional exploration activity in the Perth Basin. Strike, the joint-venture operator, has referred to its discoveries as pointing to a new conventional gas fairway. Verdict: Steak.

Week ended 23 August 2019

Cazaly

Resources announced that it had received an offer from Mineral

Resources for its Parker Range iron ore project. Completion of the

transaction would entitle Cazaly to a cash payment of $20 million and a

future royalty stream. The Mineral Resources terms trump an offer, subject

to due diligence, received by the company in June and which will now be

discontinued. The company has a range of other exploration interests

including gold in Western Australia, cobalt in Namibia and uranium in

Europe. It reported having cash assets of $837,000 at the end of June 2019.

Verdict: Steak.

Cazaly

Resources announced that it had received an offer from Mineral

Resources for its Parker Range iron ore project. Completion of the

transaction would entitle Cazaly to a cash payment of $20 million and a

future royalty stream. The Mineral Resources terms trump an offer, subject

to due diligence, received by the company in June and which will now be

discontinued. The company has a range of other exploration interests

including gold in Western Australia, cobalt in Namibia and uranium in

Europe. It reported having cash assets of $837,000 at the end of June 2019.

Verdict: Steak.

Big Star Energy announced that it had acquired oil and gas leases in the USA over areas prospective for the capture of helium. The areas involved are in the vicinity of land which had previously been used for accessing helium but are unproven exploration opportunities for which no additional technical information has been provided. Verdict: Sizzle.

Austpac Resources did not make any formal disclosure which might explain the improved investment return which was accompanied by unusually high stock turnover. In any event, the higher prices remained within the historically low range which had prevailed since June 2018. The company, backed by a Chinese steel producer, is seeking to develop technology to recover zinc and iron from furnace dusts. It had cash assets of $472,000 at the end of June 2019. Verdict: Sizzle.