The �Steak or Sizzle?� blog comments on each of the top five performing resources stocks in the prior week.

�Sell the sizzle, not the steak� is a famous sales adage. The sizzle is the showily attractive distraction from the quality of the meat. Sizzle plays on the emotions of buyers.

�All sizzle and no steak� is a reference to excitement which fails to measure up to expectations of quality.

Resource sector investors are constantly confronted by choices requiring them to distinguish between �steak� and �sizzle�.

Each commentary offers an opinion about whether recent unusually strong price performance is 'sizzle' or �steak� .

Being steak or sizzle does not necessarily say anything about near term investment returns. But sizzle can only take a company so far. Ultimately, steak is needed to sate the appetite of investors for something financially nourishing.

Year ended 31 December 2018

THEME OF THE YEAR: Bottom of the Cycle Gains

Kangaroo

Resources took two large steps forward during 2018 to deliver the

best returns in the sector for 2018. A 100% share price gain was recorded in

the first week of May (4 May 2018).

In mid-August, the company�s major shareholder initiated a takeover of the

company at a 67% price premium to the pre-existing market level. The

immediate response had left the share price 20% below the bid price with the

gap only closing in December after a court approved a scheme of arrangement. Verdict:

Steak.

Kangaroo

Resources took two large steps forward during 2018 to deliver the

best returns in the sector for 2018. A 100% share price gain was recorded in

the first week of May (4 May 2018).

In mid-August, the company�s major shareholder initiated a takeover of the

company at a 67% price premium to the pre-existing market level. The

immediate response had left the share price 20% below the bid price with the

gap only closing in December after a court approved a scheme of arrangement. Verdict:

Steak.

Galilee Energy shares posted a fivefold rise between June and mid September before partially giving up gains in the latter part of 2018. The company�s shares were among the top five best performers during June 2018 (see 22 June 2018). In December, the company completed a $13 million share placement to further the group�s drilling and development plans. Verdict: Steak.

Global Vanadium had been known as Baraka Energy and Resources when the company topped the weekly investment returns in mid June (15 June 2018). That gain was associated with a policy change in the Northern Territory permitting fracking for oil and gas. Subsequently and after a change in directors, the company announced that it would also change its strategic direction in favour of an emphasis on vanadium. The company has an interest in a project in the Philippines and is investigating opportunities in southern Africa. It is looking for a joint venture partner to pursue development of its Australian oil and gas interests. At the end of September 2018, the company had cash assets of $823,000. While there was a basis for the mid-year re-rating based on the beneficial effects of the Northern Territory policy change, the company�s strategic position looked confused by the end of 2018 with a limited financial capacity to pursue any of its contemplated ventures. By the end of 2018, the company�s share price was slightly below the peak level achieved in June. Verdict: Sizzle.

Galan Lithium changed its name from Dempsey Minerals during the year after it acquired a position in the Argentine brine lithium industry. The company was among the top five weekly performers in February when it first announced its Argentine investment intentions (9 February 2018) and again in June (29 June 2018) when a takeover giving it an interest in the Argentine project was completed. Past mid-July, the company�s share price lost ground consistent with investors� general loss of enthusiasm for lithium investments. The company�s first drilling at the South American brine project is due to commence in January 2019. Verdict: Sizzle.

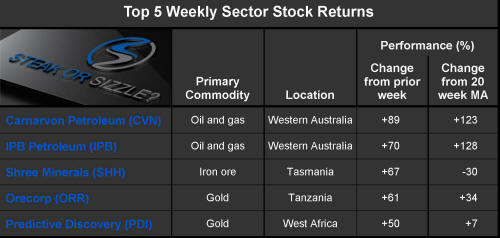

Carnarvon Petroleum experienced a fourfold share price rise during July after reporting an oil discovery off the coast of Western Australia (20 July 2018). By the end of 2018, the company�s share price had halved from the strong reaction immediately after the reported discovery. The company expects to begin drilling appraisal wells in the second quarter of 2019. Verdict: Steak.

Month ended 31 December 2018

THEME OF THE MONTH: Copper-gold-coal return

Ikwezi

Mining began December with an open share entitlement offer and

shares trading below the underwritten offer price. The price recovered

after the offer closing date but, in any event, the company is only very

lightly traded with transactions valued at that less than $11,000 through

the month. The share price rise in mid-December left the company with a

price below where it had traded for nearly the entire year. The Bermuda

registered company operates thermal coal mining assets in South Africa. Verdict:

Sizzle.

Ikwezi

Mining began December with an open share entitlement offer and

shares trading below the underwritten offer price. The price recovered

after the offer closing date but, in any event, the company is only very

lightly traded with transactions valued at that less than $11,000 through

the month. The share price rise in mid-December left the company with a

price below where it had traded for nearly the entire year. The Bermuda

registered company operates thermal coal mining assets in South Africa. Verdict:

Sizzle.

Horseshoe Metals has exploration tenements north of Meekatharra in Western Australia prospective for copper-gold mineralisation. The company is looking to complete a scoping study for a small-scale mine. At the end of October 2018, the company had cash assets of just $2,000 and depending dependent on its chairman for ongoing funding. The company did not make any formal disclosure which might explain the improved share price which had, in any case, started from a historically depressed level to revert to prices which remained lower than at any time prior to the beginning of October. Late in the month, the company chairman pleaded guilty to tax law violations for which the prosecutor in the case urged a term of imprisonment, according to the West Australian newspaper. There was no evident impact on the share price following publication of the report. Verdict: Sizzle.

Explaurum has been subject to a takeover offer from Ramelius (14 December 2018) which was declared unconditional during December. At the end of the month, the bidder reported being entitled to 54% of the outstanding shares in the target company. The 10% rise in the ASX gold equity price index assisted the Ramelius share price and would have also contributed to the improved value of the Explaurum shares. Verdict: Steak.

Magmatic Resources experienced a lower trending share price throughout 2018. The rise in December was a modest bounce from an end of November historically low level which left the market value only slightly above the weakest levels in the history of the company. In mid-December, the company purchased an outstanding net smelter royalty applying to its copper-gold exploration properties in New South Wales. The purchase was intended to eliminate restrictions which were affecting the company�s scope to arrange finance and secure development and exploration partners. Subsequently, the company issued two statements outlining its next steps in analysing the potential of the exploration properties. It had cash assets of $1.2 million at the end of October 2018. Verdict: Sizzle.

Gascoyne Resources made a modest recovery from historically low prices at the end of November. In common with other companies in the same predicament, relatively small absolute price movements were translated into large percentage changes even as the overall market value remains historically depressed (7 December 2018). On Christmas Eve, the company disclosed updated details of its operational outcome for the about to be completed December quarter suggesting that its output rates had improved. The company also released guidance for production in 2019 which implied production would run at about 30% higher than the annual rate in the December quarter. Verdict: Steak.

Week ended 28 December 2018

THEME OF THE WEEK: Low Quality Gains Persist

Orion

Metals traded for the first time since June 2018. The company holds

exploration properties in Western Australia and Queensland. Its rare earth

and gold exploration interest in Western Australia has been placed into a

joint venture in which the new partner is able to earn a 35% interest in

exchange for a $40,000 payment. Orion itself reported having cash assets of

just $70,000 at the end of November 2018 with its ongoing efforts to be

funded by its largest shareholder which holds a 67% stake. No field work has

been undertaken recently with the company having stated its openness to

approaches from potential joint venturers interested in its Queensland

properties. Verdict:

Sizzle.

Orion

Metals traded for the first time since June 2018. The company holds

exploration properties in Western Australia and Queensland. Its rare earth

and gold exploration interest in Western Australia has been placed into a

joint venture in which the new partner is able to earn a 35% interest in

exchange for a $40,000 payment. Orion itself reported having cash assets of

just $70,000 at the end of November 2018 with its ongoing efforts to be

funded by its largest shareholder which holds a 67% stake. No field work has

been undertaken recently with the company having stated its openness to

approaches from potential joint venturers interested in its Queensland

properties. Verdict:

Sizzle.

Alligator Energy did not make any formal disclosure which might explain the share price activity during the week. The company is looking for uranium mineralisation in the Alligator Rivers region which has a record of hosting uranium finds. The company also holds exploration interests prospective for nickel and cobalt mineralisation in Italy. It reported having cash assets of $2.3 million at the end of September 2018 with the intention of spending $1.1 million in the just completed December quarter. The share price improvement comes after historically weak prices since September 2018 leaving them still well below anything prior to three months ago. Verdict: Sizzle.

Rimfire Pacific Mining did not make any formal disclosure to explain what, in any case, was only a slightly improved share price after a period of trading at historically low levels. After reporting cash assets of $445,000 at the end of September 2018, the company completed a $1.1 million capital raising through a rights issue to continue its activities at a gold-silver discovery in central New South Wales. The share price rise was a slight rebound from historically low levels with gains made from turnover valued at approximately $7,500. Verdict: Sizzle.

Mount Ridley Mines is another example of seemingly strong percentage share price gains arising from very slight absolute price rises from historically low levels. The company did not make any formal disclosure which might explain an increased interest in the company. The company holds nickel-copper exploration interests in the Albany-Fraser region of Western Australia. It concluded the September quarter with cash assets of $1.5 million with the expressed intention of spending $380,000 in the December quarter. The company subsequently raised $0.297 million through a rights issue. Verdict: Sizzle.

Peninsula Mines is another example of a company with a share price rising from historically depressed levels to post an unusually large percentage change. The company did not make any formal disclosure which might explain the share price action which, in any event, came from transactions worth just $1,585. Earlier in December, the company had disclosed assays from a graphite exploration property in South Korea where it had recently completed six diamond drill holes. Verdict: Sizzle.

Week ended 21 December 2018

THEME OF THE WEEK: Weak Quality Gains

Coppermoly

did not make any formal disclosures which might explain the share price

activity during the week. The infrequently traded stock returned to price

levels from a fortnight earlier as a result of a single trade with a value

of just $250 in another example of the leverage arising from historically

depressed share prices among illiquid stocks. Verdict:

Sizzle.

Coppermoly

did not make any formal disclosures which might explain the share price

activity during the week. The infrequently traded stock returned to price

levels from a fortnight earlier as a result of a single trade with a value

of just $250 in another example of the leverage arising from historically

depressed share prices among illiquid stocks. Verdict:

Sizzle.

Crater Gold recovered from the lowest price experienced in the past year a few days before it announced a $1 million loan facility from its major shareholder. The company also released a notice for its annual meeting of shareholders during the week. The Papua New Guinea gold producer previously reported having cash assets of $242,000 at the end of September 2018 with expectations of recommencing production during November. Earlier in December, the $4.5 million market capitalisation company announced a renounceable share offer targeting a highly dilutive raising of $23.056 million for ongoing activity in PNG and to retire over $13 million in debt used to fund earlier work. The provider of the debt, a company associated with the chairman, intends subscribing for enough shares to cover the repayment. Verdict: Sizzle.

Sun Resources, an infrequently traded oil and gas stock, attracted unusually strong interest after the company announced that it had commenced modelling with a view to selecting a site for a first well at a resource in shallow water south of New Orleans in which the company holds a 50% working interest. The company has said that a development would involve five horizontal wells. The company reported having cash assets of $31,000 at the end of September 2018 with the intention of spending $356,000 in the three months ending December 2018. Planned closing of a share purchase plan was extended by a month to the end of the just concluded week. The rising share price returns the market value to levels which had prevailed in the second and third quarters of 2018. Verdict: Sizzle.

Resource Generation had announced in early December that it had encountered further delays in finalising finance for its South African coal development and, as a result, was beginning a search for alternative funding sources. Since then, the share price of the company has risen as much as 62% without the company having said anything more publicly about its funding arrangements or other development activities. Verdict: Sizzle.

Perpetual Resources is a very infrequently traded company which benefited from a single trade valued at just $534 in the past week to produce the relatively strong performance. The company had not made any formal disclosures which might explain the fresh, albeit modest, interest in the company which has been exiting gold exploration properties in New South Wales while flagging an intention to look elsewhere for alternatives. The company, with cash assets of $601,622 at the end of September 2018, did not spend anything on exploration in the prior three months. Verdict: Sizzle.

Week ended 14 December 2018

THEME OF THE WEEK: Low Quality Gains Once Again

Explaurum,

which has been subject to a takeover offer from fellow gold producer

Ramelius, received an updated bid raising the previous all scrip offer by

$0.02 a share in cash. The immediate market response was a $0.03 share price

rise. Explaurum directors had previously recommended that shareholders

reject the Ramelius bid and had negotiated a share placement with ASX-listed

Alkane under which it would invest $8 million in exchange for a 12.2%

interest in Explaurum. The Ramelius bid is conditional on the Alkane

investment not proceeding. Ramelius held slightly over 20% of the

outstanding Explaurum shares at the time of its improved bid. Verdict:

Steak.

Explaurum,

which has been subject to a takeover offer from fellow gold producer

Ramelius, received an updated bid raising the previous all scrip offer by

$0.02 a share in cash. The immediate market response was a $0.03 share price

rise. Explaurum directors had previously recommended that shareholders

reject the Ramelius bid and had negotiated a share placement with ASX-listed

Alkane under which it would invest $8 million in exchange for a 12.2%

interest in Explaurum. The Ramelius bid is conditional on the Alkane

investment not proceeding. Ramelius held slightly over 20% of the

outstanding Explaurum shares at the time of its improved bid. Verdict:

Steak.

Oilex did not make any formal disclosure which might explain unusually strong investor interest in the company. In any event, the extra turnover with a value of $12,670 occurred on a single day. The performance in the past week came after reversal in gains achieved in the first half of November (see 16 November 2018) and which resulted in the company posting strong share price increases at that time. The company remains in dispute with a joint venture partner which has opted to invoke the arbitration provisions of the joint venture agreement. Verdict: Sizzle.

Bowen Coking Coal announced that it had appointed two new directors with coal industry experience as well as receiving $500,000 in funding from interests associated with one of the new appointees. The company holds coking coal interests in the Bowen Basin. It had cash assets of $2.04 million at the end of September 2018 after having spent $515,000 in the prior three months and before anticipated expenditure of $865,000 in the December quarter. Verdict: Sizzle.

Celsius Resources received a query from ASX about the reasons for the share price activity during the week. Directors said they had no additional information to offer but conjectured that the price action may have been related to the appointment of a new director to the board earlier in December. The new director, who was an existing shareholder, brings a background in minor metal sales and production. The company is looking to define a cobalt resource in Namibia for which it completed a scoping study in early November 2018. After the share price appreciation, from record low levels in December, the market price remained lower than at any time prior to the beginning of November 2018. The relatively well financed company had cash holdings at the end of September 2018 of $10.7 million. Verdict: Sizzle.

EMU announced that it had agreed to place shares, subject to shareholder approval, in exchange for funding of $1.0 million. The company is engaged in exploration activities in Chile over ground prospective for gold mineralisation. After a share price fall of nearly 80% since January 2018, the performance in the past week has made little headway in recouping earlier losses and left the share price lower than at any time over the three years prior to the end of October 2018. The company had previously reported cash holdings of $301,000 at the end of September 2018. It completed a share purchase plan subsequently to raise $374,200. Verdict: Sizzle.

Week ended 7 December 2018

THEME OF THE WEEK: Low Quality Gains

Hipo

Resources did not make any formal disclosure that might explain the

share price action in the past week and which simply restores the price to

levels which had prevailed in September, previously low point in the recent

history of the African lithium and cobalt explorer. The current commodity

exposure is just the latest manifestation for a company which had been

launched to develop silver deposits in the USA before meandering to its

current interests in pursuit of a viable business. At the end of September

2018, the company held cash assets of $1.15 million. Verdict:

Sizzle.

Hipo

Resources did not make any formal disclosure that might explain the

share price action in the past week and which simply restores the price to

levels which had prevailed in September, previously low point in the recent

history of the African lithium and cobalt explorer. The current commodity

exposure is just the latest manifestation for a company which had been

launched to develop silver deposits in the USA before meandering to its

current interests in pursuit of a viable business. At the end of September

2018, the company held cash assets of $1.15 million. Verdict:

Sizzle.

Mindax did not make any formal disclosure which might explain the share price action in the past week and which continued the heightened investor interest from a week earlier ( see 30 November 2018). Verdict: Sizzle.

Frontier Resources disclosed geophysical modelling based on analysis of mineralisation within a region in Papua New Guinea connected geologically to the Ok Tedi and Porgera mineral deposits. The data had been generated from historical airborne magnetics. Earlier in the year, the company had undergone a board reconstruction and completed a $6.0 million capital raising to fund PNG exploration activities. At the end of September 2018, the company held cash assets of $5.7 million with the expressed intention of spending $360,000 in the December quarter, including $155,000 on exploration related activities. Verdict: Sizzle.

Gascoyne Resources claimed, after a query from ASX about the unusual market performance, that it did not have anything to add to an operational update released on the day of its annual shareholder meeting at the end of November. Last week�s share price performance came after the company�s market value had slumped more than 80% since early May 2018. In May, the company had commenced production with a market capitalisation of $190 million and cash and debt of $25 million and $60 million, respectively, aiming for annual gold production of 100,000 ounces. Since then, production has fallen short of the company�s targets with it now saying that it should reach 7,300 ounces in December. The company has been improving operational outcomes but its financial condition has deteriorated. An additional 81 million shares (a 19% increase) have been issued since May with net debt rising by $40 million to fund working capital. The company generated cash of approximately $2 million in the September quarter. The value proposition is improving but the company will have to show a clear-cut route to sufficiently higher sustainable profitability to validate better market returns. The recent share price gains, albeit very modest against the historical backdrop, reflect a hope that this could happen. Verdict: Steak.

Scorpion Minerals changed its name from Pegasus Metals during the week and re-commenced trading for the first time since early November. The company holds base metal exploration interests in Burkina Faso and Western Australia. The African assets came from the acquisition by Pegasus of Scorpion Minerals. After the price performance last week, the share price remained below pre-August 2018 levels, another example of the strong leverage to small changes in sentiment near historically low prices driven by relatively small flows of funds. The value of transactions during December has been less than $20,000. The company did not spend anything on exploration in the three months ended September 2018, ending the quarter with minimal cash assets of $1,000 and having to rely on a line of credit from its major shareholder. It said it expected to spend $260,000 in the December quarter. Verdict: Sizzle.

November 2018

THEME OF THE MONTH: Riding BHP and Rio Tinto Coattails

Of

the highest returning companies during November, the following have been commented

upon during the month:

Of

the highest returning companies during November, the following have been commented

upon during the month:

Cohiba Minerals Verdict: Sizzle.

Redbank Copper Verdict: Sizzle.

Antipa MInerals Verdict: Steak.

Kazakhstan Potash Corporation did not make any specific announcement which might explain the market performance but, following the share price rise, the company announced that it had met the threshold conditions for its takeover of Satimola, the holder of potash interests in Kazakhstan, and had placed a majority of directors on the board of the target company. The two companies had been in dispute over the terms of the takeover originally launched in October 2017. Kazakhstan Potash had cash assets at the end of September 2018 of $411,000. Verdict: Sizzle.

Eon NRG announced that it had made record gas sales of US$660,000 in October 2018 from wells in western USA. The company also announced that it would begin drilling at a new location in Wyoming prospective for gas. At the end of June 2018, the company held cash assets of $0.5 million with loans outstanding of 6.2 million. Verdict: Steak.

Antipa Minerals has experienced a rising share price trend since late October 2018 after speculation arose about a Rio Tinto copper find in the eastern Pilbara region of Western Australia where Antipa also has interests. Midway through the month, the company released details of drilling activity within the region and near the Telfer gold mine. The company also reported on the results of exploration activity conducted by Rio Tinto in one area covered by a joint venture where Rio Tinto is working to acquire an interest of up to 75% by completing expenditure of $60 million. The company had cash assets of $5.2 million at the end of September 2018 with the expressed intention of spending $2.3 million in the December quarter, including $1.9 million on exploration and evaluation. Verdict: Steak.

Week ended 30 November 2018

THEME OF THE WEEK: BHP Saves the Day

Cohiba

Minerals announced that it would accelerate its exploration efforts

after BHP announced a fresh discovery of copper mineralisation on the

eastern edge of the Gawler Craton late in the month. Cohiba has exploration

rights over tenements adjacent to those in which BHP has been working.

During the last month, the company also announced the results of a scoping

study for a gypsum quarry in Western Australia. The WA project involves

upfront capital spending estimated at $1.2 million. The company reported

having cash assets of $1.3 million at the end of September 2018.

Verdict: Sizzle

Cohiba

Minerals announced that it would accelerate its exploration efforts

after BHP announced a fresh discovery of copper mineralisation on the

eastern edge of the Gawler Craton late in the month. Cohiba has exploration

rights over tenements adjacent to those in which BHP has been working.

During the last month, the company also announced the results of a scoping

study for a gypsum quarry in Western Australia. The WA project involves

upfront capital spending estimated at $1.2 million. The company reported

having cash assets of $1.3 million at the end of September 2018.

Verdict: Sizzle

Redbank Copper is usually a very lightly traded stock with 90% of shares outstanding held by 100 shareholders. After receiving a query from ASX about the reasons for the unusual investor interest, the company said it did not have any new information to disclose but drew attention to an announcement from BHP which referred to a new discovery of copper mineralisation in South Australia. Coincidentally, Redbank had been granted tenements in the Gawler Craton earlier in November and has outstanding applications for exploration rights over additional land where it is looking for Olympic Dam type targets. The company also holds exploration interests in the Northern Territory prospective for copper-cobalt mineralisation. At the end of September 2018, the company had cash assets of $3,000 and reported having to rely on a $1.5 million loan facility from its chairman for working capital. Verdict: Sizzle

Strategic Energy Resources responded to a ASX query about the surge in its share price and increased turnover by drawing attention to the announcement by BHP about a new copper mineralisation discovery on the eastern margin of the Gawler Craton in South Australia, a region in which the company also has exploration interests. The following day, the company announced that it had lodged applications to explore over additional land, in competition with others. The company held $1.6 million in cash assets at the end of September 2018. Verdict: Sizzle

Pacific Bauxite is in dispute with the government of the Solomon Islands over whether the latter could cancel a prospecting licence held by a joint venture in which the company holds 50%. The company had reported during the week that it intended to pursue its legal interests in the matter when two non-executive directors of the company resigned forcing a rearrangement of responsibilities immediately prior to the company�s annual meeting of shareholders. The company held cash assets of $1.4 million at the end of September 2018 after raising $335,000 in the preceding three months. As well as its Solomon Island interests, the company has acquired exploration rights over land in Western Australia although the development prospects there will be complicated by competing land uses in the Darling Range region. Verdict: Sizzle

Mindax did not make any formal disclosure which might explain the heightened interest in the stock during the week. The company which holds iron and gold exploration interests in Western Australia has referred to its Mount Forrest interests as needing the participation of other companies in the region so as to achieve a size which would permit an economically feasible development to proceed. The company has referred to discussions having been undertaken without holding out significant hope of there being a change in circumstances. At the end of September 2018, the company held cash assets of $100,000 with the expressed intention of spending $80,000 during the December quarter. Verdict: Sizzle

Week ended 23 November 2018

THEME OF THE WEEK: More Gains Without Momentum

Hampton

Hill Mining, an infrequently traded stock which holds a 25% stake

in a Pilbara zinc exploration opportunity, did not make any formal

disclosure which may account for the trading outcome. In any event, the

share price change involved only one transaction with a value of $3,037.

The company which held cash assets of $589,000 at the end of September 2018,

with loans outstanding of $500,000, did not spend anything on exploration

during the preceding three months and expected to spend just $83,000 in the

December quarter. The company has said it is seeking new exploration

opportunities.

Verdict: Sizzle

Hampton

Hill Mining, an infrequently traded stock which holds a 25% stake

in a Pilbara zinc exploration opportunity, did not make any formal

disclosure which may account for the trading outcome. In any event, the

share price change involved only one transaction with a value of $3,037.

The company which held cash assets of $589,000 at the end of September 2018,

with loans outstanding of $500,000, did not spend anything on exploration

during the preceding three months and expected to spend just $83,000 in the

December quarter. The company has said it is seeking new exploration

opportunities.

Verdict: Sizzle

Emperor Energy partially regained previously lost share price ground after the company disclosed the results of reservoir modelling for a gas field in the Gippsland Basin in which it holds a 100% interest. The simulation indicated that the gas reservoir could deliver 29 billion cubic feet per year for 20 years. The company subsequently concluded its annual general meeting at which all resolutions were carried. Now, with a market capitalisation of $2.7 million, the company has a very limited financial capacity to undertake the development implied by the resource potential. At the end of September 2018, it held cash assets of $216,607 with estimated cash outflows in the current quarter of $202,000, throwing doubt on the wisdom of granting leases to companies with insufficient funding to properly complete development. After rising, the company�s share price remains in the middle of the range within which it has traded throughout the last 12 months. Verdict: Sizzle

MZI Resources made its share price gains in the days leading to its annual meeting of shareholders but after the company had lost two thirds of its value since the beginning of October. In addressing shareholders, directors reiterated their plans to build on the existing mineral sands production platform despite it having failed to meet the goals set in the original design concept. Shareholders were told that other producers have taken two to five years to meet their start-up targets. After a 90% fall in share price, the company now has a market capitalisation of $17.4 million and has reported net debt of $167.4 million at the end of September 2018. The funding task will have been made harder, after an already disconcerting track record, by deteriorating financial market conditions. Verdict: Sizzle

Peako did not make any formal disclosure which might explain the upturn in investor interest. In any event, the higher share price did not breach levels which had prevailed prior to July 2018. The company has exploration interests in the East Kimberley region of Western Australia where it has joined other companies searching for gold and base metals. It spent $81,000 during the three months ended September 2018 leaving it with cash assets of just $48,000 and in need of a loan for working capital in the current quarter. Verdict: Sizzle

Redbank Copper, a lightly traded stock, did not make any formal disclosure which might explain the stronger investor interest. In any event, the share price gain occurred with transactions valued at approximately $4,000 and left the company�s shares trading within the same price range evident since August and 80% below where they had been 12 months ago. The company holds exploration interests in the Northern Territory prospective for copper-cobalt mineralisation. At the end of September 2018, the company had cash assets of $3,000, now having to rely on a $1.5 million loan facility from its chairman. Verdict: Sizzle

Week ended 16 November 2018

THEME OF THE WEEK: Resource Building Re-emerges

Davenport

Resources announced an inferred potassium oxide resource within one

of its German tenement holdings, based on available historical data and

following advice from an external consultant. Earlier work had been

completed under the former East German government. Further work is now being

undertaken in other areas over which the company also has rights to JORC

compliant resources. Drilling will be required to raise the status of the

latest resource estimate from inferred to indicated. The company had cash

assets of $2.4 million at the end of September 2018 with which to pursue its

exploration plans.

Verdict: Steak

Davenport

Resources announced an inferred potassium oxide resource within one

of its German tenement holdings, based on available historical data and

following advice from an external consultant. Earlier work had been

completed under the former East German government. Further work is now being

undertaken in other areas over which the company also has rights to JORC

compliant resources. Drilling will be required to raise the status of the

latest resource estimate from inferred to indicated. The company had cash

assets of $2.4 million at the end of September 2018 with which to pursue its

exploration plans.

Verdict: Steak

Boadicea Resources did not make any specific announcement connected to the share price performance during the week. It did hold its annual general meeting of shareholders on the previous Friday but no trading occurred in the company�s shares in the following two days with the bulk of the share price rise during the week occurring on the last trading day with turnover valued at under $38,000. The company has a variety of exploration interests covering six areas in Western Australia including in the Fraser Range where it is hoping to emulate the Nova-Bollinger nickel-copper find by Sirius Resources and a more recent discovery, according to reports, by a privately held company in the vicinity of one of its properties. The company held cash assets of $1.06 million at the end of September 2018. Verdict: Sizzle

Oilex has been in a legal battle in India with a joint venture partner after the latter failed to address a default notice served on it by the company. In a recent judgement, the Gujarat High Court had required the joint venture partner to deposit the equivalent of US$3.1 million prior to commencement of arbitration proceedings during which time the effect of the notice of default would be delayed. At the end of the week, the company said that it believed the funds had been deposited although it had not been able to confirm their lodgement. Verdict: Sizzle

Encounter Resources announced that it had joined with Independence Group to progress the company�s copper-cobalt project interests in the Paterson region of Western Australia. Independence will make an initial investment of $1.8 million via an issue of new shares in the company and will be able to secure a 70% project interest with expenditure of $15 million. The company has a large portfolio of exploration interests in Western Australia, including five joint ventures with Newcrest Mining. The company held cash assets of $2.1 million at the end of September 2018 with expected expenditure of $475,000 in the December quarter. Verdict: Steak

Lake Resources did not make any specific announcement which might explain the share price performance during the week although it did conduct its annual meeting of shareholders. The meeting did not have any unusual business before it. The price action and improved stock turnover occurred after the shareholder meeting. The company has lithium development and exploration interests in Argentina. Earlier in the month, the company had announced an expansion of lease holdings at its Kachi project. The company was left with $290,000 in cash assets at the end of September 2018 after having spent $2.3 million in the prior quarter. It has foreshadowed expenditure of $1.2 million in the December quarter. Verdict: Sizzle

Week ended 9 November 2018

THEME OF THE WEEK: Bottom of the Cycle Volatility

Antipa

Minerals received a query from ASX about the reasons for the recent

activity in the market for its shares. The company said it did not have

anything specific to say but drew attention to media reports speculating

about a major copper find in the eastern Pilbara by Rio Tinto. Rio Tinto

has made no announcement but interest in its activities has been heightened

by aerial photographs showing an extended camp and by the company�s request

for a permit allowing an airfield to service the location. Antipa has land

holdings in the region, including some held in joint venture with Rio Tinto.

The company has not made any announcement as yet about its own exploration

activity as it awaits results.

Verdict: Sizzle

Antipa

Minerals received a query from ASX about the reasons for the recent

activity in the market for its shares. The company said it did not have

anything specific to say but drew attention to media reports speculating

about a major copper find in the eastern Pilbara by Rio Tinto. Rio Tinto

has made no announcement but interest in its activities has been heightened

by aerial photographs showing an extended camp and by the company�s request

for a permit allowing an airfield to service the location. Antipa has land

holdings in the region, including some held in joint venture with Rio Tinto.

The company has not made any announcement as yet about its own exploration

activity as it awaits results.

Verdict: Sizzle

Octanex has offshore oil and gas interests in waters off Western Australia, New Zealand and Malaysia. The company did not make any specific disclosure which might explain the strengthening investor interest in the past week. In any event, the large percentage gain still leaves the company�s share price near record low levels after a decline of 95% from a year ago. The company had $1.05 million in cash at the end of September 2018 which is inadequate for the high cost of offshore exploration and development activities. Its Ascalon gas accumulation in the Bonaparte Basin is the only prospect in which the company holds a large enough interest (100%) to permit it the option of seeking out a joint venture partner to help dilute the cash demands of exploration and development. Verdict: Sizzle

Polar X announced the results of an aeromagnetic survey of ground prospective for copper-gold mineralisation in Alaska. The company had also reported drill results a week earlier in its September quarterly activities report which it described as �very encouraging�. The company spent over $3 million on an aggressive exploration program in the September quarter to finish with cash assets of $749,000 after having raised $3.9 million from issuance of new shares. While the exploration results are encouraging, the company may have insufficient funds to drive the market value higher before initiating further capital raising activity. The company said it intends to spend $487,000, including $234,000 on exploration, in the December quarter. Verdict: Steak

Eclipse Minerals conducted a limited drilling program in Queensland over ground prospective for manganese mineralisation. Following a review of the most recent results, the company has indicated it will plan the next stage of exploration. At the end of September 2018, the company held cash assets of $590,000 after having spent $32,000 on exploration. The company foreshadowed spending of $70,000 on exploration in the December quarter. Verdict: Sizzle

King River Copper disclosed results from an updated scoping study for its Speewah vanadium project near Kununurra in Western Australia. The company concluded that the study demonstrates a business case for further development. A pre-feasibility study is scheduled for early 2019 after completing a heap leach analysis. All going well, the company believes that full production could be achieved in July 2023. The company reported having cash assets of $5.6 million at the end of September 2018 with foreshadowed spending in the December quarter of $1.6 million. Verdict: Steak

October 2018

THEME OF THE MONTH: Low Quality Speculative Flows

Of

the highest returning companies during October, the following have been commented

upon during the month:

Of

the highest returning companies during October, the following have been commented

upon during the month:

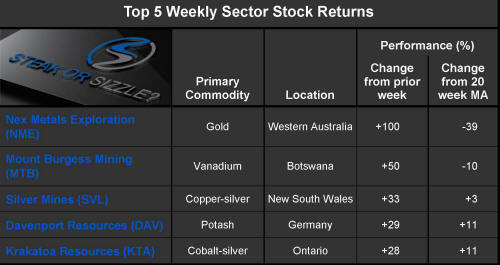

Nex Metals Exploration Verdict: Steak.

Athena Resources Verdict: Sizzle.

Abilene Oil and Gas Verdict: Steak.

Enegex Verdict: Sizzle.

Silver Mines Verdict: Sizzle.

Week ended 2 November 2018

THEME OF THE WEEK: A Rare New Producer

Nex

Metals Exploration disclosed having cash assets at the end of

September 2018 of $80,000. The company continues to attract negligible

investor interest (see 19 October 2018) with the latest rise in share price based on a single

trade valued at just $95. The company said it has obtained outside advice on

the value of its assets as it considers funding options.

Verdict: Sizzle

Nex

Metals Exploration disclosed having cash assets at the end of

September 2018 of $80,000. The company continues to attract negligible

investor interest (see 19 October 2018) with the latest rise in share price based on a single

trade valued at just $95. The company said it has obtained outside advice on

the value of its assets as it considers funding options.

Verdict: Sizzle

Coppermoly disclosed in its quarterly activities report for the three months ended September 2018 that it had begun drilling aimed at upgrading the copper-gold resource at its Mt Nakru deposit on New Britain in Papua New Guinea. The company also reported a cash balance of $1.015 million at the end of the quarter. Trading in the company�s shares is infrequent with the rise in share price during the week coming from transactions with a value of $3,111, the largest daily turnover by value since the last week of July 2018. Verdict: Sizzle

GWR Group confirmed in its latest quarterly activities report that the ASX had blocked the proposed sale of the company�s Hatches Creek tungsten-copper-gold project in the Northern Territory. The proposed sale to Tungsten Mining, in which GWR holds a 9.6% stake, had a cash value of $8.7 million. The two companies have indicated an intention to modify their agreement to find an alternative way in which to permit Tungsten Mining to invest in the project. Tungsten Mining is one of a portfolio of investments, with a reported value at the end of September 2018 of $29.7 million, held by the company. The company also held cash assets of $3.3 million. Verdict: Sizzle

Lithium Consolidated Mineral Exploration has a stated aim of establishing �a dominant position� in hard rock lithium mining in Zimbabwe and Mozambique. The company also holds exploration properties in Nevada, Western Australia, South Australia and Botswana. Other than summarising its intentions, the company did not make any formal disclosure to explain its share price action which came over two days of modestly higher volumes in the number of shares traded. The company reported having cash on hand at the end of September 2018 of $1.3 million, not a significant amount in the context of its ambitions and fallen investor appetite for lithium exposed companies. Verdict: Sizzle

New Century Resources announced that it had finalised a $40 million funding deal with National Australia Bank to supplement cash assets of $32.2 million at the end of September 2018. The company has reported commencement of production at the restarted tailings treatment operation at the Century zinc mine with the aim of completing the phase one production ramp up by the end of March 2019. Verdict: Steak

Week ended 26 October 2018

THEME OF THE WEEK: Gains Still Lacking Momentum

Athena

Resources did not say anything formally which might explain the

share price movement during the past week. In the previous week, it had

sent out a notice convening its annual meeting of shareholders which

appeared unexceptional as it only involved votes on matters required by the

corporations laws. The company controls the Byro iron ore project in

Western Australia which, since the collapse in iron ore prices, has been the

subject of several technical reviews with the aim of identifying alternative

uses for the magnetite. The company�s major shareholder had held an option

to purchase the project but, following a series of extensions to the

contract period, the company issued a notice terminating the transaction

earlier in 2018.

Verdict: Sizzle

Athena

Resources did not say anything formally which might explain the

share price movement during the past week. In the previous week, it had

sent out a notice convening its annual meeting of shareholders which

appeared unexceptional as it only involved votes on matters required by the

corporations laws. The company controls the Byro iron ore project in

Western Australia which, since the collapse in iron ore prices, has been the

subject of several technical reviews with the aim of identifying alternative

uses for the magnetite. The company�s major shareholder had held an option

to purchase the project but, following a series of extensions to the

contract period, the company issued a notice terminating the transaction

earlier in 2018.

Verdict: Sizzle

Pegasus Metals reported results from a recently completed drilling program at its Doblo tenements in Burkina Faso. The tenements are prospective for palladium-platinum-gold-nickel-copper mineralisation. The drilling encountered mineralisation in several locations but without any outstanding results and without clarifying a coherent explanation of the regional geology. While further work will be pursued, there is nothing in the results so far suggesting commercial potential. Entry to the Burkina Faso properties was completed in early October after the acquisition of a company which held an option over the mineral rights and following shareholder approval. The company is now entitled to raise its stake in the properties from 15% to 70%. At the end of June 2018, the company held cash assets of $28,000, debt of $330,000 and undrawn loan facilities of $670,000. Verdict: Sizzle

Crater Gold Mining announced that gold delineated at its Crater Mountain gold deposit in Papua New Guinea will allow mining to commence during November after an earlier scheduled start had been delayed. At the end of June 2018, the company held cash assets of $265,000 with outstanding loans of $13.7 million. The loan amounts, owed to an entity associated with the company�s Chairman, were restructured following the end of the financial year. Verdict: Sizzle

Cannindah Resources gained after it made it the announcement referred to below (19 October 2018) and after it had given up a part of those earlier price increasers. Verdict: Sizzle

Energex did not make any disclosure which might explain the share price performance in the past week. The heightened market activity occurred for the second week in the past month (see 12 October 2018) in which relatively strong gains have been made in this infrequently traded stock with an interest in Western Australian offshore gas. The price change over the past week was driven by share transactions with a value of approximately $1,200. Verdict: Sizzle

Week ended 19 October 2018

THEME OF THE WEEK: No Momentum

Nex

Metals Exploration is rarely traded and, with cash assets at the

end of June 2018 of only $57,000, unable to undertake any meaningful

activity. The company indicated in its June quarterly activities report that

it would review funding alternatives as well as its operational approach.

It had made no announcement which might explain the share price movement

which, in any event, occurred with only a single trade with a value of

$2,226.

Verdict: Sizzle

Nex

Metals Exploration is rarely traded and, with cash assets at the

end of June 2018 of only $57,000, unable to undertake any meaningful

activity. The company indicated in its June quarterly activities report that

it would review funding alternatives as well as its operational approach.

It had made no announcement which might explain the share price movement

which, in any event, occurred with only a single trade with a value of

$2,226.

Verdict: Sizzle

Mount Burgess Mining did not make any disclosure which might explain the share price movement which, in any event, kept prices within the trading range of the past few weeks and well below prices which had prevailed in prior months. Earlier in October, the company announced that it intended to raise $34,500 via an issue of shares to supplement cash holdings of $26,000 at the end of June 2018 and a $40,000 loan in July from associates of the company. The company holds exploration ground in Botswana prospective for vanadium. Verdict: Sizzle

Silver Mines did not make any specific disclosure which might explain the share price movement although, earlier in the month, the company had foreshadowed commencement of a drilling program over ground in central New South Wales prospective for copper, gold and silver. The company also holds a large undeveloped silver resource in the region. It held cash assets at the end of June 2018 of $730,000 before raising an additional $3.85 million through an issue of new shares in September. Verdict: Sizzle

Davenport Resources announced a 1.13 million tonne potash resource containing 11.1% potassium oxide in one of its German mining regions. The exploration areas in eastern Germany had been assessed previously for mineralisation by the former East German government. Resource definition work incorporates the historical analysis. The company held cash assets at the end of June 2018 of $722,000 with estimated September quarter outflows of $1.05 million. It subsequently completed a placement of shares to raise $2.1 million and raised $286,000 through a share purchase plan to enhance its financial position while still leaving it with limited funding for the extent of the exploration work that it will need to complete. Verdict: Sizzle

Krakatoa Resources provided a progress report covering exploration activity over ground in Ontario, Canada. The company completed acquisition of the properties during the June quarter following which it completed a review of available geophysical data. Targets prospective for cobalt-silver mineralisation are being assessed in a maiden field program. The company had $686,000 in cash assets at the end of June 2018 with the intention of spending $160,000, of which $120,000 was to be on corporate expenses, during the recently completed September quarter. Verdict: Sizzle

Week ended 12 October 2018

THEME OF THE WEEK: Unimpressive Upside

Cannindah

Resources reported on discussions with Minjar Gold about the

Piccadilly gold project near Charters Towers. During the talks, according

to the company, Minjar outlined a potential resource of up to 53,000 ounces

in which it would have an interest as a source of feed for its mill in the

region. Cannindah indicated in its statement that it was more interested in

searching for the source of the identified mineralisation which, in the

company�s view, offers the chance of a significantly larger find. The

discussions did not appear to herald a commercial link between the two

companies. At the end of June 2018, Cannindah had cash assets of just

$10,000 and outstanding debt of $3.2 million with the expressed intention of

spending $230,000 in the recently completed September quarter. During the

September quarter, the company issued shares in two tranches to raise

$139,000 and $30,000, respectively.

Verdict: Sizzle

Cannindah

Resources reported on discussions with Minjar Gold about the

Piccadilly gold project near Charters Towers. During the talks, according

to the company, Minjar outlined a potential resource of up to 53,000 ounces

in which it would have an interest as a source of feed for its mill in the

region. Cannindah indicated in its statement that it was more interested in

searching for the source of the identified mineralisation which, in the

company�s view, offers the chance of a significantly larger find. The

discussions did not appear to herald a commercial link between the two

companies. At the end of June 2018, Cannindah had cash assets of just

$10,000 and outstanding debt of $3.2 million with the expressed intention of

spending $230,000 in the recently completed September quarter. During the

September quarter, the company issued shares in two tranches to raise

$139,000 and $30,000, respectively.

Verdict: Sizzle

Greenpower Energy did not make any formal statement that might have affected the share price. The move kept the company�s market value within the range it had occupied since the end of August with the performance simply a product of the normal ebb and flow of the market for a company with an already deeply discounted share price. The company has lithium exploration interests in Guyana and the Northern Territory and has applied for an exploration licence covering coal in Victoria. It is also finalising an acquisition of a company with battery minerals exploration interests. Verdict: Sizzle

Petrel Energy announced that its joint venture partner in a Uruguayan oil exploration project had restructured its holding to give it an additional 8%, leaving Petrel with 41%. Petrel retains a right to an additional 9.7%. The share price movement kept the company�s value within the range it had occupied in recent months with the performance simply a product of the normal ebb and flow of the market for a company with a deeply discounted share price. Verdict: Sizzle

East Energy Resources, an infrequently traded stock with coal exploration interests in Queensland, did not make any disclosures which might explain the share price movement during the week. The company had said in its June quarter activities report that it would review project opportunities in addition to its Blackall coal project which is being affected adversely by political opposition to use of coal as an energy source. The company had $88,000 in cash assets at the end of June 2018. Subsequent to the end of the quarter, the company received a $400,000 loan from Noble Limited which has a 93.4% shareholding, to enable it to continue its activities. Verdict: Sizzle

Energex, which holds a 15% interest in a Browse Basin exploration area, did not make any formal disclosure which might explain the share price movement. In its June quarter activities report, the company disclosed that an $80 per barrel oil price would be needed to validate commercial development of its exploration interests prompting the company to look for attractive alternative opportunities. At the end of the June quarter, the company had cash assets of $287,000 with expectations of spending $50,000 during the recently completed September quarter. Verdict: Sizzle

Week ended 5 October 2018

THEME OF THE WEEK: Bottom of the Cycle Volatility

Abilene

Oil and Gas did not formally disclose any information that might

explain the share price movement. The company�s last quarterly activities

statement referred predominantly to events which occurred in 2014 and 2015,

emphasising the absence of reasons for investors to revalue the business.

The infrequently traded stock added $1.6 million to its $ 0.8 million market

capitalisation with a single trade valued at $1,200. The company which has

oil and gas production interests in the midwest of the USA had $297,000 in

cash at the end of June 2018 with outstanding loans of $4.3 million.

Verdict: Sizzle

Abilene

Oil and Gas did not formally disclose any information that might

explain the share price movement. The company�s last quarterly activities

statement referred predominantly to events which occurred in 2014 and 2015,

emphasising the absence of reasons for investors to revalue the business.

The infrequently traded stock added $1.6 million to its $ 0.8 million market

capitalisation with a single trade valued at $1,200. The company which has

oil and gas production interests in the midwest of the USA had $297,000 in

cash at the end of June 2018 with outstanding loans of $4.3 million.

Verdict: Sizzle

Horizon Gold reported assay results from a recently completed diamond drill hole from the company�s Gum Creek tenements in Western Australia. The zinc-copper intercept is below the level of historical drilling opening up the possibility of a previously unexpected mineralised deposit. Further drilling will be required to improve the company�s understanding of the orientation and extent of mineralisation. The company finished the June quarter with cash assets of $7.16 million with the intention of spending $1.7 million in the just completed September quarter. The company is drawing on funds from a 2016 initial public offering. Verdict: Sizzle

Tasman Resources is exploring in South Australia in the vicinity of the Olympic Dam deposit. The company also holds a 42% stake in ASX listed Eden Innovations. The current $44 million value of the shareholding exceeds the $31 million market value of Tasman itself. The Eden share price rose by 65% over the past week. Eden markets a range of technology solutions for the treatment of concrete and reduction or control of carbon emissions. The company had made several announcements in late September about commercial successes in Australia and the USA for its products. During the week, Tasman itself completed a $2 million capital raising after placing shortfall shares from a previous entitlement offer. At the end of June 2018, Tasman had cash assets of $2.17 million with the expressed intention of spending $285,000 in the September quarter of which only $50,000 was attributed to exploration and evaluation. Verdict: Sizzle

Winchester Energy has oil and gas exploration interests in the Permian Basin in Texas where recent drilling activity has encountered unexpectedly strong oil flows. An assessment of the longevity of the flows is now needed. The company already owns interests in eight producing assets which accounted for revenues of US$357,807 in the June quarter. The company had cash assets of $1.6 million at the end of June 2018. Verdict: Steak.

Cauldron Energy has agreed to acquire two tenement areas in the Pilbara region of Western Australia prospective for lithium. The predominantly scrip based transaction put a value of approximately $2 million on the properties. Previously, Cauldron�s principal interests had involved uranium exploration in Western Australia. The company had said that it was reviewing alternative project opportunities given the negative attitude of the government to uranium mining. No work has been undertaken on exploration interests prospective for copper and silver in Argentina, another exploration holding. The company had cash assets of $1.95 million at the end of June 2018 with the stated intention of spending $670,000 in the just completed September quarter. Verdict: Sizzle

September Quarter 2018

THEME OF THE QUARTER: Energy to the Fore

Of

the highest returning companies during the September quarter, the following have been commented

upon during the period:

Of

the highest returning companies during the September quarter, the following have been commented

upon during the period:

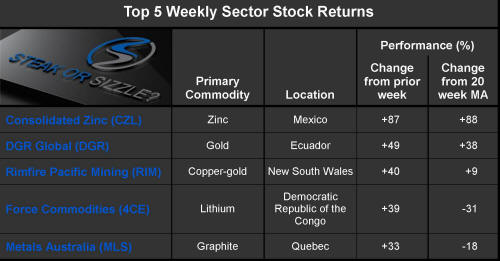

Consolidated Zinc Verdict: Steak.

IPB Petroleum Verdict: Sizzle.

Helios Energy Verdict: Steak.

Carnarvon Petroleum Verdict: Steak.

White Energy Company Verdict: Sizzle.

September 2018

THEME OF THE MONTH: Obscure Gold Locations

Of

the highest returning companies during September, the following have been commented

upon during the month:

Of

the highest returning companies during September, the following have been commented

upon during the month:

Consolidated Zinc Verdict: Steak.

Niuminco Group Verdict: Sizzle.

Ventnor Resources Verdict: Steak.

DGR Global Verdict: Sizzle.

Vector Resources announced progress toward finalising the acquisition of a 60% interest in the Adidi-Kanga gold project in the Democratic Republic of the Congo. The project, with a 3.2 million ounce gold resource, had previously been the subject of a US$520 million exploration program by AngloGold Ashanti, according to the new buyer. The company also said, in its early September filing, that the settlement deadline for the transaction which had been first announced in July had been extended to 15 September. Funding proposals for the $20 million transaction had also been received. The company subsequently advised that debt facilities for $55 million to cover existing loans and upcoming working capital needs had been negotiated but that the settlement date for the transaction had been further delayed until early October. The company had cash assets of $759,000 at the end of June 2018 with planned expenditures of $735,000 in the September quarter. Verdict: Sizzle

Week ended 28 September 2018

THEME OF THE WEEK: Modest Recoveries

Niuminco

Group disclosed gold grades of 93.8 g/t from sampling a vein at its

Edie Creek project in PNG. It has been ramping up production at the project

site as well as conducting exploration in the area. The company has reported

having produced 30.2 ounces from 10 tonnes of vein material. At the end of

the quarter, the company held cash assets of $2,000 before a rights issue

raised $310,000 from the issue of new shares. The company expected cash

flows of $350,000 from metal sales to cover expenses of a like amount in the

September quarter.

Verdict: Sizzle

Niuminco

Group disclosed gold grades of 93.8 g/t from sampling a vein at its

Edie Creek project in PNG. It has been ramping up production at the project

site as well as conducting exploration in the area. The company has reported

having produced 30.2 ounces from 10 tonnes of vein material. At the end of

the quarter, the company held cash assets of $2,000 before a rights issue

raised $310,000 from the issue of new shares. The company expected cash

flows of $350,000 from metal sales to cover expenses of a like amount in the

September quarter.

Verdict: Sizzle

RMG announced completion of the first stage of the company�s copper-gold exploration program in northern Chile which has involved mapping and sampling. The first batch of assays includes copper grades of up to 6.3% and gold up to 3.12 g/t. The company had $803,000 in cash at the end of June 2018 to fund its ongoing activities with the intention of spending $300,000 in the three months to the end of September. At the beginning of August, the company disclosed that it had issued a debt security to raise an additional $656,000. Verdict: Sizzle

Resource Generation announced that it had progressed a funding proposal for its South African coal interests, expecting final approval by the end of October 2018. The company, which had cash assets of $1.73 million at the end of June 2018 while looking to spend $4.4 million in the September quarter, is targeting coal production of six million tonnes a year. The company already has drawn loan facilities of $47.4 million, mostly funded by Noble Resources. Verdict: Sizzle

Lepidico received a query from ASX about its share price movement and trading volumes for which the company did not have any specific reasons. The company was concluding an entitlement share offer during the week to raise $7.9 million and pointed to price action typically occurring around such issues. The company�s principal interest is in technology to process lithium-containing minerals that cannot be treated by conventional technologies, enabling additional low cost sources of the metal for which demand is expected to grow strongly. The company has mineral assets in Portugal with additional mineral sourcing opportunities in Western Australia. The Lepidico share price movement tops the performance of a selection of 30 lithium exposed companies listed on ASX over the past two weeks. The Lepidico share price remains 60% below levels reached in late 2017. Verdict: Sizzle

Archer Exploration has graphite mineral interests in South Australia with an emphasis on commercialisation of advanced technologies. The company has a range of strategic research partnerships investigating advanced materials technologies. It has been selling its non graphite mineral exploration interests. In the past week, the company announced that it had finalised an agreement with a German biotechnology company to develop an electrochemical biosensor using printable graphene components for detecting disease. The company held cash assets of $2.7 million at the end of June 2018 with the intention of spending $900,000 during the three months to September 2018. Verdict: Sizzle

Week ended 21 September 2018

THEME OF THE WEEK: Big Dividends

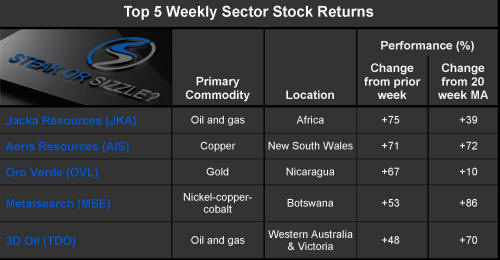

Rand

Mining announced that it would pay a fully franked dividend of

$1.25 per share. Immediately before the announcement, the company�s shares

had been trading at $2.40. The cash available for payment of the dividend

arises from the company�s 12.25% joint venture interest in the East Kundana

gold project along with Northern Star Resources (51%) and Tribune Resources

(36.75%). Rand Mining also holds a 26.32% stake in Tribune Resources. The

level of future dividends is uncertain making value assessment based on the

proposed payout difficult. That said, the company has recognised the

revaluation potential from establishing a track record of returning excess

cash to investors. Verdict: Steak.

Rand

Mining announced that it would pay a fully franked dividend of

$1.25 per share. Immediately before the announcement, the company�s shares

had been trading at $2.40. The cash available for payment of the dividend

arises from the company�s 12.25% joint venture interest in the East Kundana

gold project along with Northern Star Resources (51%) and Tribune Resources

(36.75%). Rand Mining also holds a 26.32% stake in Tribune Resources. The

level of future dividends is uncertain making value assessment based on the

proposed payout difficult. That said, the company has recognised the

revaluation potential from establishing a track record of returning excess

cash to investors. Verdict: Steak.

Consolidated Zinc announced that it had completed the first shipment of zinc-lead-silver ore from its Plomosas mine in Mexico (See 7 September 2018). The company plans for shipments, initially at a rate of 100 tonnes a day, to rise to 10,000 tonnes a month. The ramp up is expected to take nine months. The material is being sent to a nearby concentrator for processing. Verdict: Steak.

Tribune Resources announced that shareholders would receive a fully franked dividend of $3.50 a share totalling $175 million arising from its interest in the East Kundana gold joint venture with Rand Mining (12.25%) and Northern Star Resources (51%). Rand Mining holds a 26.32% interest in Tribune. The announcement by the latter was in almost identical terms to the announcement by Rand Mining about reasons for its own dividend payment and the consequences for future funding. Immediately before the dividend announcement, Tribune Resources shares had been trading at $7.00. The size of the dividend reflects a build up in cash and bullion holdings within the company so cannot be relied upon as an indicator of ongoing annual payments. That said, directors of Tribune and Rand Mining have recognised the revaluation potential from establishing a track record of returning excess cash to investors. Verdict: Steak.

Ventnor Resources announced that it had received the results from test work confirming the suitability of product for glass making from its two Western Australian silica sands sites. Further internal testing and reviews by potential customers will follow. The work being undertaken will also assist in defining a resource. The company had ended June with cash assets of $277,000 after having spent $1.8 million during 2017/18. Subsequently, the company raised $2.2 million via a share issue. Verdict: Steak.

Rawson Oil and Gas received a notice from Lakes Oil disclosing that the latter was entitled to 81.85% of the ordinary shares of the company following a takeover offer. The duration of the offer had been extended earlier in the month until 24 September with Lakes oil indicating that failure to reach the 90% compulsory acquisition threshold would result in a loss of liquidity for remaining shareholders and the possibility that their positions may be diluted if capital had to be raised to fund the company�s share of exploration and development costs. Verdict: Steak.

Week ended 14 September 2018

THEME OF THE WEEK: Gold Explorers Come to Life

Explaurum

received an unsolicited scrip bid from Ramelius Resources valued at $59

million for all its outstanding shares. The proposed bid price was 66%

higher than the previous closing price of the company. The Explaurum share

price was 6.5% lower than the bid price at the end of the week. In response

to the bid, Explaurum said that Ramelius had pre-empted further discussions

after an initial and inconclusive meeting between the companies. It called

the Ramelius bid inadequate and opportunistic. Ramelius is seeking to take

advantage of the geographic proximity of development assets held by

Explaurum to its own gold assets in Western Australia. Verdict: Steak.

Explaurum

received an unsolicited scrip bid from Ramelius Resources valued at $59

million for all its outstanding shares. The proposed bid price was 66%

higher than the previous closing price of the company. The Explaurum share

price was 6.5% lower than the bid price at the end of the week. In response

to the bid, Explaurum said that Ramelius had pre-empted further discussions

after an initial and inconclusive meeting between the companies. It called

the Ramelius bid inadequate and opportunistic. Ramelius is seeking to take

advantage of the geographic proximity of development assets held by

Explaurum to its own gold assets in Western Australia. Verdict: Steak.

Elementos did not make any formal announcement which might explain the share price action in the past week. In any event, the price only reverted to levels which had prevailed in months prior to historically unusual weakness at the end of August. The company had previously been forced to delay completion of negotiation for purchase of a Malaysian tin-related development opportunity following a change in official personnel after the country�s recent elections. The company, which has long sought to complete a Tasmanian tin mine development has lost significant value after foreshadowing acquisition of a portfolio of tin development assets, including another in Spain. The company also completed a share placement at the end of July after finishing June 2018 with cash assets of $937,000. Investors have been left questioning whether Elementos is on the road to three successful development opportunities or, having not completed one, tripled the chance of disappointment. Verdict: Sizzle

Perpetual Resources did not make any formal disclosure which might explain the price action. Earlier, the company had announced completion of a buyback of small share parcels, cancelling 2.16 million shares accounting for less than 1% of the total outstanding, for which it had paid $32,400. The company has gold exploration interests in New South Wales on which it had only spent $46,710 in the 12 months ended June 2018. The higher share price remained below levels prevailing in November 2016. Verdict: Sizzle

Lefroy Exploration had reported on recent exploration activity over tenements near Kalgoorlie prospective for gold mineralisation, in the prior week. One of the project areas is subject to an earn-in by Gold Fields which can take an 70% interest by spending $25 million over six years. After spending $2.47 million in the year to June 2018, including $1.7 million on exploration, the company finished with $521,000. It estimated cash outflows in the September quarter of $1.4 million of which $540,000 was to be on exploration. Subsequently, the company raised $2.6 million to help fund its field activity and administration expenses. Verdict: Sizzle

Ardiden rebounded modestly from having posted the lowest share price levels in three years. At the end of August, the company had disclosed assays from drilling at its Pickle Lake gold exploration interests in Ontario. At the same time, the company emphasised that its focus will be on its lithium exploration interests at Seymour Lake in Ontario for which it released drilling results in late August and for which there was no discernible market reaction at the time. The company spent $3.6 million on exploration (out of total spending of $4.9 million) over the 12 months to June 2018 leaving it with cash assets of $6.9 million to further its exploration efforts. Verdict: Sizzle

Week ended 7 September 2018

THEME OF THE WEEK: Small Gains Within Downtrends

Consolidated

Zinc announced that it would begin mining immediately at its

Plomosas zinc mine in Mexico having received funding via convertible notes

issued to existing shareholders and the company chairman. The company said

it would need only $0.5 million to initiate production at the mine acquired

in 2015 and where mining has occurred on site since 1945. An estimated

resource of 1.178 million tonnes, in which the company has a 51% interest,

is estimated to contain 189,700 tonnes of lead and zinc. Operating costs

are expected to be less than $0.50 per lb of zinc after by-product credits.

Ore processing will occur at a nearby Grupo Mexico plant. The company

expects to have its ore toll treated at a rate of 2,500 tonnes a month. Verdict: Steak.

Consolidated

Zinc announced that it would begin mining immediately at its

Plomosas zinc mine in Mexico having received funding via convertible notes

issued to existing shareholders and the company chairman. The company said

it would need only $0.5 million to initiate production at the mine acquired

in 2015 and where mining has occurred on site since 1945. An estimated

resource of 1.178 million tonnes, in which the company has a 51% interest,

is estimated to contain 189,700 tonnes of lead and zinc. Operating costs

are expected to be less than $0.50 per lb of zinc after by-product credits.

Ore processing will occur at a nearby Grupo Mexico plant. The company

expects to have its ore toll treated at a rate of 2,500 tonnes a month. Verdict: Steak.