The 'Steak or Sizzle?' blog comments on each of the top five performing resources stocks in the prior week.

'Sell the sizzle, not the steak' is a famous sales adage. The sizzle is the showily attractive distraction from the quality of the meat. Sizzle plays on the emotions of buyers.

'All sizzle and no steak' is a reference to excitement which fails to measure up to expectations of quality.

Resource sector investors are constantly confronted by choices requiring them to distinguish between 'steak' and 'sizzle'.

Each commentary offers an opinion about whether recent unusually strong price performance is 'sizzle' or 'steak' .

Being steak or sizzle does not necessarily say anything about near term investment returns. But sizzle can only take a company so far. Ultimately, steak is needed to sate the appetite of investors for something financially nourishing.

Month ended December 2021

Since

being commented upon previously, the

following companies have not made any subsequent disclosures which may have

materially impacted their investment performance:

Since

being commented upon previously, the

following companies have not made any subsequent disclosures which may have

materially impacted their investment performance:

Carnaby Resources Verdict: Sizzle.

DiscovEx Resources Verdict: Steak.

Superior Resources Verdict: Sizzle.

Emmerson Resources Verdict: Sizzle.

Emperor Energy holds areas prospective for gas in the offshore Gippsland Basin. The company, still in need of appropriate backing, is seeking to drill an appraisal well in early 2023 to prove the adequacy of the gas reserves for commercial development. At the end of November, the company share price had been little different to the range in which it had traded during 2017-2019 but appeared to receive a boost from Australian government statements supporting the need for additional gas production to meet rising demand along the east coast of Australia. Verdict: Sizzle.

Week ended 31 December 2021

DiscovEx

Resources retains a free carried 17.5% interest in exploration

activity being conducted in the Mt Isa area by Carnaby Resources (see

24 December 2021). Verdict: Sizzle.

DiscovEx

Resources retains a free carried 17.5% interest in exploration

activity being conducted in the Mt Isa area by Carnaby Resources (see

24 December 2021). Verdict: Sizzle.

Carnaby Resources announced assays from the first hole at its Mt Isa exploration tenements, reporting copper grades between 4% and 10% (see 24 December 2021). Verdict: Steak.

Superior Resources did not make any formal disclosures which might explain the share price action during the week. The company had previously attributed intersections of copper sulphide mineralisation near Townsville to a copper-gold porphyry system, with little discernible impact on the market price of the company. Queried by ASX about the large price swing, directors said they had no new information to impart and were not aware of any reasons for the price action. Verdict: Sizzle.

Morella Corporation, formerly known as Altura Mining, emerged from a 14 month trading suspension in December after failure of its Pilbara lithium mining venture and its forced sale to Pilbara Minerals. The company now holds another lithium exploration interest in the Pilbara as well as one in Nevada. The company did not make any formal disclosure which might explain the heightened investor interest leading into the last days of 2021. Verdict: Sizzle.

Focus Minerals received a bidders statement relating to an unsolicited takeover offer from Theta Gold Mines in the prior week. Subsequently, the company completed a $25 million entitlement share offer which had been initiated prior to launch of the bid. Focus is seeking to restart gold mining on the outskirts of Coolgardie in Western Australia based on a 2020 pre-feasibility study. Verdict: Sizzle.

Week ended 24 December 2021

Carnaby

Resources repeated disclosures made in the prior week relating

to its Mt Isa copper discovery (see 17

December 2021) with new details about the intersected mineralisation.

While the company was required to meet its full disclosure obligations, the

second round of publicity would have helped sustain its market presence when

there might have otherwise been a lull in investor interest. Verdict:

Steak.

Carnaby

Resources repeated disclosures made in the prior week relating

to its Mt Isa copper discovery (see 17

December 2021) with new details about the intersected mineralisation.

While the company was required to meet its full disclosure obligations, the

second round of publicity would have helped sustain its market presence when

there might have otherwise been a lull in investor interest. Verdict:

Steak.

Copper Strike did not make any formal disclosure which might explain the surge investor interest. The company had previously flagged that it was investigating investment opportunities both within and outside the materials space with the help of external advisors. The company had previously reported holding 9.14 million shares in Syrah Resources at the end of September, with a market value of $9.7 million. The investment value accounted for the largest part of the company’s $10.1 million market capitalisation at the time. During the past week, the Syrah Resources share price rose by 26%. Verdict: Sizzle.

Syrah Resources announced that it had executed an agreement with the electric motor vehicle manufacturer Tesla to supply natural graphite anode material from its the Vidalia plant in Louisiana where it is currently producing material for customer assessment before an investment commitment expected in early 2022. Verdict: Steak.

AXP Energy did not make any formal disclosure which might explain the higher share price. The price had appeared to weaken on relatively high volumes during the earlier part of December. The resulting partial recovery in the past week still left the share price significantly below levels prevailing in the latter part of October. The company holds oil and gas production and development interests in the USA. Verdict: Sizzle.

Redstone Resources did not make any formal disclosure which might explain the share price action accompanying a modest pick up in investor interest. The resulting price remains below levels which had prevailed through November. The company has copper exploration interests in the West Musgrave region of Western Australia. Verdict: Sizzle.

Week ended 17 December 2021

Carnaby

Resources announced “a spectacular copper discovery” at Mt Isa in

Queensland. Copper sulphide mineralisation was identified at a depth of

248-282 metres within the first hole drilled to test a geophysical anomaly.

Further drilling will be required to confirm the orientation and width of

the mineralisation. Verdict:

Steak.

Carnaby

Resources announced “a spectacular copper discovery” at Mt Isa in

Queensland. Copper sulphide mineralisation was identified at a depth of

248-282 metres within the first hole drilled to test a geophysical anomaly.

Further drilling will be required to confirm the orientation and width of

the mineralisation. Verdict:

Steak.

Tennant Minerals announced that it had raised $1 million to fund ongoing diamond drilling at the company’s Barkly copper-gold exploration site in the Northern Territory. The company said that four completed holes had encountered mineralisation which was being prepared for analysis. Verdict: Steak.

Golden Rim Resources reported assays from resource definition drilling at the site of multiple zones of gold mineralisation in Guinea. The company is aiming to deliver a maiden resource estimate in January 2022. Verdict: Sizzle.

Superior Resources did not make any formal disclosure which might explain the modest uplift in investor interest during the week. The share price action followed a general meeting of shareholders at the end of the prior week. The company has exploration interests at several sites in Queensland, including a short life gold project for which a scoping study has been completed. Verdict: Sizzle.

Magnetite Mines announced the appointment of an investment strategic advisor to assist with project financing. The appointee had previously assisted Hancock Prospecting and had been employed by a Japanese financial institution. Magnetite holds iron ore development interests in South Australia. The company, which has a three billion tonne resource, is in the process of completing a feasibility study. The price action comes after the share price had fallen to the lowest levels since January 2021. The higher price remains below prices which had prevailed between March and September. Verdict: Sizzle.

Week ended 10 December 2021

Emmerson

Resources reported a 117 metre intersection of mineralisation

containing 3.3% copper at tenements in Tennant Creek in the Northern

Territory. The company’s tenements cover a cluster of prospects which have

not received exploration attention for over 20 years. Verdict:

Steak.

Emmerson

Resources reported a 117 metre intersection of mineralisation

containing 3.3% copper at tenements in Tennant Creek in the Northern

Territory. The company’s tenements cover a cluster of prospects which have

not received exploration attention for over 20 years. Verdict:

Steak.

Astron Corporation did not make any formal disclosure which might explain why its share price had risen. That said, immediately prior to the rise, the share price had been sitting at the lowest levels since April 2021. During the week and prior to the price improvement, the company released a corporate presentation without referring to the audience for whom it had been prepared. The company holds heavy mineral sands development interests north west of Melbourne in Victoria. The zircon-rich mineralisation also contains rare earth elements. The company expects to deliver a definitive a feasibility study midway through 2022 on the way to starting production in 2025. Verdict: Sizzle.

Grange Resources announced that directors had approved a special dividend of $0.10 a share after already having paid out $0.04 for 2021. The company reported earnings of 17.8 cents a share for the six months to June based on the sale of iron ore from its Savage River property in Tasmania. Verdict: Steak.

Ironbark Zinc announced that the US Export-Import Bank had issued a preliminary project letter outlining an intention to provide funding of US$657 million to underpin development of the Citronen zinc project in Greenland, subject to further due diligence and internal approvals. Subsequently, the company announced that it had raised $4 million to cover the costs of the further capital raising efforts it needs to complete. Verdict: Steak.

Leigh Creek Energy did not make any formal disclosure which might explain the stronger investor interest in the company although, after the share price rise, the company released a statement observing the extent to which its employment base had grown and commenting on the renewed ability of executives to visit its South Korean partner to further plans for a South Australian nitrogen-based fertiliser plant. At the end of November, Leigh Creek had announced a heads of agreement with the Korean party covering some 500,000 tonnes of production over five years. Verdict: Sizzle.

Week ended 3 December 2021

Minrex

Resources did not make any formal disclosures during the week

which might explain the share price uplift. Queried by ASX about the reasons

for the price action, company directors said they had no new information to

impart while referencing the investor interest in previously announced

lithium related property acquisitions in the Pilbara region of Western

Australia. Verdict: Sizzle.

Minrex

Resources did not make any formal disclosures during the week

which might explain the share price uplift. Queried by ASX about the reasons

for the price action, company directors said they had no new information to

impart while referencing the investor interest in previously announced

lithium related property acquisitions in the Pilbara region of Western

Australia. Verdict: Sizzle.

Marquee Resources disclosed that drilling in the US state of Washington had intercepted visible copper mineralisation. The share price reaction was not sufficient to reproduce the levels which had been achieved in early November after the company announced the acquisition of a portfolio of copper, gold and lithium exploration interests in the USA. No assays were available at the time of the disclosure. Verdict: Sizzle.

Develop Global did not make any formal disclosure which might explain the steadily strengthening share price over the past two weeks. The company, known as Venturex Minerals until October, has copper exploration interests in the Pilbara region of Western Australia and has announced a move into contracted mining services under a new board and management. Verdict: Sizzle.

Aston Minerals reported partial results for a maiden drill hole at a nickel-cobalt exploration target in Ontario. The announcement came several days after evidently stronger investor interest had begun to impact the share price. In any event, the rise was only enough to push the share price to the upper end of a range which has prevailed since late June after touching the bottom end of the range most recently. Verdict: Sizzle.

Firefinch announced that the first funding from Chinese corporate Ganfeng had been received as part of its joint venture obligations covering development of the companies’ Goulamina lithium deposit in Mali. At the same time, the Australian Financial Review reported that the company was visiting financial intermediaries with an eye to raising fresh capital. In any event, the price rise is the latest instalment in an upward share price trend evident since the second quarter of 2020 during which time the company has experienced an eightfold share price improvement. The company has led investors to expect a completed feasibility study in the near term. Verdict: Sizzle.

Month ended November 2021

Since

being commented upon previously, the

following companies have not made any subsequent disclosures which may have

materially impacted their investment performance:

Since

being commented upon previously, the

following companies have not made any subsequent disclosures which may have

materially impacted their investment performance:

Devex Resources Verdict: Sizzle.

Hawthorn Resources Verdict: Steak.

Australian Silica Quartz Group Verdict: Sizzle.

Minrex Resources Verdict: Sizzle.

AVZ Minerals Verdict: Sizzle.

Week ended 26 November 2021

White

Cliff Minerals announced that it had raised $912,000 through an

issue of new shares. At the end of September, it had held cash assets of

$1.2 million which it had characterised in late October as sufficient

funding for planned activities over coming quarters. In late November, the

company announced that it would acquire two privately held companies with

lithium and rare earth element exploration interests in Western Australia to

which the newly raised cash would be directed. The company had previously

held gold exploration interests near Cue in Western Australia. Verdict: Sizzle.

White

Cliff Minerals announced that it had raised $912,000 through an

issue of new shares. At the end of September, it had held cash assets of

$1.2 million which it had characterised in late October as sufficient

funding for planned activities over coming quarters. In late November, the

company announced that it would acquire two privately held companies with

lithium and rare earth element exploration interests in Western Australia to

which the newly raised cash would be directed. The company had previously

held gold exploration interests near Cue in Western Australia. Verdict: Sizzle.

E2 Metals announced the discovery of significant gold and silver mineralisation from an initial round of shallow drilling within the company’s Conserrat exploration area in southern Argentina. The latest results are from a location approximately 2.5 kilometres from a discovery reported by the company in early October. Last week’s price action was a modest response to the exploration news after the share price had plumbed the lowest levels since a year ago when it began reporting positive exploration outcomes which had temporarily resulted in a rapid fourfold price appreciation. Verdict: Sizzle.

Altech Chemicals announced that it had successfully combined silicon and graphite to produce an anode for use in a lithium-ion battery with a higher energy capacity. The Altech share price has been recovering since mid-2021 after having been on a declining track since the beginning of 2018. The company’s initial promise to move swiftly to produce high purity alumina has been delayed as it ventures into battery research. Altech has recently appeared to benefit from the broad based appeal of energy storage investment themes despite having failed to deliver on its original business strategy and having ventured into research areas in which it lacks recognised expertise. VerdVerdict: Sizzle.

Australian Silica Quartz Group has been on a rising share price trend since early October as its joint venture partner Devex Resources reported results from drilling copper-nickel-PGE mineralisation at their Sovereign prospect in the Julimar region of Western Australia (see 12 November 2021). Verdict: Sizzle.

Prospect Resources did not make any formal disclosure which might explain the share price action in the past week. In any event, the company’s share price has been on a rising trend since the beginning of June as investors have become more interested in lithium related investments. Prospect holds lithium development interests in Zimbabwe for which it produced a feasibility study in October for a staged development. Since then, the company has been telling investors that market conditions are suited to it abandoning the staged approach in favour of an immediate push to full-scale production. The company has hinted at the possibility of strategic partnerships to fund the development opportunity. Verdict: Sizzle.

WeekWeek ended 19 November 2021

Hawthorn

Resources announced that a subsidiary of Hancock Prospecting is to

take a joint venture interest in the company’s 1,170 million tonne magnetite

deposit north of Kalgoorlie in Western Australia. Hawthorn currently has a

40% interest with the balance held by Legacy Iron Ore. Hancock will take an

initial 30% stake with a $9 million investment. It will retain an option to

move to 51% with completion of a feasibility study. Verdict:

Steak.

Hawthorn

Resources announced that a subsidiary of Hancock Prospecting is to

take a joint venture interest in the company’s 1,170 million tonne magnetite

deposit north of Kalgoorlie in Western Australia. Hawthorn currently has a

40% interest with the balance held by Legacy Iron Ore. Hancock will take an

initial 30% stake with a $9 million investment. It will retain an option to

move to 51% with completion of a feasibility study. Verdict:

Steak.

Legacy Iron Ore benefitted from the joint venture agreement with Hancock Prospecting covering the Mt Bevan magnetite resource north of Kalgoorlie in Western Australia jointly owned with Hawthorn Resources (see above). Verdict: Steak.

Sunstone Metals disclosed assays from drilling at its Bramaderos gold prospect in southern Ecuador. The potential discovery follows recent exploration success at the company’s El Palmar gold-copper discovery in the north of the country (see 8 October 2021). Verdict: Steak.

Todd River Resources announced that drilling had recommenced at its Berkshire Valley nickel-copper-PGE project north of the Chalice Mining Julimar discovery following completion of the local grain harvest. Verdict: Sizzle.

Icon Energy did not make any formal disclosure which might explain the surge in investor interest during the last trading day of the week. The company is drilling appraisal wells in the Eromanga Basin in Queensland. At the end of October, the company had referred to an aim of separating carbon dioxide and hydrogen at the wellhead to become a green oil producer. Verdict: Sizzle.

Week ended 12 November 2021

Latrobe

Magnesium announced that it had raised $11.5 million. The placement

occurred following an announcement late in the prior week that directors

were going to examine an expansion of the company’s planned magnesium pilot

plant from 1,000 to 10,000 tonnes a year. The decision to speed up

production follows strong expressions of interest from potential buyers of

the metal as near-term shortages rapidly transform the business outlook (see

29 October 2021). VVerdict:

Steak.

Latrobe

Magnesium announced that it had raised $11.5 million. The placement

occurred following an announcement late in the prior week that directors

were going to examine an expansion of the company’s planned magnesium pilot

plant from 1,000 to 10,000 tonnes a year. The decision to speed up

production follows strong expressions of interest from potential buyers of

the metal as near-term shortages rapidly transform the business outlook (see

29 October 2021). VVerdict:

Steak.

Devex announced that low grade nickel copper sulphide mineralisation had been observed in drilling at the company’s Sovereign exploration site within the Julimar region in Western Australia. Verdict: Sizzle.

Minotaur Exploration and Andromeda Metals announced a merger of the two companies to consolidate ownership of the Great White kaolin project in South Australia. The combination should make funding the project simpler. The proposed transaction will involve Minotaur shareholders receiving Andromeda scrip. At the same time, the non-kaolin assets of Minotaur will be demerged in a separately listed company. VerdiVerdict: Steak.

Australian Silica Quartz Group benefited from the Devex announcement (see above). Devex is earning a 50% interest from the company in the Sovereign exploration prospect. Verdict: Sizzle.

Chalice Mining announced the maiden resource estimate for its Gonville nickel-copper-PGE deposit within the Julimar region of Western Australia. The 330 million tonne resource includes 530,000 tonnes of contained nickel and 10 million ounces of PGE metals. Directors emphasised the flat grade-tonnage curves, in making the announcement, to illustrate the future development flexibility of the resource. Verdict: Steak.

Week ended 5 November 2021

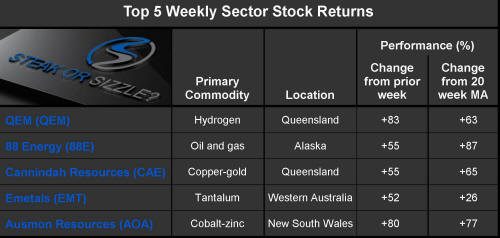

Cannindah

Resources investors had been experiencing a rising share price

trend since late August after drilling had commenced at the company’s

copper-gold property near Gladstone in Queensland. Queried by ASX about the

trending share price in late October, directors said they had no additional

information of relevance but drew attention to the tightly held shares of

its major shareholders which would give the company unusual leverage to any

news about potential discoveries. The share price rise accelerated

dramatically in the past week after the company announced that he had made a

$1.5 million placement of shares to a major existing shareholder. Verdict: Sizzle.

Cannindah

Resources investors had been experiencing a rising share price

trend since late August after drilling had commenced at the company’s

copper-gold property near Gladstone in Queensland. Queried by ASX about the

trending share price in late October, directors said they had no additional

information of relevance but drew attention to the tightly held shares of

its major shareholders which would give the company unusual leverage to any

news about potential discoveries. The share price rise accelerated

dramatically in the past week after the company announced that he had made a

$1.5 million placement of shares to a major existing shareholder. Verdict: Sizzle.

Reedy Lagoon Corporation did not make any formal disclosure which might explain the share price action, although price pressure had been building since mid-October when the company reported geophysical results from surveys at its lithium brine project in Nevada. The company will have benefitted from the recent strength in lithium prices and the heightened investor interest in this segment of the resources market. VerdiVerdict: Sizzle.

AVZ Minerals did not make any formal disclosure which might explain the acceleration in a rising share price trend dating from July. The company had previously announced that it had signed a joint venture agreement with a Chinese company covering development of a lithium-tin project in the Democratic Republic of the Congo. The company had recently confirmed that good progress was being made toward completing the deal. It would also have benefited from growing interest among investors in lithium and tin development opportunities. Verdict: Sizzle.

Arizona Lithium announced that it had raised $13 million to further development of its Nevada lithium assets. The company will also have benefited from the heightened interest among investors in lithium related resource companies. Verdict: Sizzle.

Marquee Resources announced that it had acquired an interest of up to 80% in land holdings prospective for lithium brine and clay lithium deposits near the Rhyolite Ridge lithium-boron deposit of Ioneer in Nevada. The acquisition adds to existing holdings by the company in the area. At the same time, the company said it had acquired up to 80% of an existing copper-gold deposit in Washington situated among historical workings and on patented land. The company is able to earn its interests in the targeted properties over a period of 18 to 24 months. Directors also foreshadowed a $3 million capital raising. Verdict: Sizzle.

Month ended October 2021

Since

being commented upon previously, the

following companies have not made any subsequent disclosures which may have

materially impacted their investment performance:

Since

being commented upon previously, the

following companies have not made any subsequent disclosures which may have

materially impacted their investment performance:

Korab Resources Verdict: Sizzle.

Sunstone Metals Verdict: Steak.

Avenira Verdict: Sizzle.

Xantippe Resources Verdict: Sizzle.

Centrex Metals Verdict: Sizzle.

Week ended 29 October 2021

Korab

Resources did not make any formal disclosure which might

explain the large increase in share volumes traded and accompanying share

price rise on a single day during the week. Queried by ASX, the company said

that it had discussed potentially supplying car manufacturers with magnesium

sourced from the groups Winchester project near Darwin in the Northern

territory. Directors emphasized that these talks may not amount to anything

commercially substantial. They also highlighted shortages in the amount of

magnesium available for purchase and recent price rises as contributors to

the rising market value of the company. Subsequently, directors announced

that they had made a placement of shares at a 25% discount to the market to

raise $1.9 million. The company had reported having cash assets of $93,000

at the end of June with borrowings of $665,000 from a $678,000 facility. Verdict: Sizzle.

Korab

Resources did not make any formal disclosure which might

explain the large increase in share volumes traded and accompanying share

price rise on a single day during the week. Queried by ASX, the company said

that it had discussed potentially supplying car manufacturers with magnesium

sourced from the groups Winchester project near Darwin in the Northern

territory. Directors emphasized that these talks may not amount to anything

commercially substantial. They also highlighted shortages in the amount of

magnesium available for purchase and recent price rises as contributors to

the rising market value of the company. Subsequently, directors announced

that they had made a placement of shares at a 25% discount to the market to

raise $1.9 million. The company had reported having cash assets of $93,000

at the end of June with borrowings of $665,000 from a $678,000 facility. Verdict: Sizzle.

Latrobe Magnesium did not make any formal disclosure which might explain the heightened investor interest in the company during the first part of the week. In the prior week, the company had completed a $3 million equity raising. The funds will allow it to fast track construction of a magnesium production demonstration plant in Victoria. Investor interest will have been boosted by recent capacity closures in China and comments attributed to Angela Merkel that European car manufacturers would run out of magnesium in the coming month. Verdict: Sizzle.

S2 Resources announced that it had won a much-anticipated tender for exploration ground surrounding the high grade Fosterville gold mine in Victoria. The win confers an exclusive option to apply for an exploration licence. The land is one of four blocks on offer and subject to competitive bidding. Exploration and mining will be subject to the company reconciling competing land uses. Verdict: Sizzle.

Avenira did not make any formal disclosure which might explain the unusually strong investor interest in the company which is seeking to develop the Wonorah phosphate deposit in the Northern Territory. Queried by ASX about the market action, directors said that they did not have anything to disclose but did draw attention to rises in phosphate prices and media comments about the future use of phosphate in batteries. They also said that they had signed a confidentiality agreement which could lead to an investment in the project but would not know the outcome for two months. Verdict: Sizzle.

Sparc Technologies announced that it executed a non-binding agreement with the University of Adelaide to jointly form a hydrogen technology company. The company described a process that uses radiation from the sun to convert water into hydrogen and oxygen without use of wind power or photovoltaic panels. The company also announced a $2 million capital raising. The company had been engaged in development of graphene-based technologies which could be applied to the hydrogen production plans envisaged by the university's processes. Verdict: Sizzle.

Week ended 22 October 2021

Centrex

Metals announced that it had signed a highly conditional

agreement with fertiliser trader Samsung C&T Corporation covering phosphate

marketing activities in Korea, Japan, Indonesia, India and Mexico. The

potential final agreement will account for up to 20% of the first three

years of anticipated production from the company’s Ardmore phosphate project

in north west Queensland. Funding for the $78 million project will be made

easier by having incredible offtake arrangements in place although this

agreement is no more than an option from which Samsung can walk for a range

of reasons. Verdict: Sizzle.

Centrex

Metals announced that it had signed a highly conditional

agreement with fertiliser trader Samsung C&T Corporation covering phosphate

marketing activities in Korea, Japan, Indonesia, India and Mexico. The

potential final agreement will account for up to 20% of the first three

years of anticipated production from the company’s Ardmore phosphate project

in north west Queensland. Funding for the $78 million project will be made

easier by having incredible offtake arrangements in place although this

agreement is no more than an option from which Samsung can walk for a range

of reasons. Verdict: Sizzle.

Xantippe Resources had announced in late September that fire assay results from an auger drilling program at its Southern Cross prospect indicated gold anomalism signalling targets for future drilling activity. Subsequently, the company did not make any formal disclosures which might explain the more recent rise in investor interest. After initiating a rights issue in August, the company completed placement of the shortfall at the start of the week for a total raising of approximately $2 million. The company reported having cash assets of $271,000 at the end of June 2021. Verdict: Sizzle.

A-Cap Energy did not make any formal disclosure prior to the share price action which might explain the timing or size of the price movement. However, subsequently, the company announced that it had closed a rights issue, opened in late September, raising $17.4 million. The company had reported having cash assets of $3.6 million at the end of June. It holds nickel-cobalt exploration interests in Western Australia and uranium-related prospects in Botswana. Verdict: Sizzle.

Arizona Lithium, having changed its name from Hawkstone Mining in September, did not make any formal disclosure which might explain the price action. Queried by ASX about the reasons for the share price uplift, directors said that they had nothing to disclose but drew attention to recent strength in lithium prices and the company's divestment of non-lithium assets to concentrate on US lithium development prospects. Verdict: Sizzle.

Lake Resources did not make any formal disclosure which might explain a surge in investor interest during the week but has been actively marketing its innovative approach to extracting lithium from Argentine brine deposits, highlighting a substantially lower carbon footprint than that of other lithium producers. During September, the company had made several announcements with a potentially beneficial impact on its capacity to fund its Argentine development. Investor interest will have also been stoked by reports of stronger lithium prices. Verdict: Steak.

Week ended 15 October 2021

Australian

Pacific Coal did not make any formal disclosure which might explain

the stronger investor interest. The company holds thermal coal development

prospects in the Hunter Valley region of New South Wales. The company’s

development efforts have been stymied by legal and funding obstacles

consistent with the recent reluctance of regulators and financiers to back

coal production. The price action returns the company’s share price to

similar levels which had prevailed in the past 12 months. Stronger coal

market conditions may have raised hopes among some investors that progress

through the development impasse may be possible. Verdict: Sizzle.

Australian

Pacific Coal did not make any formal disclosure which might explain

the stronger investor interest. The company holds thermal coal development

prospects in the Hunter Valley region of New South Wales. The company’s

development efforts have been stymied by legal and funding obstacles

consistent with the recent reluctance of regulators and financiers to back

coal production. The price action returns the company’s share price to

similar levels which had prevailed in the past 12 months. Stronger coal

market conditions may have raised hopes among some investors that progress

through the development impasse may be possible. Verdict: Sizzle.

Nova Minerals has continued to report strong drilling results from within its Estelle exploration area in Alaska as it moves toward a maiden resource estimate and, then, a scoping study. Verdict: Steak.

Wildcat Resources has experienced a rising share price trend throughout October after announcing an option to acquire a lithium project near Coolgardie in Western Australia. Within days, the company reported having intercepted pegmatites from drilling on the property. The company also holds active gold exploration interests in the Pilbara region of Western Australia and the Lachlan Fold Belt in New South Wales. After the share price had risen on the last day of trading in the week, the company initiated a trading halt pending an announcement. Verdict: Sizzle.

Caspin Resources did not make any formal disclosure which might explain a sharp rise in investor activity during the final day of the week. The company had made a presentation to the Australian Nickel Conference on 5 October without any apparent impact on market activity at that time. In late September, the company had reported that drilling at its Yarawindah Brook PGE-nickel-copper project in Western Australia had been completed with assays pending. A resumption of drilling was foreshadowed for late October. Verdict: Sizzle.

Consolidated Zinc did not make any formal disclosure which might explain a pickup in investor activity during the last trading day of the week. The day before, the company had lodged a copy of a 121 Latin American Conference presentation. The company operates a zinc mine in Mexico and would have benefited from the sharp rise in the zinc price in the days immediately beforehand. Verdict: Sizzle.

Week ended 8 October 2021

Sunstone

Metals reported receiving the first assays from drilling at the El Palmar

gold-copper property in Ecuador. Directors characterised a 480 metre

intersection of gold and copper as typical of gold rich porphyry systems.

Further results are expected in six weeks. The company is earning a 51%

stake in the project with an option to acquire 100%. Verdict:

Steak.

Sunstone

Metals reported receiving the first assays from drilling at the El Palmar

gold-copper property in Ecuador. Directors characterised a 480 metre

intersection of gold and copper as typical of gold rich porphyry systems.

Further results are expected in six weeks. The company is earning a 51%

stake in the project with an option to acquire 100%. Verdict:

Steak.

Tigers Realm Coal did not make any formal disclosure which might explain the stronger investor interest and accompanying share price action. The latest rise follows earlier large gains dating from late August. The company is mining coking coal deposits in Russia. Directors have foreshadowed sales of 750-800,000 tonnes during 2021 after selling 169,000 tonnes in the June quarter. Stronger coal market conditions in the Asian region will have favourably impacted financial outcomes in recent months and stoked investor interest. Verdict: Sizzle.

Doriemus did not make any formal disclosure which might explain the share price action which, in any event, is part of a longer-term trend dating from June. The company holds oil and gas exploration interests in the UK and, indirectly, in Greenland. Stronger oil and gas prices amid concerns about energy supply shortfalls in the UK will have added investor interest. Verdict: Sizzle.

ADX Energy disclosed that it had signed an agreement to supply green electricity with joint development of green hydrogen production in the Vienna Basin, in conjunction with an Austrian renewable power generation company. The project will be designed to capture electricity at those times when access to the Austrian grid is unavailable. Verdict: Sizzle.

Altech Chemicals did not make any formal statement which might validate an improved valuation for the company. In recent days, the company appointed a new chief financial officer and opened nominations for the election of directors at an upcoming meeting of shareholders. Altech has been constructing a high purity alumina plant in Malaysia connected to upstream kaolin mining in Western Australia although, increasingly, it has been repositioning as a participant in the European battery supply chain. Initial plans for financing the Johor plant, construction of which has stalled, have proven overly optimistic. Verdict: Sizzle.

Week ended 1 October 2021

Amani

Gold did not make any formal disclosure which might explain the

surge in investor interest on the last trading day of the week. In early

September, the company had announced that it would raise $7 million which

would be used to further exploration efforts at the Giro gold project in the

Democratic Republic of the Congo. At the end of June, the company held cash

assets of $873,000. Verdict: Sizzle.

Amani

Gold did not make any formal disclosure which might explain the

surge in investor interest on the last trading day of the week. In early

September, the company had announced that it would raise $7 million which

would be used to further exploration efforts at the Giro gold project in the

Democratic Republic of the Congo. At the end of June, the company held cash

assets of $873,000. Verdict: Sizzle.

New Talisman Gold Mines announced that it had entered into a binding agreement to acquire a small-scale working gold mine in Vanuatu adjacent to a currently owned existing mining operation. The apparent size of the market response reflects the share price of the company having briefly fallen to a historically low level in the days immediately preceding last week. The $6 million company is looking to consolidate and then divest its gold exploration interests. Verdict: Sizzle.

Red Dirt Metals announced a non-binding agreement in early September to acquire the Mt Ida gold-copper project north of Menzies in Western Australia. The company, which was to pay $11 million for the purchased asset, also raised $15 million through a convertible loan. The company’s share price rose relatively modestly leading up to completion of due diligence late in the month and before directors announced that, during the course of their examination of the company, they had found evidence of multiple high grade lithium intersections in earlier drill results. About 1% of holes drilled had shown evidence of potential lithium mineralisation. Verdict: Sizzle.

QX Resources disclosed that a trenching program at gold prospects in central Queensland had been completed. No results were made available. A day later, the company announced that it had acquired an option over an exploration licence application covering Pilbara land prospective for lithium. Due diligence for the share transaction is scheduled over a 30 day period. Verdict: Sizzle.

Hydrocarbon Dynamics provided a commentary on favourable feedback from a Cooper Basin trial of its proprietary oil treatment technology. It reported reduced sludge build-up in two production tanks. The company is in the process of quitting its Utah oil sands interests. Completion of the transaction had been scheduled for the end of September after which the company says it will be focused on market development efforts through agents and distributors of its oil treatment products. Verdict: Sizzle.

Month ended September 2021

Hannans

did not make any further disclosures (see 17 September 2021) which might

explain the further share price strength later in the month. Queried by ASX

about the price action, company directors said that they had no new

information to impart but drew attention to the company’s early September

announcement about a potential recycling joint-venture in Europe and the

pre-existing shareholding of ASX-listed Neometals in the company as having

stimulated fresh interest among investors. After losing some of the earlier

gains in the last days of the month, the company called for a trading halt

following an unexplained shift higher in the share price. Later, the trading

halt was followed by a suspension of trading while the company prepared to

make another announcement about its European metal recycling aspirations. Verdict: Sizzle.

Hannans

did not make any further disclosures (see 17 September 2021) which might

explain the further share price strength later in the month. Queried by ASX

about the price action, company directors said that they had no new

information to impart but drew attention to the company’s early September

announcement about a potential recycling joint-venture in Europe and the

pre-existing shareholding of ASX-listed Neometals in the company as having

stimulated fresh interest among investors. After losing some of the earlier

gains in the last days of the month, the company called for a trading halt

following an unexplained shift higher in the share price. Later, the trading

halt was followed by a suspension of trading while the company prepared to

make another announcement about its European metal recycling aspirations. Verdict: Sizzle.

Red Dirt Metals announced a non-binding agreement in early September to acquire the Mt Ida gold-copper project north of Menzies in Western Australia. The company, which was to pay $11 million for the purchased asset, also raised $15 million through a convertible loan. The company’s share price rose relatively modestly leading up to completion of due diligence late in the month and before directors announced that, during the course of their examination of the company, they had found evidence of multiple high grade lithium intersections in earlier drill results. About 1% of holes drilled had shown evidence of potential lithium mineralisation. Verdict: Sizzle.

Grand Gulf Energy followed up its early September announcement (see 3 September 2021) about a helium related acquisition in Utah with confirmation, later in the month, that due diligence had been completed and that the transaction would proceed to the next stage. Verdict: Sizzle.

Norwest Energy released additional information about its Lockyer Deep-1 gas find in the Perth Basin (see 10 September 2021). The share price retraced slightly near the end of the month when directors announced that the cost of the well appraisal would exceed the company’s earlier estimates. Verdict: Steak.

Eastern Iron announced that it had raised $3.6 million to further the goals of the strategic link with a Chinese chemical producer (see 10 September 2021). Subsequently, the company announced that a study of the Nowa Nowa iron ore project had been completed by an external consultant as a step towards completing a feasibility study by the end of 2021. The study flagged “potential to be a viable proposition”. Verdict: Sizzle.

Week ended 24 September 2021

Genesis

Minerals announced that it would issue new shares to raise $16

million with a former Saracen and Northern Star executive to take up the

majority of the issue and lead a group of well-known industry executives to

assume management of the company. The stated aim of the new arrangements is

to turn Genesis into a mid-tier Australian gold company. Verdict: Sizzle.

Genesis

Minerals announced that it would issue new shares to raise $16

million with a former Saracen and Northern Star executive to take up the

majority of the issue and lead a group of well-known industry executives to

assume management of the company. The stated aim of the new arrangements is

to turn Genesis into a mid-tier Australian gold company. Verdict: Sizzle.

PepinNini Minerals announced that it had signed an agreement with a subsidiary of Ganfeng Lithium in Argentina to allow a lithium brine pipeline to cross a PepinNini property. The agreement calls for the companies to co-operate in a geophysical survey of the proposed pipeline route which, as a by-product, will give PepinNini evidence of potential copper mineralisation in the area. Verdict: Sizzle.

Hannans did not disclose any additional information which might explain the continuation of the share price rise from the previous week (see 17 September 2021). Queried by ASX about the reasons for the rises, directors said that they had been briefing investors about their Nordic battery recycling plans following a 9 September announcement but had nothing to add. Verdict: Sizzle.

EQ Resources released an updated resource statement for its Mt Carbine tungsten property near Cairns in Queensland following remodelling of the resource and further diamond drilling. The re-estimation is feeding into a bankable feasibility study. Verdict: Steak.

Resource Mining Corporation did not make any formal disclosure which might explain the share price action. Queried by ASX about the reasons for the price move, the company said that it had no new information to impart. The company had acquired nickel exploration interests in Tanzania in February. In August, it announced that it had divested its laterite nickel exploration interests in Papua New Guinea which would permit it to fully extinguish its debt. At the end of June 2021, the company held cash assets of $38,000 with outstanding loans of $4.8 million. Verdict: Sizzle.

Week ended 17 September 2021

Metal

Hawk reported having intersected massive nickel sulphide

mineralisation from drilling on the company’s tenements 20 kilometres east

of Kalgoorlie after surface electromagnetic surveys had proven effective.

The company now intends to initiate a downhole electromagnetic survey in

preparation for diamond drilling. Verdict: Sizzle.

Metal

Hawk reported having intersected massive nickel sulphide

mineralisation from drilling on the company’s tenements 20 kilometres east

of Kalgoorlie after surface electromagnetic surveys had proven effective.

The company now intends to initiate a downhole electromagnetic survey in

preparation for diamond drilling. Verdict: Sizzle.

Hannans did not appear to make any formal disclosure which might explain the sharp rise in the share price. A week before, the company had announced that it would participate in a joint venture to recover metal from spent lithium-ion batteries in Norway, Sweden, Denmark and Finland. The company advised investors that it had made a commitment to the ASX that its spending on the new venture would be limited to $1.5 million to ensure that it would not breach listing rules relating to changes in the nature of the business. The company had previously been exploring for gold and copper-nickel mineralisation in Western Australia. It reported having cash assets of $1.0 million at the end of June 2021. Verdict: Sizzle.

Twenty Seven Company disclosed that a data review had highlighted new lithium and tin targets on its exploration tenements in the Broken Hill region. The company will undertake rock chip sampling in the next stage of exploration. Verdict: Sizzle.

A-Cap Energy did not make any formal disclosure before the share price rise and a halt in trading of its shares. The company has exploration rights covering nickel within tenements held by Wiluna Mining Corporation. It also holds a uranium exploration property in Botswana which is currently under care and maintenance. The share price move, although unexplained, could be connected to renewed market interest in uranium-related stocks. Verdict: Sizzle.

Kingwest Resources announced that drilling had intersected significant gold mineralisation under Lake Goongarrie (between Menzies and Kalgoorlie) in Western Australia. Three quarters of the assays from the latest round of drilling remain outstanding. Verdict: Steak.

Week ended 10 September 2021

Norwest

Energy reported a significant gas discovery at Lockyer Deep-1 in

the Perth Basin in Western Australia at a depth of 4,041-4,067 metres.

Further appraisal work is being undertaken. The company holds a 20% interest

in the exploration permit which is operated by Mineral Resources, the holder

of the remaining interest. Verdict:

Steak.

Norwest

Energy reported a significant gas discovery at Lockyer Deep-1 in

the Perth Basin in Western Australia at a depth of 4,041-4,067 metres.

Further appraisal work is being undertaken. The company holds a 20% interest

in the exploration permit which is operated by Mineral Resources, the holder

of the remaining interest. Verdict:

Steak.

Eastern Iron announced that the company had signed a memorandum of understanding with a Chinese producer of lithium hydroxide and lithium carbonate chemicals under which the two companies would jointly acquire and develop lithium projects. In early August, the company had acquired an option to buy a 100% interest in a Pilbara exploration property prospective for lithium-caesium-tantalum pegmatites. The memorandum of understanding, if it proceeds to a formal agreement, would introduce the Chinese company as a joint venture partner. The company, which already held iron ore related exploration interests in eastern Victoria, reported having cash assets of $1.5 million at the end of June. Verdict: Sizzle.

Nexus Minerals reported assays from a further round of drilling within the company’s Walbrook gold project in the eastern goldfields of Western Australia. The site of the new results is a short distance from mineralised structures previously reported by the company and which have helped sustain a sharply rising share price since early August. Verdict: Steak.

Key Petroleum did not make any formal disclosure which might explain the share price rise. In any event, the rise occurred from near record low prices after unusually high trading volumes. The company has oil exploration interests in the Perth Basin where preparations are underway for a forthcoming seismic survey. With only $46,000 in cash assets at the end of June and borrowings of $200,000, the company has been looking at to sell assets to help fund the business. Verdict: Sizzle.

African Gold, with gold exploration interests in Cote d’Ivoire, reported the results of screen fire assays from previously advised mineral intersections. The high grades complement historical results in the area and are consistent with free gold finds by artisanal miners in the surrounds. At the same time, the company announced it would undertake a rights issue to raise $3.9 million. The company had reported having cash assets of $475,000 at the end of June 2021. Verdict: Sizzle.

Week ended 3 September 2021

Pan

Asia Metals announced that it had applied for prospecting licences

in Thailand over an area prospective for lithium mineralisation, including

areas in which geothermal energy sources can be used to extract the battery

metal. The company foreshadowed further applications. The company, which had

cash assets of $1.2 million at the end of June, ended the week in an

unexplained trading halt. Verdict: Sizzle.

Pan

Asia Metals announced that it had applied for prospecting licences

in Thailand over an area prospective for lithium mineralisation, including

areas in which geothermal energy sources can be used to extract the battery

metal. The company foreshadowed further applications. The company, which had

cash assets of $1.2 million at the end of June, ended the week in an

unexplained trading halt. Verdict: Sizzle.

Grand Gulf Energy announced that it had acquired a private Australian company with joint-venture interests in helium exploration properties in Utah. The properties of interest are in an area of existing helium production. Prior to the helium-related acquisition, the company’s primary interest was in oil production in Louisiana, where it had been reporting quarterly production of 4-5,000 barrels a day over the past year. The company held cash assets of $1.1 million at the end of June. Verdict: Sizzle.

Great Boulder Resources reported initial results from drilling at the company's Mulga Bill gold prospect near Meekatharra in Western Australia. Grades in a 10-368/t range were reported with further results to come as laboratory reporting permits. The company, which had cash assets of $6.8 million at the end of June, holds other ground in Western Australia prospective for gold and copper-nickel-PGE mineralisation. Verdict: Sizzle.

Valor Resources reported assays from ground sampling at the company’s Hook Lake property in northern Saskatchewan where it is seeking to define a uranium resource. The sampling indicated the presence of uranium, silver, lead and rare earth metals. Verdict: Sizzle.

Paladin Energy did not make any formal disclosure which might explain the strong share price uplift. However, uranium-related companies have generally attracted stronger investor interest since an improvement in uranium spot prices at the end of August. The long-awaited recovery in prices is a critical precondition for companies seeking to lock in contract prices sufficiently high to underpin production starts. Verdict: Steak.

Month ended August 2021

The

following companies have not made any subsequent disclosures which may have

impacted their investment performance since being commented upon previously:

The

following companies have not made any subsequent disclosures which may have

impacted their investment performance since being commented upon previously:

Red Hill Iron Verdict: Steak.

Ikwezi Mining Verdict: Sizzle.

Pan Asia Metals Verdict: Sizzle.

American Rare Earths Verdict: Steak.

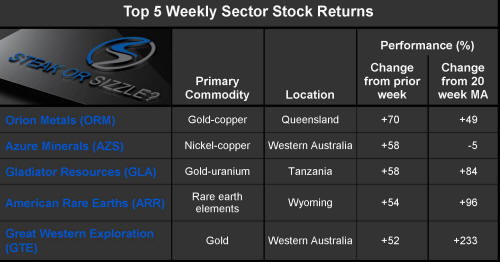

Orion Metals Verdict: Sizzle.

Week ended 27 August 2021

Orion

Metals did not make any formal disclosure which might explain the

share price movement in the rarely traded stock. in any event, the price

rise occurred as a result of trades valued at less than $1,000. The company,

which reported having cash assets of just $9,000 at the end of June, entered

into an agreement in early July with an entity promising to facilitate

future corporate transactions. In late July, the company announced an

extension to the duration of the agreement until the end of the month but

nothing further has been heard. Verdict: Sizzle.

Orion

Metals did not make any formal disclosure which might explain the

share price movement in the rarely traded stock. in any event, the price

rise occurred as a result of trades valued at less than $1,000. The company,

which reported having cash assets of just $9,000 at the end of June, entered

into an agreement in early July with an entity promising to facilitate

future corporate transactions. In late July, the company announced an

extension to the duration of the agreement until the end of the month but

nothing further has been heard. Verdict: Sizzle.

Azure Minerals reported multiple nickel-copper sulphide intersections as a result of 22 new drill holes at the company’s Andover exploration area in Western Australia. Verdict: Steak.

Gladiator Resources did not make any formal disclosure in the past week which might explain the share price action. However, the share price has been rising with unusually strong volumes traded over the past three weeks following an announcement that Gladiator had agreed to acquire exploration tenements in Tanzania prospective for gold and uranium. The company, which had cash assets of $0.9 million at the end of June, also announced that it had raised $1.0 million through a share placement. Verdict: Sizzle.

American Rare Earth released the results of surface sampling from its rare earth exploration site in Wyoming. The site was acquired in August 2020 against the backdrop of concerns among US policy makers that the country’s rare earth element supply chain was too heavily reliant on Chinese companies. The latest share price movement is an extension of a rise which commenced early in August following disclosure of an increase in the company’s rare earth resource in Arizona. Verdict: Steak.

Great Western Exploration announced a strong gold in soil anomaly at the Firebird gold project near Wiluna in Western Australia. The company referred to the presence of the anomaly within the geological setting recognised in a recent review of historical data as “a compelling target”. Verdict: Sizzle.

Week ended 20 August 2021

Intra

Energy Corporation did not make any formal disclosure which might

explain the heightened investor interest in what is a usually very lightly

traded stock. At the end of July, the company had referred in its quarterly

activities report to a change in strategic direction. It intended to opt out

of African coal production in favour of gold mining in Mozambique and

copper-gold exploration in Australia. The company had made licence

applications to further the new strategic aims. At the end of June, the

company, which is looking to exit its coal properties, held cash assets of

$220,000 against debts of $1.7 million. Verdict: Sizzle.

Intra

Energy Corporation did not make any formal disclosure which might

explain the heightened investor interest in what is a usually very lightly

traded stock. At the end of July, the company had referred in its quarterly

activities report to a change in strategic direction. It intended to opt out

of African coal production in favour of gold mining in Mozambique and

copper-gold exploration in Australia. The company had made licence

applications to further the new strategic aims. At the end of June, the

company, which is looking to exit its coal properties, held cash assets of

$220,000 against debts of $1.7 million. Verdict: Sizzle.

Aguia Resources did not make any formal disclosure which might explain the share price action which resulted in a retreat from historically low levels to prices which had prevailed in early July. The company, which is seeking to develop phosphate and copper mining interests in Brazil, has become entangled in legal proceedings over the conduct of an environmental study covering of the phosphate property. Verdict: Sizzle.

Nexus Minerals reported drilling results from exploration activity within tenements in the eastern goldfields of Western Australia. It reported on 11 holes with results from a further eight to come. The drilling, to test for depth and strike extensions, has produce results consistent with continuity of mineralisation. Verdict: Steak.

Nagambie Resources disclosed that it had received permission to undertake work connected with construction of a gold treatment plant at the Nagambie mine in Victoria. The company said that work would commence by the end of December with a view to a production start by mid-2022. The share price response restored the company’s market value to where it had been at the start of August before a sharp decline through the main part of the month. Verdict: Steak.

Zeotech sought a trading halt for its stock in the latter part of the week after it had received a query from ASX about the price action. The company foreshadowed an announcement about an acquisition. Verdict: Sizzle.

Week ended 13 August 2021

Ikwezi

Mining did not make any formal disclosure which might explain the

continuing share price rise dating from the first week in August. The South

African coal producer will have benefitted from strengthening thermal coal

prices. Verdict: Sizzle.

Ikwezi

Mining did not make any formal disclosure which might explain the

continuing share price rise dating from the first week in August. The South

African coal producer will have benefitted from strengthening thermal coal

prices. Verdict: Sizzle.

AXP Energy announced that the company had generated revenue of $1.8 million in July and was on track for a quarterly outcome ahead of the June quarter result. All of the share price gain had occurred by the end of the first day of the week after volumes traded has started to rise in the prior week. The company has oil and gas interests across several US states. Verdict: Sizzle.

Aruma Resources did not make any formal disclosure which might explain a strong lift in share turnover and rising share price through the course of the week. The company has gold exploration interests in Western Australia and New South Wales. In addition, the company holds land in southeast Western Australia prospective for lithium-tantalum mineralisation. The company had said at the end of July that it intended to commence exploration drilling in the September quarter. Verdict: Sizzle.

Bowen Coking Coal has experienced a rising share price trend since late July when it announced the acquisition of coking coal assets, including train loading facilities, in Queensland from New Hope Corporation. The transaction was accompanied by a capital raising through a rights issue which was launched during the week. Verdict: Steak.

Global Energy Ventures announced that it had an agreement with a proposed producer of green hydrogen in Western Australia to study the feasibility of delivering product within the Asia Pacific region using the Global Energy marine supply chain based around its unique oceangoing storage facilities. Verdict: Sizzle.

Week ended 6 August 2021

Red

Hill Iron confirmed that it had sold its joint venture interest in

the Red Hill iron ore mine to Mineral Resources. The seller will receive

two payments of $200 million and a royalty. The transaction, still subject

to shareholder approval, raised the company’s market capitalisation from $65

million to $260 million. Verdict:

Steak.

Red

Hill Iron confirmed that it had sold its joint venture interest in

the Red Hill iron ore mine to Mineral Resources. The seller will receive

two payments of $200 million and a royalty. The transaction, still subject

to shareholder approval, raised the company’s market capitalisation from $65

million to $260 million. Verdict:

Steak.

Magnis Energy Technologies announced that it had secured funds of $20 million from two US financiers. The company is seeking to manufacture lithium-ion batteries at new facilities in New York and Townsville. It has a graphite mining development opportunity in Tanzania. Verdict: Sizzle.

Lepidico did not make any formal disclosure which might explain the heightened investor interest and accompanying share price rise. In the prior week, the company did release its quarterly activities report for the period ended June but the latest business changes to which it referred were in May. The company has a proprietary technology for the extraction of lithium carbonate from lithium rich mica minerals. It also holds exploration and development interests in Namibia. Verdict: Sizzle.

Lake Resources has been experiencing a rising share price trend since mid-May. The more rapid price ascent over the past two weeks coincided with the company announcing an issue of bonus options. The issue was designed to appease potentially disgruntled shareholders whose positions were going to be diluted by upcoming new capital raisings to fund the company’s Argentine lithium development opportunities. The short dated options will expire in October. Verdict: Sizzle.

Jadar Resources did not make any formal disclosure which might explain the share price action. In any event, the rise occurred after prices had fallen to historically low levels. The largest part of the price rise occurred on the last day of the week with unusually strong share turnover levels. In mid-July, the company said it was in the final stage of buying a silver-tungsten project in North Queensland with completion expected in four weeks. Verdict: Sizzle.

Month ended July 2021

The

following companies have not made any subsequent disclosures which may have

impacted their investment performance since being commented upon previously:

The

following companies have not made any subsequent disclosures which may have

impacted their investment performance since being commented upon previously:

Okapi Resources Verdict: Sizzle.

Conico Verdict: Sizzle.

Korab Resources Verdict: Sizzle.

Predictive Discovery Verdict: Sizzle.

Atrum Coal Verdict: Sizzle.

Week ended 30 July 2021

Conico

announced that its drilling in Greenland had encountered sulphide

mineralisation prospective for nickel and copper. The announcement was

based solely on visual inspection of the ore as it had not yet been

submitted for laboratory analysis. Verdict: Sizzle.

Conico

announced that its drilling in Greenland had encountered sulphide

mineralisation prospective for nickel and copper. The announcement was

based solely on visual inspection of the ore as it had not yet been

submitted for laboratory analysis. Verdict: Sizzle.

Argonaut Resources announced that a drilling rig was approaching its destination at a company exploration site in Zambia where it is targeting copper-cobalt mineralisation. Despite the apparent size of the share price reaction, the level remained anchored near historically low levels after a 60% decline since mid-March. Verdict: Sizzle.

Great Western Exploration reported a large anomaly northwest of the Degrussa mine in Western Australia which the company has interpreted as an analogue to the Sandfire owned copper deposit. The share price reaction resulted in a return to levels which had prevailed at the end of May and prior to a share price slump to historically low levels. Since the beginning of February, the Great Western share price has declined 65%. Verdict: Sizzle.

Lefroy Exploration released its quarterly activities report but made no specific announcement which might explain the share price movement. In any event, the share price rise was only a partial retracement of lost ground since the end of May during which time it had declined by over 50%. The company had already announced that a diamond drilling program at its copper-gold Burns project in the eastern goldfields of Western Australia had commenced. Verdict: Sizzle.

Brookside Energy announced that completion operations were underway at the company’s Jewell well in the Anadarko Basin in Oklahoma. A contractor had agreed to start site operations by the end of July. The company will have benefited from strengthening US crude oil prices through the week. Verdict: Sizzle.

Week ended 23 July 2021

Dreadnought

Resources has been experiencing a steeply rising share price trend

since the start of July. Contributing to the momentum in the past week, the

company disclosed high grade rare earth element assays at a 100% owned

prospect east of Exmouth in the Gascoyne region of Western Australia near a

mine currently under construction by Hastings Technology Metals. The

encouraging result is some way from confirmation of a commercial discovery

but has added to a sequence of positive exploration results to bolster

market interest. Verdict: Sizzle.

Dreadnought

Resources has been experiencing a steeply rising share price trend

since the start of July. Contributing to the momentum in the past week, the

company disclosed high grade rare earth element assays at a 100% owned

prospect east of Exmouth in the Gascoyne region of Western Australia near a

mine currently under construction by Hastings Technology Metals. The

encouraging result is some way from confirmation of a commercial discovery

but has added to a sequence of positive exploration results to bolster

market interest. Verdict: Sizzle.

Predictive Discovery released high grade gold assays from drilling at its Bankan project in Guinea. The results implied higher grades at greater depths, encouraging the company to think about deeper drilling and the potential for an underground mine rather than the previously contemplated open pit. Verdict: Sizzle.

Podium Minerals did not make any formal disclosures which might explain the partial share price recovery after a slump from the steep rise in price beginning in the latter part of April (see 23 April 2021). In its quarterly activities report for the period ended June, the company reiterated assay results from platinum group metal exploration drilling at properties in the midwest region of Western Australia. The company reported having cash assets of $2.98 million at the end of the month. Verdict: Sizzle.

Korab Resources did not make formal disclosures which might explain the building investor interest and accompanying share price action. The latest price move comes within a rising price trend dating from early July. The company is planning to develop a magnesium carbonate rock quarry in the Northern Territory. Directors had previously reported having been approached to sell the property, without subsequently disclosing any further information about the outcome of discussions. The company holds a range of other exploration interests in the Northern Territory, Western Australia and the Ukraine prospective for a range of fertiliser minerals and precious metals. Verdict: Sizzle.

Peak Resources announced that the Tanzanian government had approved a special mining licence for the company’s rare earth element development proposal. The approval allows the company to proceed toward an economic agreement from which would follow, all going well, funding and off take negotiations. The announcement indicates progress but still a long road ahead before a development commitment to can be made. Verdict: Steak.

Week ended 16 July 2021

Atrum

Coal has been adversely affected by a decision of the Alberta

provincial government to review its coal mine development policies via a

public consultation process. Since the review implies that development could

be stymied, the company’s share price has fallen to a fraction of its level

in February prior to the government’s policy about face. The company did

not make any formal disclosure in the past week which might explain the

apparent shift in investor sentiment about the outcome of the review. Verdict: Sizzle.

Atrum

Coal has been adversely affected by a decision of the Alberta

provincial government to review its coal mine development policies via a

public consultation process. Since the review implies that development could

be stymied, the company’s share price has fallen to a fraction of its level

in February prior to the government’s policy about face. The company did

not make any formal disclosure in the past week which might explain the

apparent shift in investor sentiment about the outcome of the review. Verdict: Sizzle.

Bathurst Resources announced that a New Zealand Supreme Court decision relating to a prolonged legal battle over royalty payments claimed from the company would be released during the week. Later, the company confirmed that the court had ruled in its favour, resolving a negative impact on company investment returns which had persisted for some five years. In any event, the company’s financial prospects had been buoyed in recent weeks by improved coal market conditions (see 25 June 2021). Verdict: Steak.

Fe made several announcements reporting progress along the way to hauling the first shipments of iron ore from the company’s mine near Wiluna in Western Australia. In the latest announcement, the company confirmed that the first trucks had left the minesite on the way to the Geraldton port. Verdict: Steak.

Okapi Resources announced that it had a binding agreement to acquire a US company with rights to uranium mineralisation in Colorado. Earlier in the week, the company had announced that acquisition of a company with kaolin development interests Western Australia and South Australia, announced in May, had been terminated. Verdict: Sizzle.

Mithril Resources released assay results from drilling at its exploration interests in Mexico which showed high-grade gold-silver intersections. The drilling was designed to test the depth of mineralisation in a bid to better understand the geological model. Verdict: Steak.

Week ended 9 July 2021

Nex

Metals reported results from joint venture partner Metalicity after

recent drilling at the company’s Kookynie gold project in Western Australia

encountered a succession of high-grade gold intersections which the

Metalicity chief executive described as “spectacular”. Under the terms of an

earn-in agreement, Metalicity can obtain a 51% interest in the target area

after spending $5 million over five years. Nex had cash assets of $885,000

at the end of March 2021. Verdict: Sizzle.

Nex

Metals reported results from joint venture partner Metalicity after

recent drilling at the company’s Kookynie gold project in Western Australia

encountered a succession of high-grade gold intersections which the

Metalicity chief executive described as “spectacular”. Under the terms of an

earn-in agreement, Metalicity can obtain a 51% interest in the target area

after spending $5 million over five years. Nex had cash assets of $885,000

at the end of March 2021. Verdict: Sizzle.

Dreadnought Resources announced the results of reconnaissance sampling at a property in the Kimberley region of Western Australia prospective for copper mineralisation. The work was following up historically mapped mineralisation dating from the 1950s conducted by Western Mining. Subsequently, the company reported tantalum clusters and anomalous lithium identified from sampling near Kalgoorlie. Later in the week, the company announced the commencement of drilling in the Kimberley region in pursuit of nickel-copper mineralisation. Verdict: Sizzle.

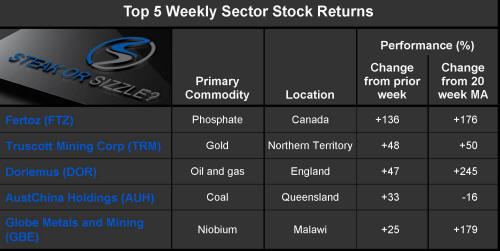

Fertoz announced that it had raised $5 million through the placement of new shares to assist the company’s move into carbon sequestration activities (see 18 June 2021). Verdict: Sizzle.

Alicanto Minerals reported that an initial round of exploration drilling at the company’s Sala prospect in Sweden had encountered visible silver, lead and zinc mineralisation. The drilling results are not surprising as the site is the location of historical mining activity based on a high grade mineral resource. Verdict: Sizzle.

Sacgasco announced that it had acquired ownership of a company with oil exploration interests, including six discoveries, in the Philippines. The company, which had cash assets of $1.98 million at the end of March 2021, paid $1 for all existing rights and obligations of the acquired company. Verdict: Sizzle.

Week ended 2 July 2021

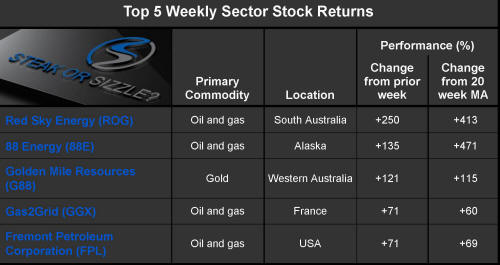

88